The big victory for President Trump and the Republicans has had a massive impact on financial markets around the world. Treasury yields surged, stocks reached new records and the dollar was king of the FX space. Animal spirits were unleashed, however, asset prices are calmer today. US Treasury yields are falling slightly, the dollar is lower and US stocks are rising moderately at the open on Thursday.

Below we look at the impact of the Trump trade on financial markets in 3 charts.

1, Global stock markets.

The win for Trump in the US is good for US stocks, with the S&P 500 and the mid cap Russell 2000 surging. This has only exacerbated the performance gap between US equity indices and European and UK stock markets, as you can see below. We expect this to continue, as Trump’s America First policy plays out in global stock markets.

Source: XTB and Bloomberg

2, Can stocks sustain higher yields?

Usually, the Russell 2000 and 2-year US Treasury yields have an inverse correlation, when bond yields rise, this weighs on the US’s mid-cap index, as rising costs of capital could hurt medium sized firms. However, the Trump trade has seen US mid cap stocks rally at the same time as yields are also surging. We do not think that this can happen indefinitely. If US yields continue to rise, then it could start to weigh on US stocks. Once the animal spirits have abated, we think that that the US stock market rally could taper off, as investors start to consider the risks from a Trump presidency.

Source: XTB and Bloomberg

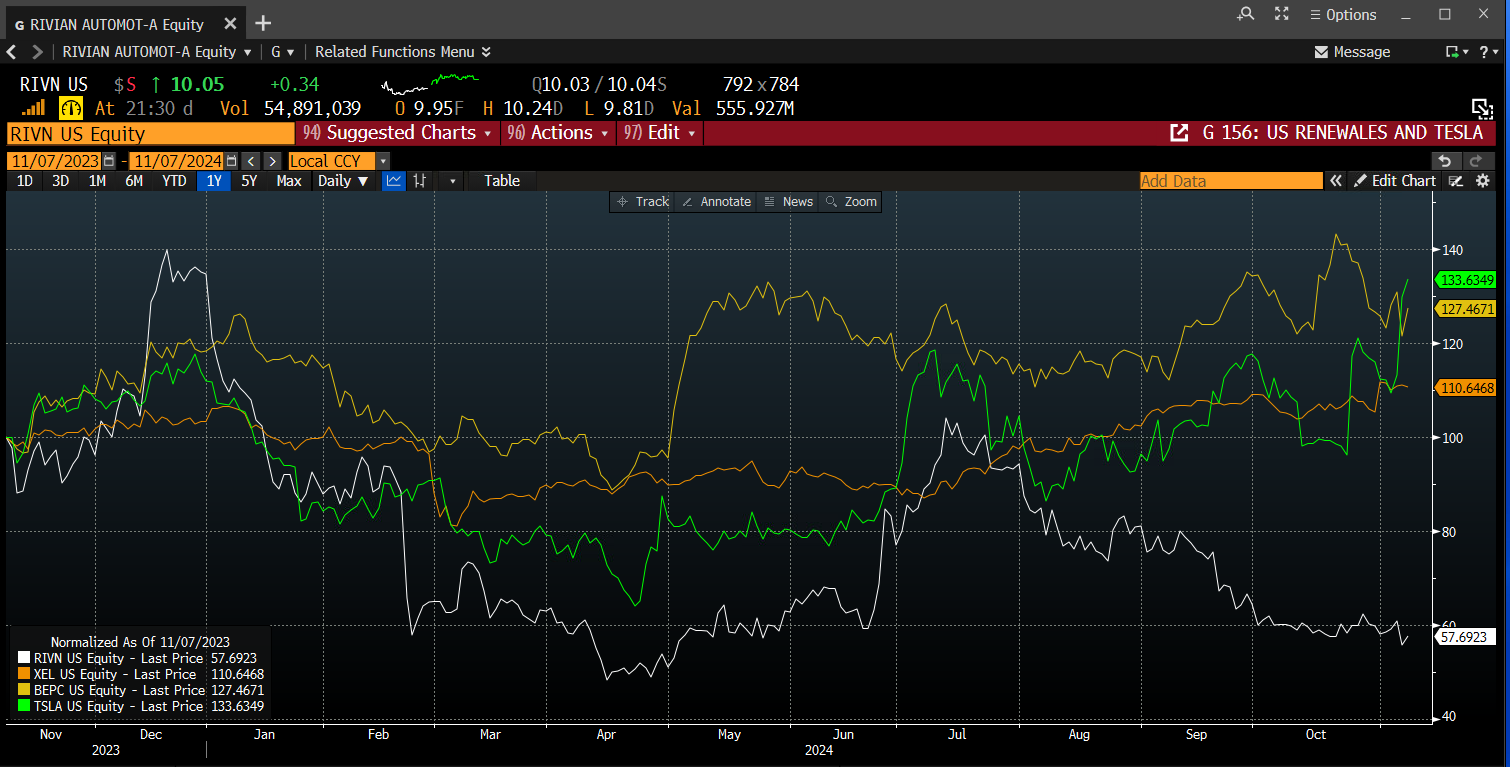

3, The rise of Tesla

Tesla was a standout performer on Wednesday as Elon Musk’s strong ties to Trump boosted the prospects of the company. While it can be useful to have friends in high places, the rise in Tesla is out of synch with declines in other renewable companies on the back of Trump’s win.

Rivian’s stock price has slumped in recent weeks, as the Trump trade has taken hold. Xcel Energy, one of the largest renewable energy producers in the US has also backed away from recent highs, and Pacific Oil and Gas, which is boosting its renewable production by 75%, has also fallen back on the back of Trump’s win. Thus, Tesla’s rally looks like an anomaly. Will it sell off because Trump is negative EVs? Or will Tesla and other domestic EV makers be able to garner the affection from Trump? If yes, then Rivian’s stock price could be ripe for a recovery.

Source: XTB and Bloomberg

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.