THE CAC 40 SHYLY BOUNCES AS FRENCH ELECTION UNCERTAINTY EASES

European indices experienced a significant boost this morning following the results of the first round of the legislative elections in France, as investors seem confident the radical right will hold no absolute majority. Shortly after the market open, the CAC 40 exhibited a strong upward movement, rising by 2.42%, which in turn lifted the EuroStoxx 50 and the DAX. However, two hours later, the French index pulled back to a performance of 1,52% as investors digested the market event. The euro also saw a substantial increase of 0.46%.

As expected, the election results clearly were in favor of the Rassemblement National (RN), with 33.14% of the vote, compared to 27.99% for the Nouveau Front Populaire and 20.76% for the presidential coalition. Left-wing parties immediately announced their eagerness to rally the centrists and deny the RN, providing the stock markets with the prospect of a centrist government and a return of optimism, as fear was mostly priced by the investors.

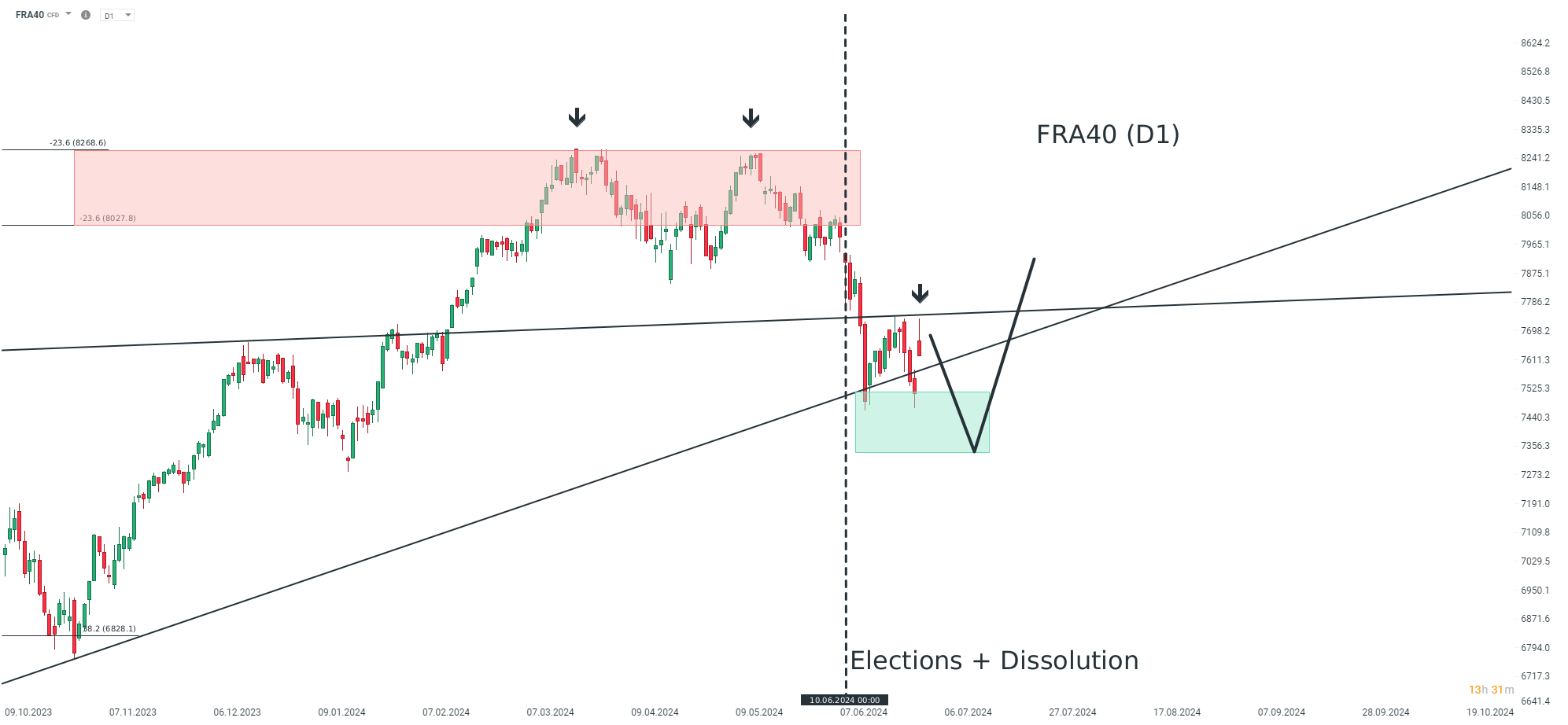

However, this rebound in the French index may be a countertrend movement. A breakout above 7750 points and then 7980 points is required to confirm the continuation of a long-term bullish trend.

FRENCH BOND YIELDS STILL AT A SEVEN-MONTH-HIGH

Despite the upward reaction in the French stock market, the bond market, which is often considered as a “smarter” market, remains wary. The French 10-year bond yield is still at its highest since November 13, 2023 (3.335%) and up this morning (+1.0%). The France-Germany yield spread stands at 0.76%.

10-year bond yields for France (white curve) and Germany (yellow curve), the latest being decently correlated to the first. Source : Bloomberg.

10-year bond yields for France (white curve) and Germany (yellow curve), the latest being decently correlated to the first. Source : Bloomberg.

The French CDS is still at a high level as well (36.76), suggesting that investors are still concerned about the political situation and financial outlook in France.

Credit Default Swap for France. Source : Bloomberg.

Credit Default Swap for France. Source : Bloomberg.

Whether the RN achieves an absolute majority or not, the French political landscape remains uncertain. In the absence of a clear majority, forming a government will require significant compromises to ensure stable governance. This political uncertainty also raises critical questions for the French economy and, by extension, for European financial markets. Can a government of an EU member state still afford to increase public spending, leading to higher deficit and debt?

Institutional and economic control mechanisms, such as European budgetary rules and financial market oversight, are essential to prevent such excesses and maintain investor confidence. A government's ability to navigate this tumultuous environment will depend on its willingness to collaborate and find compromises, while respecting the constraints imposed by its European and international commitments. The coming months will be crucial.

A COUNTERTREND BOUNCE IN THE CAC 40?

Today’s market close in the CAC 40 will be key to avoid a lower low.

Today’s market close in the CAC 40 will be key to avoid a lower low.

By Antoine Andreani, Head of Research at XTB France.

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.