Thanksgiving special: why US outperformance is set to continue

By Kathleen Brooks, research director at XTB

It’s Thanksgiving in the US, and the markets are fairly quiet. This is unlikely to be the day that new trends will develop. Instead, the focus is on where the dollar will go next, whether or not the stock market rally will broaden out to Europe in 2025, and if global interest rates will continue to fall in the coming months.

ECB may have to cut further, as market strengthens bets on a December rate cut from the Fed

In terms of interest rates, the market remains optimistic that rates will be cut further. There is now a 70% chance of a rate cut from the Federal Reserve in December, a week ago there was a 55% chance of a cut. The rise in PCE inflation for October is not expected to derail the Fed from their gradual rate cutting path. This means that there are no further 50bp cuts expected, but there could be two further cuts in 2025 if the Fed cuts as expected next month.

The market is undecided about whether the ECB will cut by 25bps or 50bps when they meet on 12th December. There is currently 38bps of cuts priced in by the market, that is down from 47 bps last week after some comments from the head of the German ECB. She said that the bank will need to tread carefully about future rate cuts due to persistent inflation. Wage growth remains strong in the currency bloc, although the latest inflation data for the individual members was weak for November. German headline inflation retreated to 2.2% from 2.3%, while the monthly rate declined by 0.2%. Harmonized German inflation also fell by 0.7% MoM in November, while the annual rate retreated to 2.4% from 2.6%. Spanish inflation, which is considered a lead indicator for the currency bloc, was mostly in line with expectations. The EU harmonized rate was 2.4% YoY; however, inflation was flat on the month. The core rate was weaker than expected at 2.4%, down from 2.5% in October. This suggests that the ECB should stick to its rate cutting cycle. There are currently more than 5 rate cuts priced in for next year in the currency bloc, however, if growth remains weak, then we think there could be further rate cuts to 1.5%, as the ECB may have to take an accommodative stance in order to boost the economy.

The FX market: 2025 themes

The elephant in the room for the EBC is President elect Trump’s tariffs. The EU was omitted from his most recent social media posting on tariffs. However, the threat still looms large. Trump has explicitly linked social issues to tariffs, including illegal immigration to tariffs on Mexican goods. The peso is in recovery mode on Thursday, after talks between the Mexican president and president elect Trump appeared to make steps towards securing the US border with Mexico.

The new world order under Trump 2.0 could see currencies react based on the strength of their leaders’ relationships with Trump and the US. In the past, there has been a rush to the bottom in the FX market, as currencies weakened on the back of Trump’s policies during his first term. However, this time, it is unclear if a weak currency will actually help those countries most at risk from Trump’s tariffs. If the US is reshoring and focusing on domestic modes of production, then global trade will be fundamentally changed. If the US trade deficit narrows, or moves into surplus, this will likely wreak more economic pain on the economies of Europe, Canada, Mexico and China as we progress through this decade. All currencies bar the Japanese yen have weakened vs. the USD so far in November, and the USD is the strongest performer in the G10 FX space so far this year. At the same time, the US is still expected to have the strongest growth next year. The link between a weaker currency and a stronger GDP rate has been broken under Trump’s plans for his second term as President.

US stock market exceptionalism expected to continue

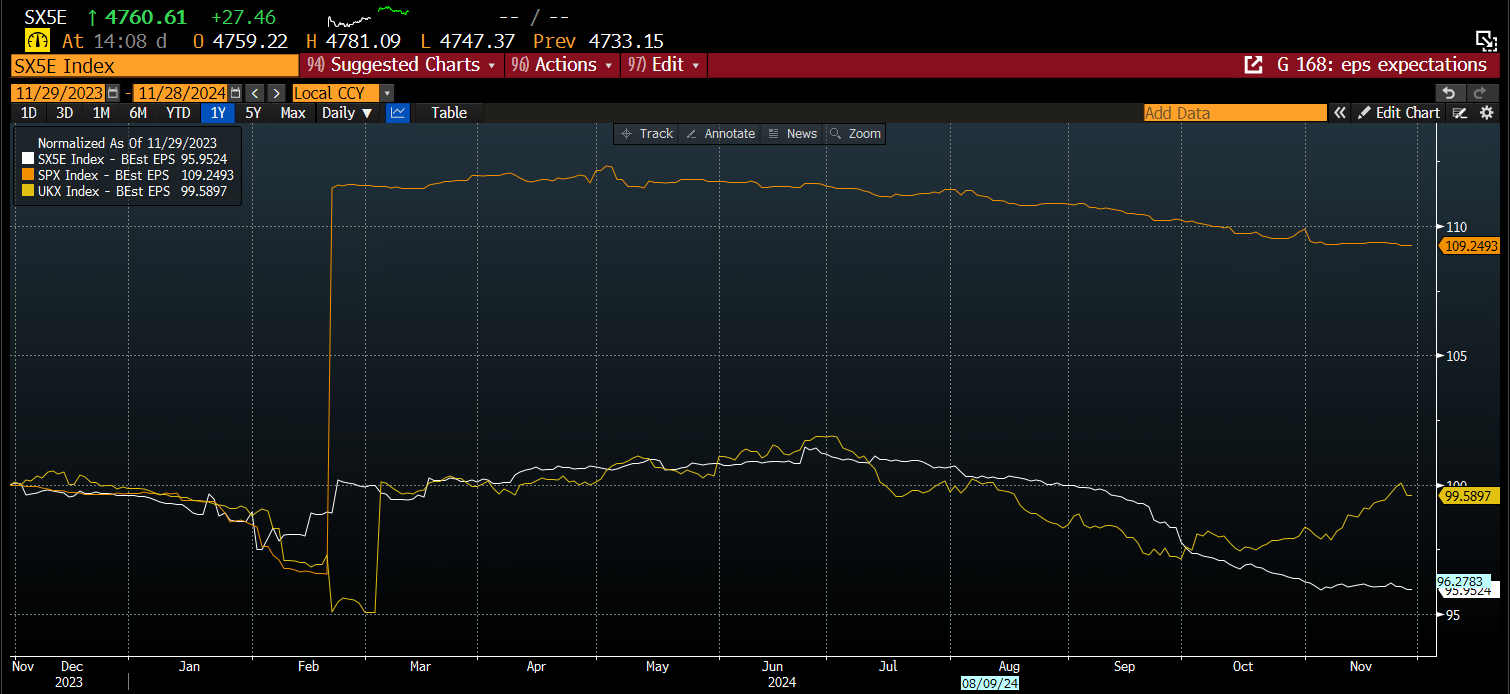

On the final point about stock market returns. The US has been the standout performer this year. The FTSE 100 is up 7%, the Eurostoxx 50 is up just over 5% and the S&P 500 is higher by more than 25%. The performance of the S&P 500 is spectacular and is leaving the rest of the world in its wake. But what about 2025? The market is expecting EPS growth for the S&P 500 of more than 10% in the next 12 months, that compares with 3.5% for the FTSE 100 and less than 1% for the Eurostoxx 50. EPS growth estimates for UK and European companies are also impacted by expected tariffs and complications from a Trump presidency, so there is subject for these estimates to change, but this data highlights how wide a gulf there is between earnings expectations in the US and elsewhere.

US stocks are very expensive and there are definitely bigger bargains to be had in the UK and Europe, however, when growth expectations are so much higher in the US compared to this side of the Atlantic, it may not entice a wave of investors to ditch US stocks in favour of UK or European indices. Thus, unless there is a big earnings disappointment in the coming months, the US is likely to enter 2025 in a strong position.

Chart 1: EPS performance normalised,

Source: XTB and Blomberg

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.