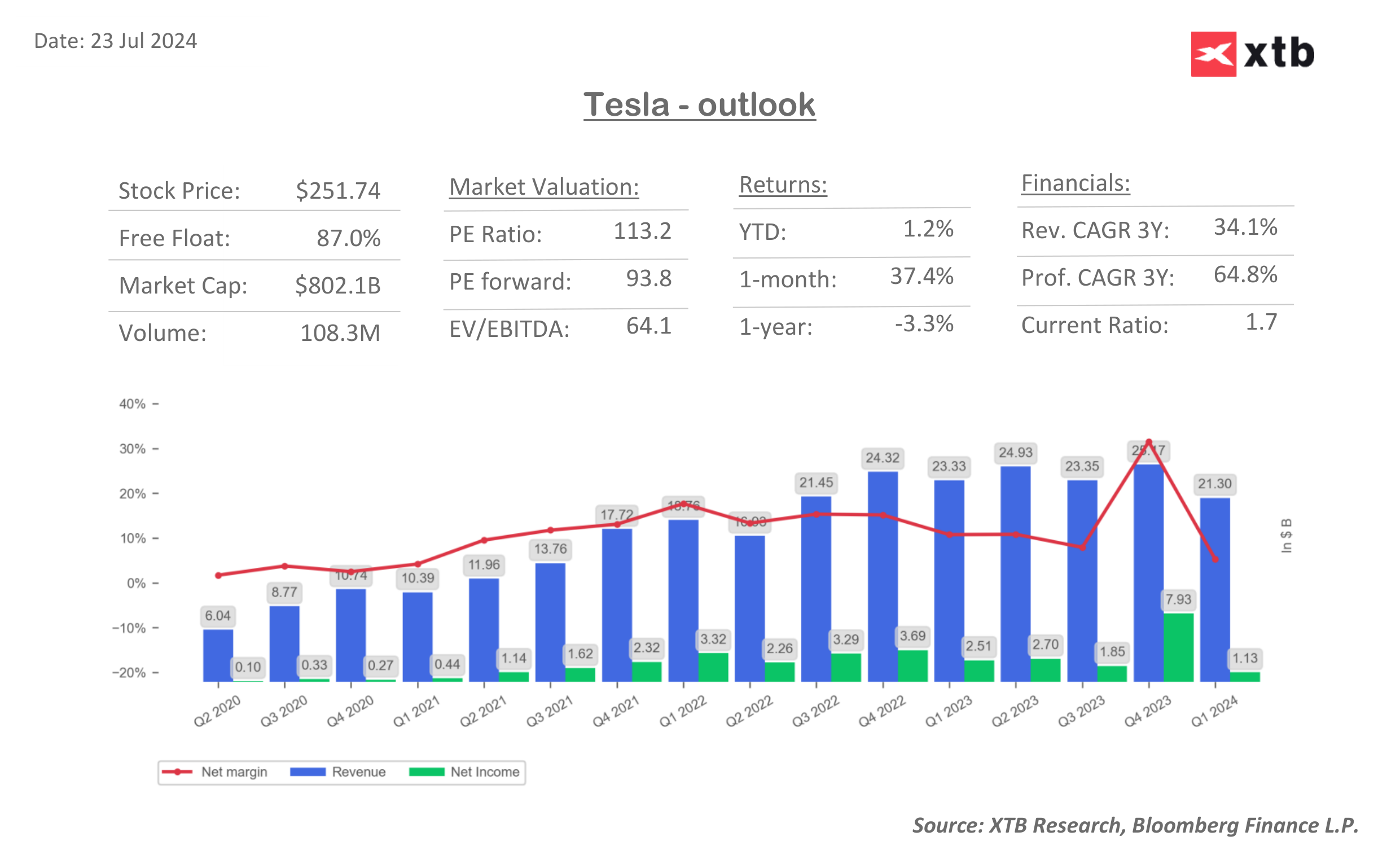

Today, after the US trading session, Tesla (TSLA.US) will present its second quarter results for the year. Given that the company's shares have risen nearly 40% over the past month and are currently trading around $250 per share, we can see considerable optimism towards the report. Tesla is valued at a very high 94x forward earnings multiple (forward P/E) against the low single-digit values of competitors in the US auto market in the form of Ford, or General Motors. Will the report justify such a sizable premium in valuation?

- After the recent rally, it seems that investors' real expectations may be anchored high, and results in line with or marginally above forecasts, if the company does not present a viable growth plan for the coming quarters, may be perceived as insufficient to justify such a robust rebound, favouring 'profit taking' scenario

- Attention will focus on expected margins as well as autonomous car technology and the impact of AI. Over the past 11 weeks, the company's capitalization has increased by $386 billion. Will the report justify this scale of growth? The options market suggests about 8% volatility in the stock after the results.

- Potential catalysts for growth include comments on y/y delivery growth in 2024, expected margin improvement after a series of model price increases, Robotaxi technology i.e. AI technology in self-driving vehicle software, expectations for regulatory approvals, visible and expected market dynamics in China, and Optimus robots.

Expectations

Revenues: $24.1 billion (down nearly 1% y/y, with an 8.5% y/y decline in shipments)

Earnings per share (EPS): $0.46 per share (down 41% y/y)

Gross margin on car sales: Expected 16.72% (lowest since 2019) vs. 16.36% in Q1 and 18.1% in Q1 2023

Reported Q2 deliveries of 977,815 vs.1.81 million in Q2 2023 - high interest rates are holding back demand for new cars

- Wall Street expects margins to start improving in 2025; along with lower production costs; however, there were no signs in Q2 (other than an approx. 10% lower y/y workforce) to suggest a very significant improvement

- Musk suggested that y/y shipment growth will increase modestly for the full year 2024; investors will at least want confirmation of this position from the company (after possibly two down y/y quarters of the year)

- Relevant comments will be on China, which is a huge market for the company, and on its partnership with Chinese technology conglomerate Bidu, which analysts believe could help the company implement autonomous technology in China

- Investors will want to hear a little more about the expected sales scale and margins from the budget electric car model, worth about $25,000, which the company plans to launch in early 2025.

- It also refreshed the Model Y, so the market can expect whether the company expects higher margins on sales from this rather costly move

What is Wall Street paying attention to? Robotaxi and AI

- Deepwater Asset Management expects Tesla's shipments to grow 15% year-on-year in 2025, and analyst forecasts suggest that a return to year-on-year growth could begin as early as September, this year

- TripleD Trading suggests that the Trump administration may prove less restrictive in approving widespread use of self-driving vehicle technology

- Analysis office Laffer Tangler suggests that final numbers and adoption rates of autonomous car technology will beat forecasts and support margins in the long term

- Nearly 10% layoffs at the company and the withdrawal of a costly production of a budget car, worth max. US$25k have supported investor sentiment

- 50 Park Investments suggests that markets' attention will focus on updated comments on AI and autonomous driving models, the successful implementation of which would justify a valuation premium over other auto makers

- Musk suggests that Optimus' humanoid robots will take over some of the basic duties of workers at the company starting in 2025, and will be ready for implementation in many factories around the world

It is unofficially known that the presentation of Tesla's technological 'innovations', which was supposed to take place on August 8, has been postponed until October - Elon Musk is likely to refer to this more extensively and comment on the reason for this decision. There is also a chance that Musk will indicate that the Robotaxi presentation will finally take place as planned.

The apparent recent downward reaction of the market, which reacted with a nearly 8% discount in Tesla shares to Bloomberg's reports of the move of the 'Robotaxi event; from August 8 to October, suggests that a good part of the rally was driven by 'artificial intelligence' and everything related to it.

Tesla chart (TSLA.US, D1 interval)

Looking at the daily interval, we see that Tesla's share price has climbed above all three, key momentum moving averages, but the stock is still losing nearly 60% to the 2021 ATH. The negative disappointment of the report may lead the market to conclude that record valuation levels may move away from the company for longer. On the other hand, beating forecasts and signaling additional positive catalysts could successfully push the stock above $300 and ensure a sustained breach of resistance at $253, where we see the 23.6 Fibonacci retracement of the 2023 upward wave. A key point of support is near the SMA200 (red line), near $210.

Source: xStation5

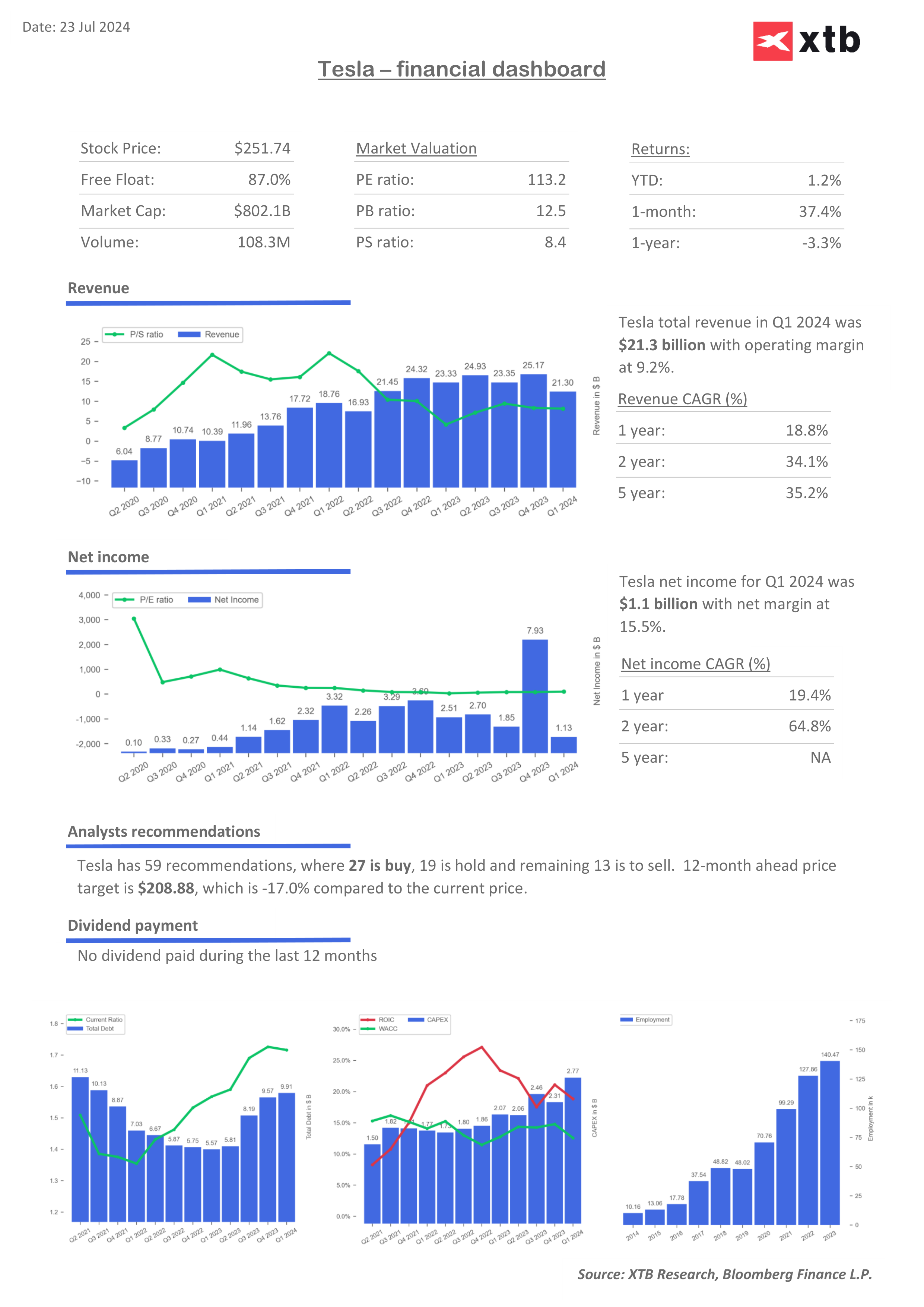

Tesla's multiples and valuation

Investors will want to see more evidence to justify Tesla's higher valuation against the auto sector, as well as realistic product projections that can improve free cash flow, which may still be under pressure from rising CAPEX while return on invested capital (ROIC) is declining.

Source: XTB Research, Bloomberg Finance L.P. Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Market update: energy markets king, as US stock market sell off moderates

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.