Tesla (TSLA.US) reported Q1 2024 earnings report yesterday after close of Wall Street session. Report turned out to be a disappointment when compared to median analysts' expectations compiled by Bloomberg. However, stock rallied in the after-hours trading yesterday and is holding onto these gains in pre-market today as some say that results are not as bad as feared.

Tesla results for Q1 2024 were weaker all cross the board. Company reported that the first year-over-year revenue drop since Q2 2020, while sales in nominal value were the lowest since Q2 2022. Gross profit, operating income and net income all missed expectations and declined significantly compared to a year ago.

Tesla Q1 2024 earnings

- Revenue: $21.30 billion vs $22.30 billion expected (-8.7% YoY)

- Automotive revenue: $17.38 billion vs $18.89 billion expected (-13.0% YoY)

- Gross profit $3.70 billion vs $3.80 billion expected (-18.7% YoY)

- Gross margin: 17.4% vs 16.5% expected (19.3% a year ago)

- Operating expenses: $2.53 billion vs $2.32 billion expected (+36.7% YoY)

- Operating income: $1.17 billion vs $1.53 billion expected (-56% YoY)

- Operating margin: 5.5% vs 7.1% expected (11.4% a year ago)

- Net income: $1.13 billion vs $1.46 billion expected (-55.1% YoY)

- Net margin: 5.3% vs 7.5% expected (10.8% a year ago)

- Adjusted EPS: $0.45 vs $0.52 expected ($0.85 a year ago)

- Capital expenditures: $2.77 billion vs $2.39 billion expected (+34% YoY)

- Operating cash flow: $0.24 billion vs $3.34 billion expected (-90.4% YoY)

- Free cash flow: -$2.53 billion vs +$0.66 billion expected (+$0.44 billion a year ago)

Tesla reported the first year-over-year revenue drop since Q2 2020. Source: Bloomberg Finance LP, XTB Research

Tesla reported the first year-over-year revenue drop since Q2 2020. Source: Bloomberg Finance LP, XTB Research

A big surprise in Tesla's Q1 2024 report was a massive and unexpected $2.5 billion cash burn. On one hand, the company reported much higher-than-expected capital expenditures and increased investments are usually long-term positive for the company. However, magnitude of CapEx beat and year-over-year increase does not justify such a deep, negative free cash flow. The answer lies in operating cash flow. Tesla reported a 90% YoY plunge in operating cash flow! This is a very worrying development that shows that price cuts are taking a heavy toll on company's financials. While negative free cash flow coming from increase investments is not as worrying as it hints at potential improvement in the future, a deep plunge in operating cash flow hints at deterioration in company's core business. On the other hand, it should be said that Tesla usually sees a seasonal dip in Q1 in operating cash flow, as many vehicle purchases tend to be made in the second half of the year, often during Q4 holiday period.

Tesla's operating cash flow plunged in Q1 2024. While Q1 often sees seasonal dip in operating cashflow, scale of the plunge suggests that price cuts are taking a toll on the company. Source: Bloomberg Finance LP, XTB Research

Tesla's operating cash flow plunged in Q1 2024. While Q1 often sees seasonal dip in operating cashflow, scale of the plunge suggests that price cuts are taking a toll on the company. Source: Bloomberg Finance LP, XTB Research

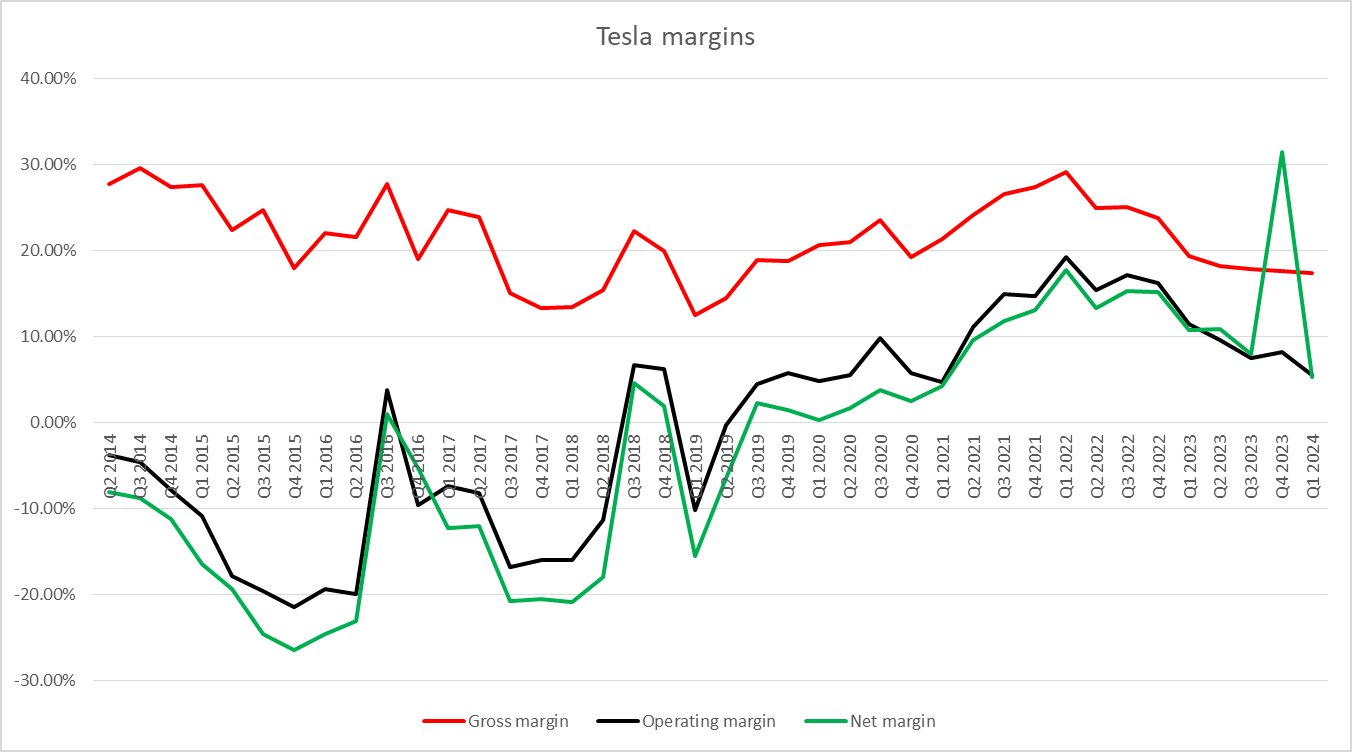

Price cuts are also reflected in Tesla's margins. While those remain positive, they have dropped to multi-year lows in the most recent quarter. Gross margin at 17.4% was the lowest since Q2 2019, while operating and net margins at 5.50% and 5.3%, respectively, were the lowest since Q1 2021.

Tesla experienced further deterioration in margins in Q1 2024. Source: Bloomberg Finance LP, XTB Research

Tesla experienced further deterioration in margins in Q1 2024. Source: Bloomberg Finance LP, XTB Research

In spite of all this negative developments, Tesla shares spiked in the after-hours trading. There was a lot of negative sentiment around Tesla recently, with company reporting weak Q1 deliveries and production data, as well as delaying some investments and announcing massive lay-offs. This could have guided market expectations below analysts' expectations and, in this regard, market participants may have expected even weaker results. This lack of outright catastrophe may have led some to believe that the company is now an investment opportunity, following an over 40% year-to-date slump.

Nevertheless, Tesla itself does not expect material improvement in business this year, saying that it still expects a notably lower volume growth in 2024. On the other hand, company tried to alleviate investors' concerns and hint that improvement is coming, with plans to accelerate launch of new models and get more heavily involved in AI, with its robotaxis. However, those announcements lacked details, but seem to be winning investors' favour combined with relatively low valuation in historical terms. Still, investors should keep in mind that current Tesla's fundamentals are not too encouraging and there is a big risk involved in the stock.

Tesla (TSLA.US) is trading over 12% higher in premarket, in spite of a release of disappointing Q1 2024 report. Guidance offered by the company has been vague and lacked details, but investors do not seem concerned. Source: xStation5

Tesla (TSLA.US) is trading over 12% higher in premarket, in spite of a release of disappointing Q1 2024 report. Guidance offered by the company has been vague and lacked details, but investors do not seem concerned. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.