Tesla (TSLA.US) shares are up 7.00% today, reaching $210, the highest among all stocks in the SP500. This marks the fifth consecutive session of gains, making it one of the best periods in the past year. The main catalyst for the increase was bullish vehicle delivery reports from Chinese competitors.

-

NIO (NIO.US) is up 7.50% today following reports of impressive June deliveries of 21,209 vehicles (up 98% year-on-year and 3.2% month-on-month). This included 11,581 electric SUVs and 9,628 sedans. In the second quarter, NIO delivered 57,373 vehicles, an increase of 144% compared to the previous year, bringing the total number of deliveries to 537,020 as of June 30, 2024.

-

Li Auto (Li.US) is up 7.90% today after the company reported June deliveries of 47,774 vehicles, a 47% year-on-year increase. These strong results contributed to a total of 108,581 vehicles delivered in the second quarter, a 26% increase compared to the previous year. As of June 30, 2024, Li Auto's total deliveries reached 822,345 vehicles. CEO Xiang Li emphasized the company's continued sales momentum and plans to launch a new generation autonomous driving system.

-

XPeng (XPEV.US) is up 6.00% after reporting June deliveries of 10,668 vehicles, a 24% year-on-year and 5% month-on-month increase. In the second quarter, the company delivered a total of 30,207 vehicles, a 30% increase compared to the previous year. XPeng also reported cumulative deliveries of 52,028 vehicles in the first half of 2024, a 26% increase compared to the previous year, and plans significant updates to its autonomous driving systems and in-car operating systems.

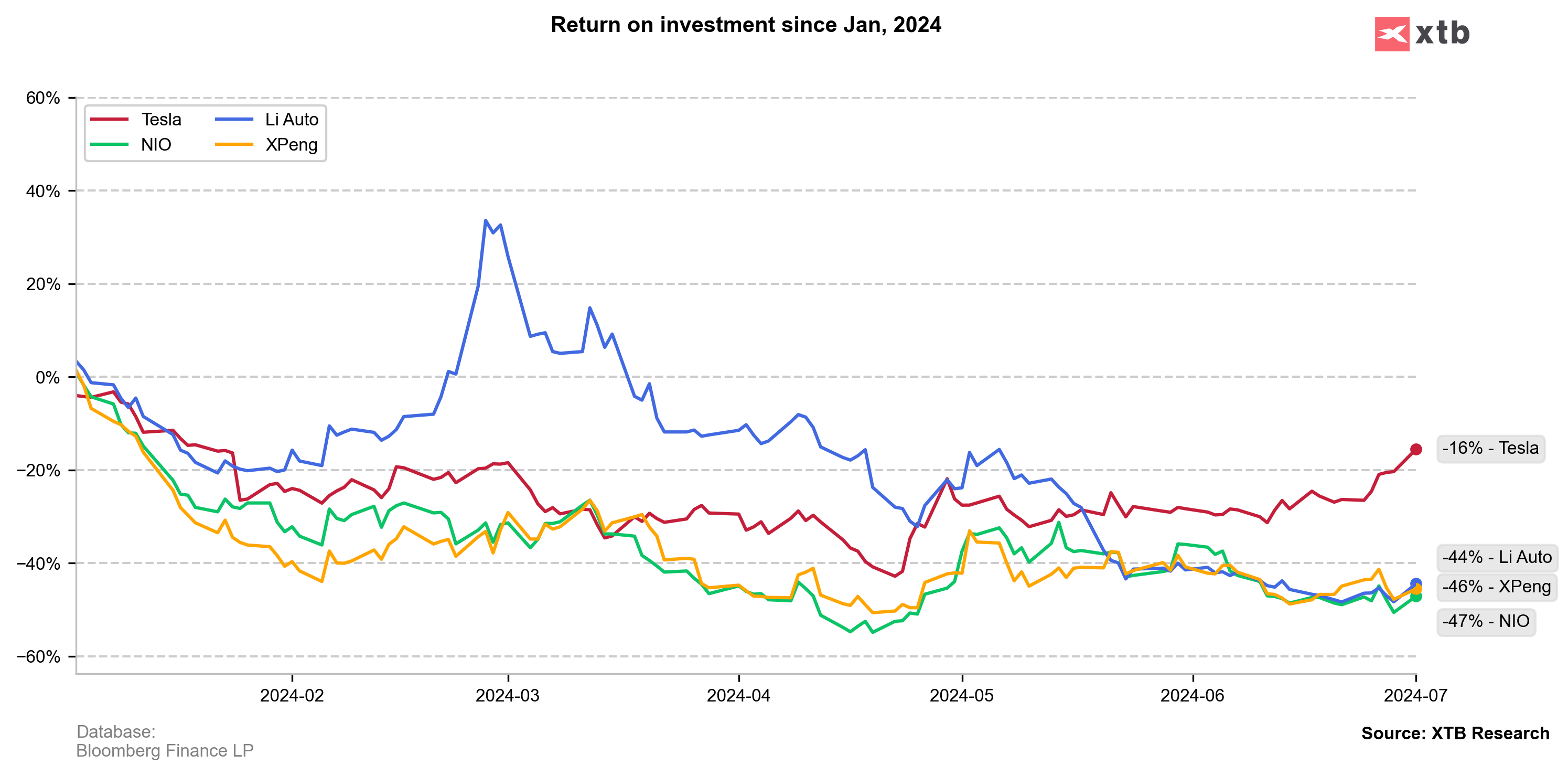

Despite promising reports, the returns on shares of Chinese competitors are still lower than those of Tesla. More importantly, all the aforementioned companies have recorded declines since January 1, 2024.

Will Tesla's report be also bullish?

Tesla is expected to release its sales data this week, with an anticipated drop in gross car margins by 2.1% year-on-year, excluding credits.

Estimates also indicate a 5.4% quarterly drop in deliveries, with 441,019 electric vehicles delivered in the second quarter, marking the second consecutive decline. Notably, this would be the first such occurrence since 2012 when it was phasing out its first Roadster model.

Tesla (D1)

Despite some analysts lowering their delivery estimates, investors remain optimistic, buoyed by Musk's promises of new models and advancements in humanoid robots and robotaxis. Although Tesla's shares have dropped by 16% over the year, Musk's plans to unveil a dedicated robotaxi in August have sparked investor interest. Moreover, the stock price is rebounding from lows set in late April, where declines reached 44% in 2024.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.