Tesla (TSLA.US) shares are trading down more than 6% after results that disappointed negatively. After initial gains after the market close, investors ultimately view the report negatively. Margins came under pressure in the face of lower model prices. A massive drop in free cash flow of less than $850 million put a question mark over the giant's market capitalization of nearly $760 billion. For the first time since 2019, the company disappointed Wall Street negatively in both earnings per share and revenue.

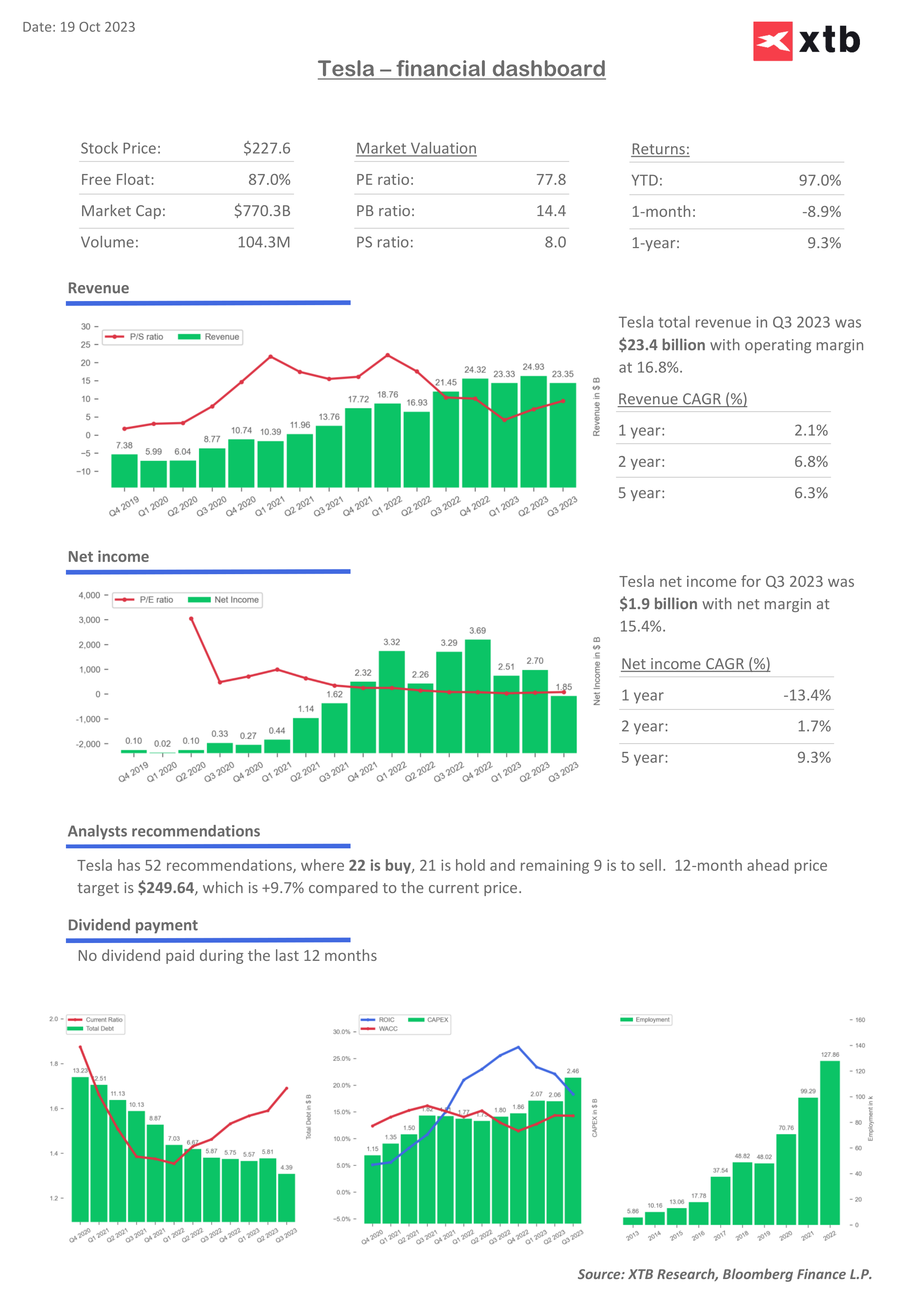

- Revenue: $23.4 billion vs. $24.06 billion forecasts

- Earnings per share (EPS): $0.66 vs $0.74 expectations

- Free cash flow: $848 million vs. $2.59 billion forecasts

- Gross margin: 17.9% vs 18% forecasts and 18.2% previously

- Deliveries: 435,059 vehicles vs. 456,722 forecasts (7% lower than Q2)

- Research and development (R&D) expenses: $1.16 billion vs. $733 million in Q3 2022

The company maintained its annual deliveries forecast at $1.8 million - if expectations are not met (which would mean that there will not be a massive surge in deliveries in the last quarter of the year) there is a chance for a negative disappointment in the next quarter. The market expected that Tesla Cybertruck would manage to improve the company's performance faster but Elon Musk warned that it would take between a year and 18 months before production of 'cybertrucks' would positively impact free cash flow. Deliveries are scheduled to begin November 30, this year.

Musk sees slowdown on the horizon?

-

At the CEO conference, Elon Musk indicated that Tesla is not going to increase advertising spending because investing in presenting people with products they can't afford would not be a smart business move

-

Musk sees the macro landscape largely affecting consumers and higher interest rates making people calculate more. Musk is concerned that demand for cars may wane and suggested that the company will continue its policy of reducing costs and prices of cars to make them more affordable to buy

- This does not appear to be positive news for investors because on the one hand we have a warning of a slowdown, and on the other hand the prospect of further pressure on margins. Cost of models sold per vehicle fell to $37,500 in the third quarter

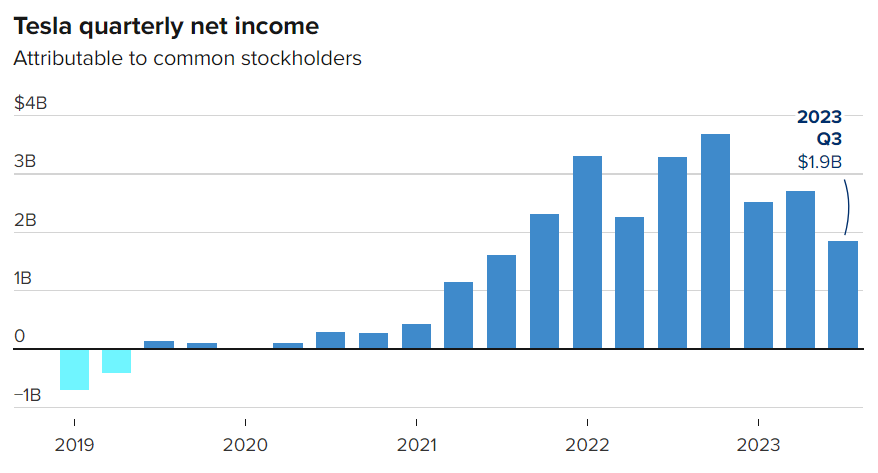

Tesla's revenue and profits on a historical basis

Source: CNBC

Tesla stock chart (TSLA.US, D1 interval)

Tesla shares opened US session with a nearly 7% downward gap near the 38.2 Fibonacci retracement of the upward wave from the fall of 2022. The local peaks of February 2023 and the price bottom of August 2023 (gray circles) are also in the area. Source: xStation5

Tesla expectations and valuation

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.