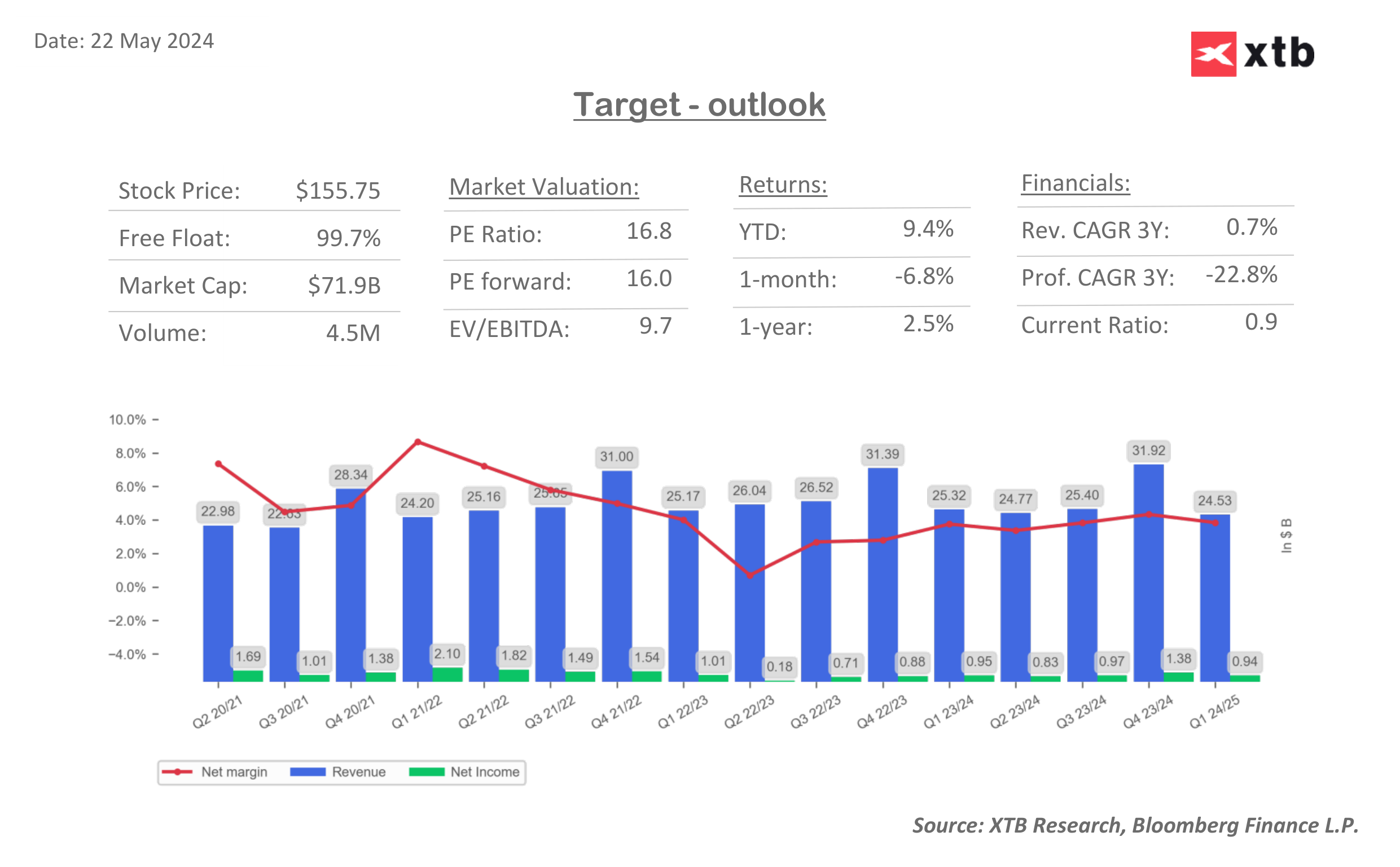

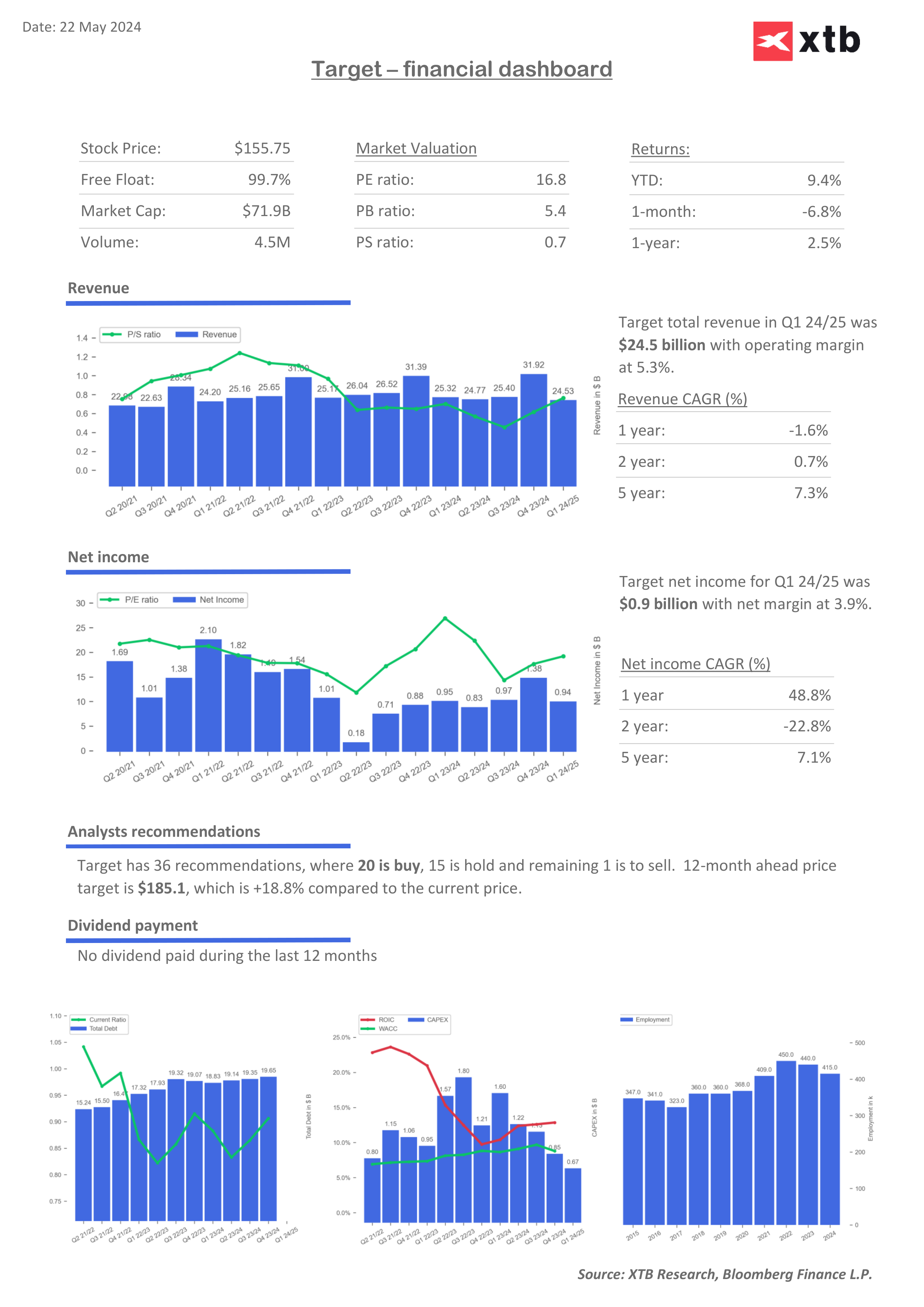

The shares of Target Corp (TGT.US), the US large format retail giant, are losing nearly 7.9% before the opening of the Wall Street session, following the release of conservative earnings forecasts for the rest of the year. Target reported that a key measure of sales fell for the fourth consecutive quarter, down 3.7%.

Adjusted earnings per share of $2.03 came in slightly below expectations, marking the first “miss” (failure to meet market expectations) of this measure in the last six quarters. Discretionary spending is likely to remain under pressure in the near term, the company's development director said, adding that demand for household products and appliances remains weak.

Selected results and forecasts presented by the company:

Q2 FORECASTS

- Adjusted earnings per share $1.95-2.35, analysts estimated $2.19

- Comparable sales flat to 2% maximum, analysts estimated +1.9%

2025 FORECAST

- Still forecast adjusted EPS of $8.60 to $9.60, analysts estimated $9.44

- Still sees comparable sales flat to 2% maximum, analysts estimated +0.9%

FIRST QUARTER RESULTS

- Comparable sales -3.7%, analysts estimated -3.68%

- Comparable digital sales +1.4% vs. -3.4% y/y, analysts estimated -0.73%

- Sales $24.14 billion, -3.2% y/y, analysts estimated $24.13 billion

- Gross margin 27.7% vs. 26.3% y/y, analysts estimated 27.4%

- Ebit $1.33 billion, -1.9% y/y

- Ebitda $2.04 billion, +1.2% y/y, analysts estimated $1.97 billion

- Customer transactions -1.9% vs. +0.9% y/y

- Average transaction amount -1.9% vs. -0.9% y/y, analysts estimated -1.9%

- Total stores 1,963, +0.5% y/y, analysts estimated 1,966

- Operating margin 5.3% vs. 5.2% y/y, analysts estimated 5.34%

- SG&A expenses $5.17 billion, +2.8% y/y, analysts estimated $5.07 billion

- Comparable store sales -4.8% vs. +0.7% y/y, analysts estimated -4.65%

- Same-store sales 81.7% vs. 82.5% y/y, analysts estimated 81%

- Adjusted EPS $2.03 vs. $2.05 y/y, analysts estimated $2.05

- Operating profit $1.30 billion, -2.4% y/y, analysts' estimate $1.3 billion

Shares of Target (TGT.US) are losing nearly 7% before the opening of the session following the release of results. Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.