Super Micro Computer (SMCI.US) is down 11% in after-hours trading following the release of mixed results for the fourth quarter of fiscal year 2024, which fell short of some analyst expectations. The AI server manufacturer reported revenue growth in line with expectations but lower-than-expected earnings and gross margins. After weaker than expected earnings, Nvidia (NVDA.US) firstly slide 2% but now gains more than 1%; also SMCI lost almost 14% in pre-market earlier, while closer to US session open, declines are slightly easing. SMCI earnings were seen as a first (before NVDA report scheduled 28 August) signal of AI businesses and hardware investment trend.

Earnings disappointed Wall Street

- Revenue: $5.31 billion

- Up 143.6% year-over-year from $2.18 billion in Q4 2023

- Up 37.9% quarter-over-quarter from $3.85 billion in Q3 2024

- Slightly below analyst expectations of $5.32 billion

- Adjusted Earnings Per Share (EPS): $6.25

- Up 78.1% year-over-year from $3.51 in Q4 2023

- Down 6% quarter-over-quarter from $6.65 in Q3 2024

- Below analyst expectations of $8.14

- Adjusted Gross Margin: 11.3% (the lowest since 2007)

- Down from 17.0% in Q4 2023 and 15.5% in Q3 2024

- Significantly below analyst expectations of 14.1%

- Net Income: $353 million

- Up 82% year-over-year from $194 million in Q4 2023

- Down 12.2% quarter-over-quarter from $402 million in Q3 2024

Operational Results:

- Cash flow from operations: -$635 million

- Capital expenditures: $27 million

Future Outlook:

- Q1 of Fiscal Year 2025 (ending September 30, 2024):

- Revenue: $6.0-7.0 billion (above consensus of $5.45 billion)

- Adjusted EPS: $6.69-8.27 (consensus: $7.58)

- Full fiscal year expectations (ending June 30, 2025):

- Revenue: $26.0-30.0 billion (above consensus of $14.94 billion)

Super Micro Computer reported record revenue growth of 143.6% year-over-year, reaching $5.31 billion in the fourth quarter of 2024, driven by strong demand for AI infrastructure. However, the company experienced a significant drop in gross margin to 11.3% from 17.0% a year earlier, due to high server production costs and competitive pricing pressures.

- Despite this, the company raised its revenue forecast for fiscal year 2025 to an impressive $26-30 billion. Wall Street ignored that fact, seeing it as a potentially uncertain amid recession risks priced higher, while much weaker earnings caused overvaluation concerns

- Earnings per share were $6.25, up 78.1% year-over-year but down 6% quarter-over-quarter and below analyst expectations of $8.14. Super Micro Computer approved a 10-for-1 stock split, set to take effect on October 1, 2024. This may be an attempt to psychologically reduce the visibility of the stock price decline.

- CEO Charles Liang emphasized that the company is well-positioned for further growth, pointing to investments in supply chain expansion in Malaysia and Silicon Valley, as well as technological leadership in industrial-scale DLC liquid cooling. The company expects margins to return to normal range before the end of fiscal year 2025.

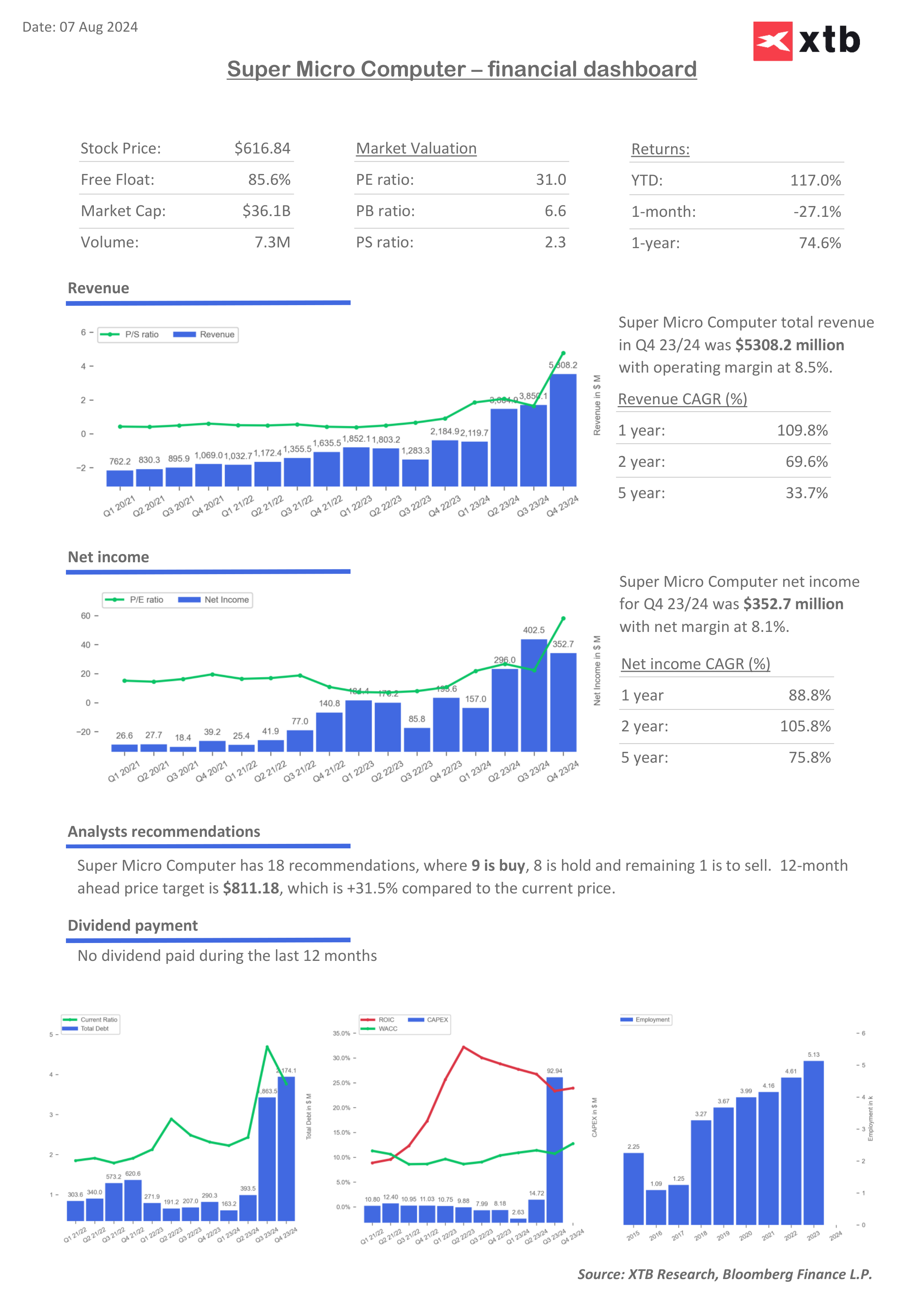

Analyst Forecasts: Super Micro Computer has 18 recommendations, of which 9 are "buy" with the highest target price at $1500, 8 are "hold", and 1 is "sell" around $325. The 12-month average stock price forecast is $811.18, implying a 31.5% upside potential compared to the current price.

Technical Analysis: After worse-than-expected results, the company is trading at $535 in pre-market, testing the opening level from two days ago. The natural support during this session will be the 78.6% Fibonacci retracement level at $501.27. At the same time, resistance remains at the 61.8% Fibonacci retracement level, which would also involve closing Friday's downward gap above $656.21. Breaking through this resistance would open the way to test the SMA 200 at $662.11, which could become new support. RSI has been weakening for two weeks with decreasing momentum, which may indicate a bullish divergence. However, MACD does not yet confirm this thesis.

Source: xStation5

Source: xStation5

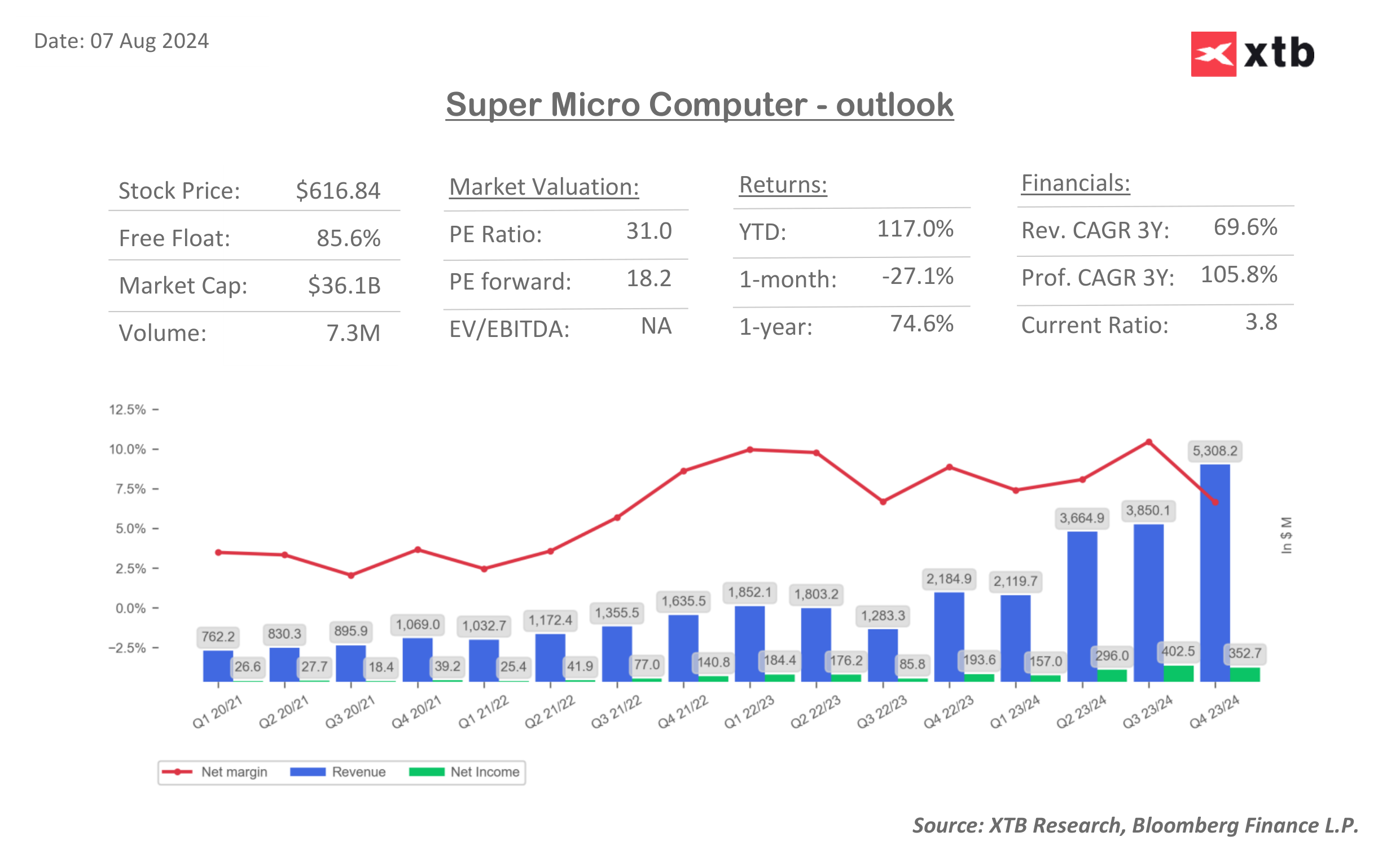

Super Micro financial dashboards and valuation

Super Micro Computer valuation seems relatively low compared to 'AI peers' with PE forward at 18 (much lower than current 31). ROIC is falling since 2023 despite AI business catalysts, while costs (WACC) rise. Despite falling (since June 2023) gross margin, net margin is significantly higher, near all-time highs; rising from 3% in 2021 to almost 9% currently. Wall Street concerns are data centres server racks oversupply risk amid falling demand, with potentially slowing, global economies but company expectations for next fiscal year signal still very strong hardware demand.

Source: XTB Research, Bloomber Finance L.P.

Source: XTB Research, Bloomber Finance L.P.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.