The yield curve in the US is experiencing increasing inversion. Today, a new local low was reached, slightly below -110 basis points. This is a result of the rising yields of 2-year Treasury bonds, while we also observe an increase in the yields of 10-year Treasury bonds. However, the increases in 2-year yields are significantly stronger. When considering the spread between the 10-year and 2-year yields along with interest rates in the US, we can observe pressure for further rate hikes to continue.

The spread between yields has entered a phase of further decline, forming an inverted yield curve. This development suggests similarities to movements observed in the late 1980s or around the year 2000. Source: Bloomberg, XTB.

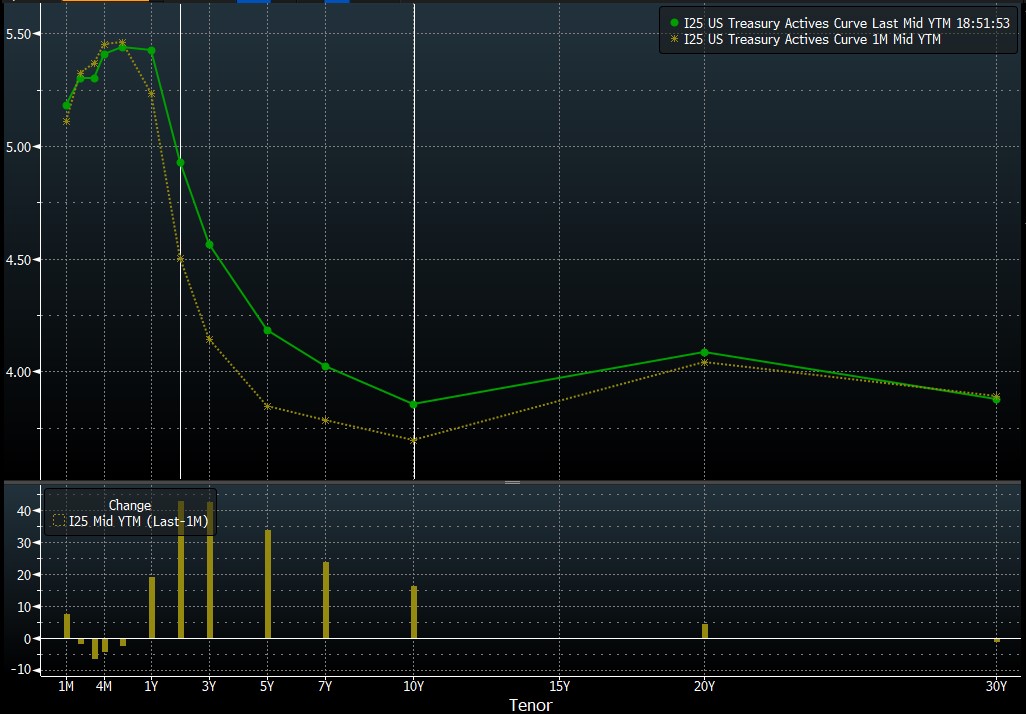

A month ago, the yield curve was noticeably flatter, although it was still far from reaching positive levels. Despite significant movements in TNOTE (10-year bond prices), as seen on the chart above, it is evident that the magnitude of the movement was not as large as in the case of 2-year yields (which saw a monthly increase of 40 basis points). Source: Bloomberg.

TNOTE is currently at a critical level, supported by the 23.6% Fibonacci retracement level and the local low from December of last year. Additionally, it is near the lower boundary of an upward trend channel. A downside break could pave the way for a test of the 110.30-111.0 zone. On the other hand, last week saw the formation of a hammer or morning star pattern. However, for this formation to be validated, the declines from today's session would need to quickly reverse.

Source: xStation5

Although today we don't have much prospect for a trend reversal, and we also have limited trading volume in the next two sessions, there may be an opportunity for a potential reversal of this trend on Friday with the release of Non-Farm Payrolls (NFP) data. Of course, for this to happen, the NFP data would need to come out weak, which would neutralize the chances of further rate hikes. However, at the moment, a rate hike in July is highly probable.

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.