Today's FOMC decision (7:00 pm GMT - decision, 7:30 pm GMT - press conference) is long-awaited and will be closely watched as it will offer hints on the timeline of policy tightening. No rate hike is expected today yet but clear guidance for the future meeting will be offered. Market participants will also look into any decision on balance sheet. US stock markets indices are trading higher ahead of the decision announcement. Nasdaq leads gains, trading 2.4% higher on the day. S&P 500 is also performing well, adding 1.5% at press time. No clear picture can be seen on the FX market however. USD trades mixed, gaining against JPY, CHF and EUR and dropping against CAD, NZD, AUD and GBP. Gold trades lower giving back most of recent gains. Precious metals tests support zone near $1,830.

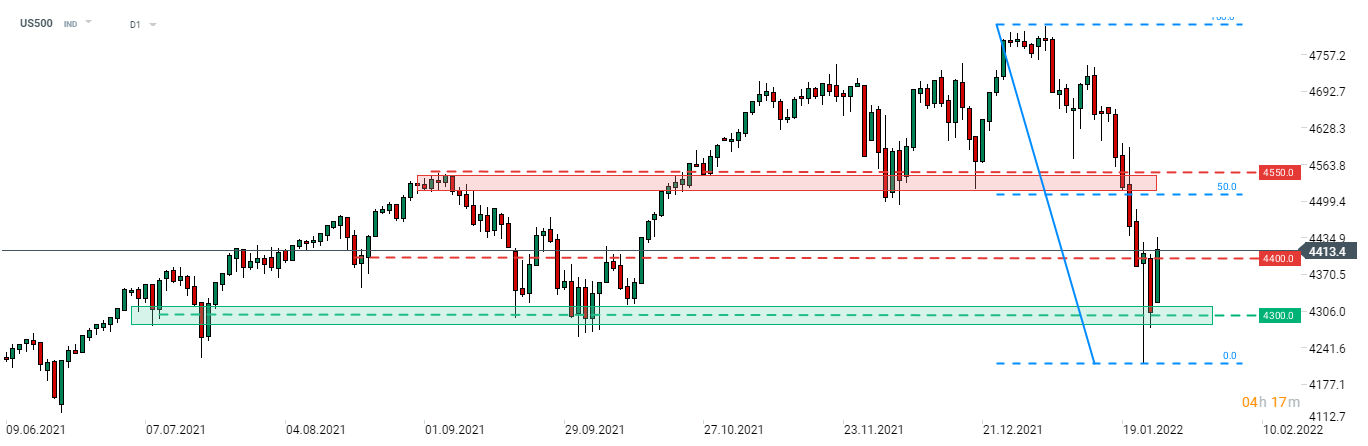

S&P 500 (US500) bounces off the lows in 4,300 pts area and breaks above resistance at 4,400 pts ahead of FOMC decision. Source: xStation5

S&P 500 (US500) bounces off the lows in 4,300 pts area and breaks above resistance at 4,400 pts ahead of FOMC decision. Source: xStation5

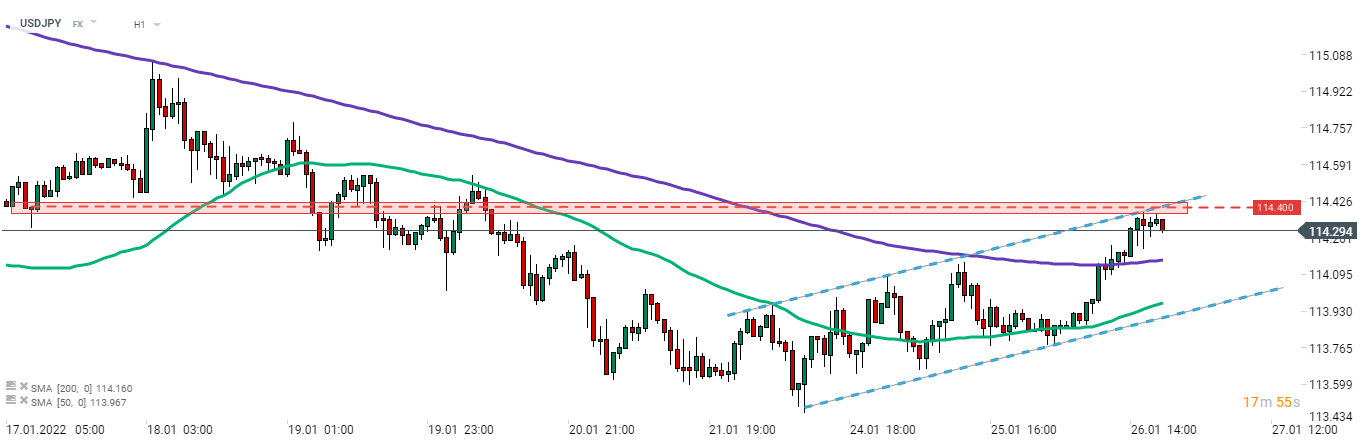

USDJPY reached the upper limit of the upward channel and resistance at 114.40. A small pullback can be observed in the final hour ahead of FOMC decision. Source: xStation5

USDJPY reached the upper limit of the upward channel and resistance at 114.40. A small pullback can be observed in the final hour ahead of FOMC decision. Source: xStation5

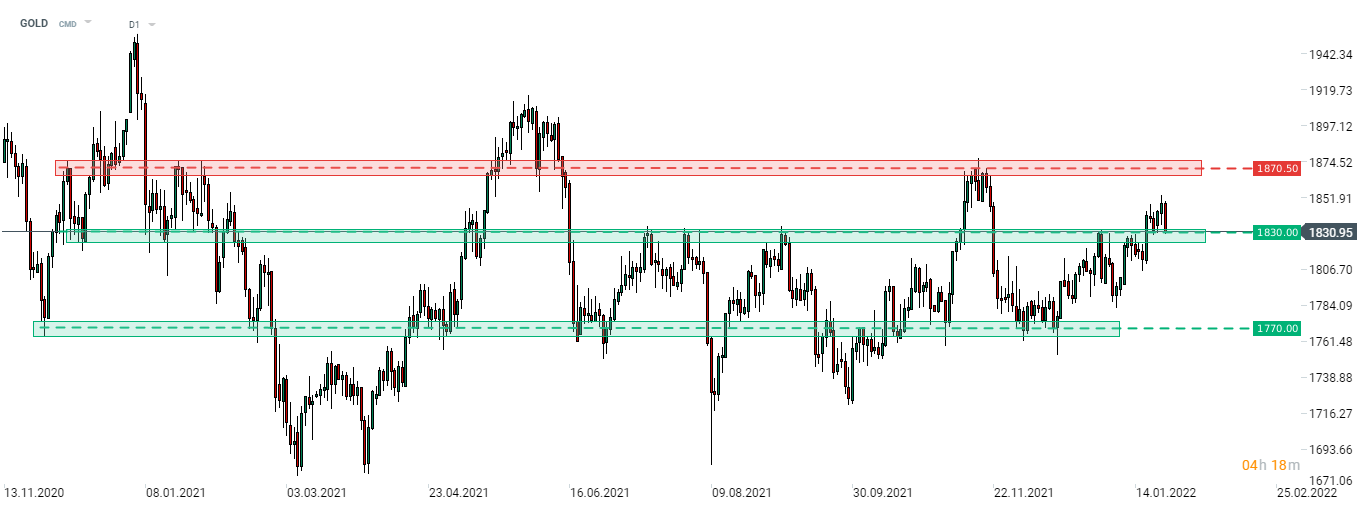

GOLD drops on Fed day with precious metal giving back all of recent gains. Price is currently testing mid-term price zone at $1,830 as a support. Source: xStation5

GOLD drops on Fed day with precious metal giving back all of recent gains. Price is currently testing mid-term price zone at $1,830 as a support. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.