Summary:

-

US stocks edge higher; H1/D1 Clouds being tested

-

Initial Jobless Claims:

-

Uber shares to rise after broker upgrade

After dropping to their lowest levels of the week overnight during the Asian session, US stock futures have recovered and they now point to some small gains on the opening bell. The main news today has been the spike in the price of crude and it should come as no surprise that energy stocks are called to open higher given the gains in excess of 3% seen in oil benchmarks. It’s a fairly quiet day on the economic calendar with the only release of note being the weekly jobless claims. A reading of 222k was above the 215k expected and also marked an increase on the 219k prior (which itself was revised up by 1k).

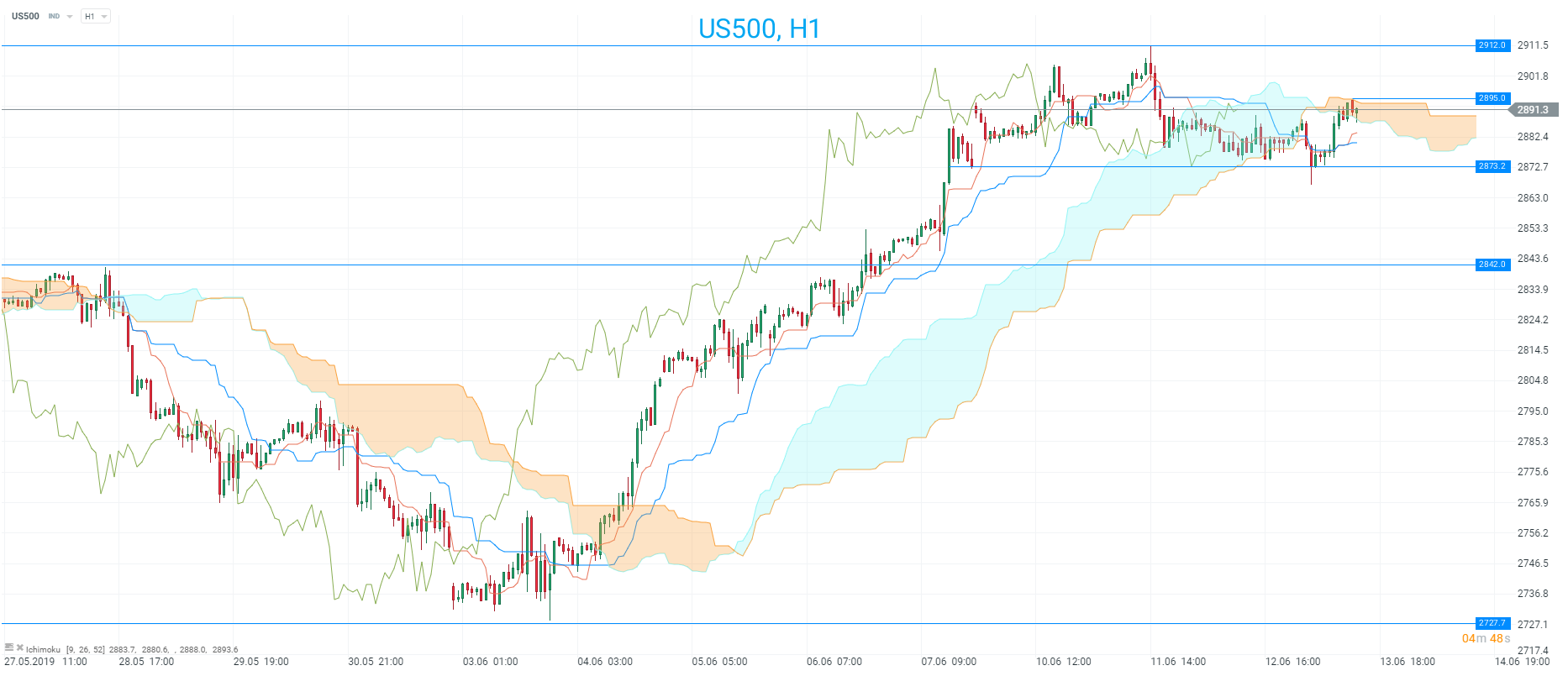

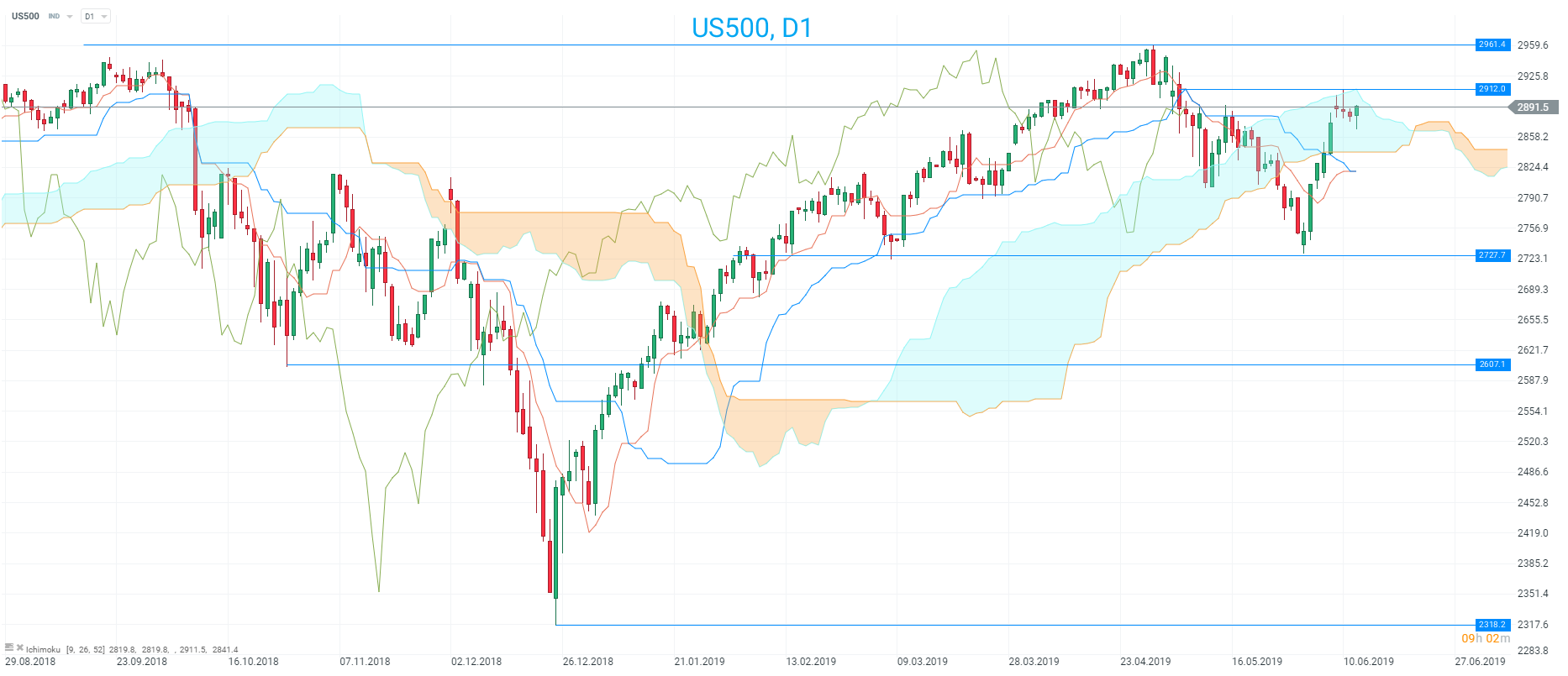

In terms of technical analysis for the S&P500 there’s a nice confluence of Ichimoku clouds developing with price testing both the H1 and D1 versions. These can be seen as potential resistance levels to keep an eye on today and a break above the H1 would be seen as positive, indicating the near-term trend has turned higher while a move above the D1 cloud would be a pleasing development for longer-term bulls.

The S&P500 is probing the top of the H1 cloud around 2895 and this is a near-term potential resistance level to keep an eye on. Source: xStation

On a daily timeframe the market is also probing the top of the Ichimoku cloud. This time the level to watch is 2912. Taken together with the H1 chart this creates a region from 2895-2912 that could be seen as potentially important resistance. Source: xStation

Uber shares went public amidst much fanfare just over a month ago, but the performance so far has not been what many had hoped. The first day saw the largest dollar value amount lost of any IPO in history and while the stock has found some support since then, it remains far from a success. Some better than expected results sent the market higher last week, but there’s been a steady drift down in the past 3 sessions. The stock has received some good news today with Evercore upgrading their view and rating. “We initiate on UBER with a $60 PT giving 40% upside on their “diversified growth at scale” or “platform as a product” and in LYFT we see a “ridesharing pure play” with a $74 PT leaving 28% upside. We see powerful near term catalysts for re-rating of both stocks on the back of a quietly improving pricing environment, incentive maturation, and we expect both to show profitability sooner than consensus is modeling. After a clearly rocky debut, we believe increased education on the business model of ridesharing will lead to multiple expansion.” The stock is called to open higher by a little over 1% this afternoon.

Uber shares have been volatile since their stock market debut last month, but investors have received some good news with an upgrade from Evercore. Source: xStation

Uber shares have been volatile since their stock market debut last month, but investors have received some good news with an upgrade from Evercore. Source: xStation

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.