Summary:

-

Wirecard (WDI.DE) unveiled goals for 2025

-

DAX newcomer expects to expand robustly

-

The company managed to put aside its shady image of the past

-

Wirecard outperforms its peers in terms of profit margins

Wirecard (WDI.DE) is the German payment company that has recently made a name for itself by ousting one of the DAX index founding members and taking its place. Additionally, ambitious “Vision 2025” strategy targets boosted sentiment towards stock in the past couple of days. In this analysis we will take a look at goals company has set for itself, its latest earnings report and how does it compare to its main competitors.

Wirecard (WDI.DE) slumped following an IPO in the middle of the dot com bubble burst. However, the stock managed to recover later on and outperform DAX index significantly in the whole period. Note that the logarithmic scale was used as normal scale would make chart unclear. Source: Bloomberg, XTB Research

Wirecard (WDI.DE) slumped following an IPO in the middle of the dot com bubble burst. However, the stock managed to recover later on and outperform DAX index significantly in the whole period. Note that the logarithmic scale was used as normal scale would make chart unclear. Source: Bloomberg, XTB Research

Wirecard was founded in 1999 in Munich and focused on providing payment solutions to the citizens of Germany. In the early years its services were mostly used by gamblers and websites providing pornography content giving the company somewhat an unethical PR. However, much has changed since then and Wirecard surfaced to be one of the biggest and most successful companies in its industry. The company went public in October 2000 and its shares did not cope too good as the dot com bubble was bursting. Wirecard saw its valuation slump by as much as 98% over the next two years before it began to slowly regain ground. It was in that year (2002) when Markus Braun became the Wirecard’s CEO, the position he holds until now. The first full year of his tenure (2003) was also the first year when Wirecard showed net profit. Under Braun’s lead the company began to slowly distance itself from the shady image it had before and expand worldwide. Nevertheless, it took Wirecard almost 12 year’s to regain its valuation from its first trading session. The company’s share price advanced from €17.4 close on its IPO date to over €160 now. Wirecard cooperates with 200 payment networks and has as much as 35 million private customers around the World but the best may be yet to come.

Electronic payment segment generates the biggest revenues for Wirecard. However, the share of revenue accounting to acquiring digital payment acceptances for retailers and issuing digital payment solutions also plays a vital role for the company. Source: Bloomberg, XTB Research

Electronic payment segment generates the biggest revenues for Wirecard. However, the share of revenue accounting to acquiring digital payment acceptances for retailers and issuing digital payment solutions also plays a vital role for the company. Source: Bloomberg, XTB Research

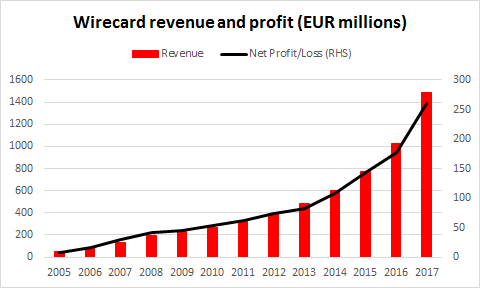

The company recently unveiled its goals in the Vision 2025 strategy and they are ambitious. Namely, the company sees its EBITDA exceeding €3.3 billion in the middle of the next decade and revenue at above €10 billion. To put this figures into context let us note that in the 2017 the company had revenue of a notch below €1.5 billion and EBITDA close to €490 million. If these goals are met it could put Wirecard’s 2025 net income at around €2.1 billion (5-year average margin was used for calculations as margins of Wirecard are quite stable). It would mark an almost 8-fold increase against 2017’s net profit. Wirecard based their estimates on the assumption that the global rise of e-commerce will continue and that will lead to increased volumes of electronic payments. In the Vision 2025 strategy the group sees volume of transactions processed by its systems rising from €91 billion in 2017 to over €710 billion in 2025. On top of that let’s mention that during an interview with Reuters company’s CEO, Markus Braun, said that goals included in the strategy represent conservative view as they are based on the bottom range of company’s projections.

Wirecard proved to be resilient to economic cycle downturns as no pullback can be visible in its revenue and earnings during the financial crisis period. Source: Bloomberg, XTB Research

Wirecard proved to be resilient to economic cycle downturns as no pullback can be visible in its revenue and earnings during the financial crisis period. Source: Bloomberg, XTB Research

Wirecard published its earnings report for the second quarter of 2018 on 16 August. The company managed to beat analyst estimates in all earnings measures with EPS reaching €0.67 and revenue moving close to €480 million mark. Through the first six months of the year the company processed transactions worth €56.2 billion marking a 49% YoY advance. Additionally, the company raised its full-year guidance for 2018. The company expects full-year EBITDA in the range of €530-560 million. By the way of announcing Vision 2025 strategy Wirecard’s executives confirmed that the company is on the best way to meet guidance. Third quarter earnings report is due on 14 November.

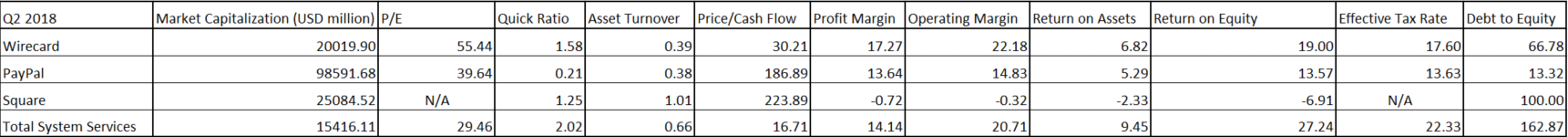

Comparison of selected financial data of Wirecard and its peers. Source: xStation5

Comparison of selected financial data of Wirecard and its peers. Source: xStation5

Comparing Wirecard with other payment companies we get an equivocal picture. On one hand, the German company has the highest operating and profit margins showing good profit prospects as well as relatively liquid position (quick ratio). On the other, along with PayPal it is one of the least efficient companies from the group in terms of asset management as shown by the lowest asset turnover ratios. To compare profitability among its peers it is better to look at return on asset ratios as the use of debt greatly varies between companies presented in the table above. In terms of this ratio Wirecard copes better than PayPal, the biggest company in the table by market capitalization. While stock market prices unit of Wirecard’s earnings (P/E) as the most expensive its cash flow is subject to the most conservative valuation (Price/Cash Flow). However, what puts Wirecard behind its peers is the effective tax rate (Total System Services tax rate appears to be higher in Q2 2018 due to one-off factors). This results from the simple fact that Wirecard is the only non-US company in the table and therefore other companies can benefit from the tax cuts passed last year in the US.

After reaching ATH at €198.80 at the beginning of September Wirecard (WDI.DE) shares began to underperform. The company’s share price was subject to wild swings throughout this week, including two days of steep declines. Nevertheless, the payment company still trades significantly above the €93.07 handle where it finished previous year. Note how the stock respected Fibo levels following reaching of the all-time high. Source: xStation5

After reaching ATH at €198.80 at the beginning of September Wirecard (WDI.DE) shares began to underperform. The company’s share price was subject to wild swings throughout this week, including two days of steep declines. Nevertheless, the payment company still trades significantly above the €93.07 handle where it finished previous year. Note how the stock respected Fibo levels following reaching of the all-time high. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.