- Spotify stock dropped 20% off recent highs

- Company announce price hikes in over 50 countries

- Sell-off driven by 'sell-the-fact' attitude

- Strong jump in Monthly Active Users in Q2 2023

- Mixed forecasts for Q3 2023

- Stock halted sell-off in the $140 area

A lot has been going on in recent days around Spotify Technologies (SPOT.US), US-listed Swedish music streaming company. Share price of the company experienced some volatile moves recently and those moves can be reasoned with two events - announced price hikes and Q2 2023 earnings release. Let's take a closer look at what's going on with Spotify!

Spotify hikes plan prices

Before we take a look at the earnings release from Spotify that was published this week, we need to take a look at what happened with the stock prior to that. Share price of Spotify has been trading higher since the beginning of 2022. However, gains accelerated in the first half of July with stock climbing to the levels not seen since early-2022. Move higher was fuelled by media speculation that the company is planning to increase prices on subscription plans, following similar actions taken by Apple Music and Amazon Music.

Those media rumors were confirmed this Monday, July 24 when Spotify announced that it will boost prices of its Premium subscription plans. Prices for most plans in the United States, company's biggest market, will increase by $1 per month, which translates into an around 10% increase. Overall, plan prices will increase in over 50 countries. Confirmation that hikes are indeed coming triggered a sell-off on company's stock on Monday in an apparent 'sell-the-fact' move.

Spotify struggled to grow its revenue faster than costs in recent quarters and price hike may help change the situation. Source: Bloomberg, XTB

Spotify struggled to grow its revenue faster than costs in recent quarters and price hike may help change the situation. Source: Bloomberg, XTB

Q2 2023 earnings offer no relief for investors

An almost-5% drop in Spotify stock recorded on Monday was just the beginning of bad news for the company's investors this week. Earnings release on Tuesday triggered another wave of selling with the stock slumping 14% to the lowest level since early-May 2023. Spotify's performance in April-June 2023 period can be best described as mixed - revenue was more or less in-line with estimates, loss was deeper than a year ago and user numbers turned out to be much better than expected.

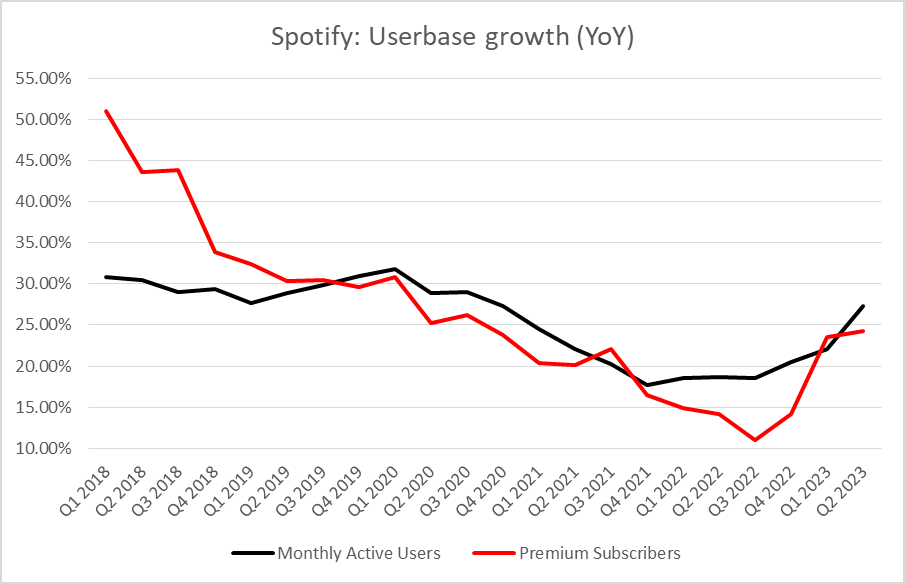

Momentum in user growth was truly stunning with the company growing its MAU base by 27% compared to a year ago and by 7% compared to end-Q1 2023. Nevertheless, this jump in users numbers did not translate into higher profitability. In fact, losses were much deeper than expected and than losses reported a year ago. This can be seen as a source of concern and a sign that more sustained improvement in profitability may still be some time away.

Spotify Q2 2023 results

-

Revenue: €3.18 billion vs €3.21 billion expected (+11% YoY)

-

Premium revenue: €2.77 billion vs €2.79 billion expected

-

-

Monthly Active Users (MAU): 551.0 million vs 529.9 million expected (+27% YoY)

-

Total Premium Subscribers: 220.0 million vs 217.1 million expected (+17% YoY)

-

Ad-supported MAUs: 343.0 million vs 322.8 million expected (+34% YoY)

-

-

Average revenue per user: €4.27 vs €4.38

-

Operating loss: -$247 million vs -$127.4 million expected (-$194.0 million a year ago)

-

Net loss: -$302.0 million vs -$123.1 million expected (-125.0 million a year ago)

-

Loss per share: -€1.55 vs -€0.85 a year ago

Not only Spotify's revenue growth is slowing but also its gross margin deteriorated to levels not seen in over 5 years. Source: Bloomberg, XTB

Price hikes unlikely to materially impact earnings until Q4 2023

Apart from Q2 2023 results Spotify Technologies also released financial forecasts for the current quarter (Q3 2023). Those, just like earnings, turned out to be mixed. Revenue guidance of €3.3 billion fell short of market's median estimate (€3.42 billion). On the other hand, Spotify projects operating loss during the quarter to be much smaller than market expected. Base of Monthly Active Users is expected to continue to grow but at a slower pace of 3.8% QoQ, or 25.4% YoY, while base of Premium Subscribers is seen growing 1.8% QoQ, or 22.4% YoY, in Q3 2023. On a positive note, gross margin is expected to recover to more or less the middle of recent range.

When it comes to recently announced price hikes, they may not have much of a positive impact on Q3 2023 results from the company. In fact, the impact of those price hikes may be even negative in this quarter! This is because Spotify will offer a 1-month grace period for current customers before higher prices take effect. This means that higher prices will only be present in the final month of third quarter 2023 and should they turn out to be discouraging for customers and cause them to drop Spotify services, net impact in Q3 2023 on results may be negative. It should be noted, however, that Apple and Amazon also increase prices on their music plans by $1-2 per month and this has not led to any major exodus of clients. Impact of higher prices on Spotify sales should be clearly positive starting from Q4 2023 (first full quarter of higher prices).

Q3 2023 forecast

-

Monthly Active Users: 572 million vs 548 million expected

-

Total Premium Subscribers: 224.0 million vs 223.5 million expected

-

Revenue: €3.3 billion vs €3.42 billion expected

-

Operating Loss: -€45 million vs -€83.6 million expected

-

Gross margin: 26% vs 25.9% expected

Pace of growth in the Spotify userbase is picking up again. Source: Bloomberg, XTB

Outlook not that bad, cost controls in spotlight

The last couple of days were far from positive for Spotify shareholders with stock dropping over 20% off a recent local high. Nevertheless, as we have already mentioned before, the sell-off was mostly likely a 'sell-the-fact' move following confirmation of price hikes. Outlook for the company's business is not that bad, especially with projections of continued strong pick-up in user numbers and higher price plans.

Whether this positive outlook materializes will depend on whether higher plan prices will lead to user exodus. However, given that churn rates in music streaming businesses are low and evidence from Spotify rivals suggests that customers are insensitive to price increases, the future looks promising for the company. Nevertheless, a point to note is that strong momentum in user growth will not help Spotify attract investors unless it better manages costs, or at least shows some signs of improvement in the path towards profitability.

A look at the chart

Taking a look at Spotify Technologies (SPOT.US) chart at H1 interval, we can see that the stock has recently broken above the upper limit of the bullish channel but bulls failed to maintain momentum and stock started to pullback following price hike news. Share price pulled back into the range of the channel and slumped below it later on. Declines were halted in the $140 area and stock started to recover from losses. Gains were halted at the 23.6% retracement of the sell-off in the $149.50 area but current premarket quotes point to an opening above $151.00 mark today. Having said that, the aforementioned $149.50 zone will act as a near-term support while the $155 area, marked with 38.2% retracement, will act as a near-term resistance.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.