-

Microsoft is the second highest valued stock on Wall Street

-

Company continues to increase share of services revenue in mix

-

Cloud remains a key business going forward

-

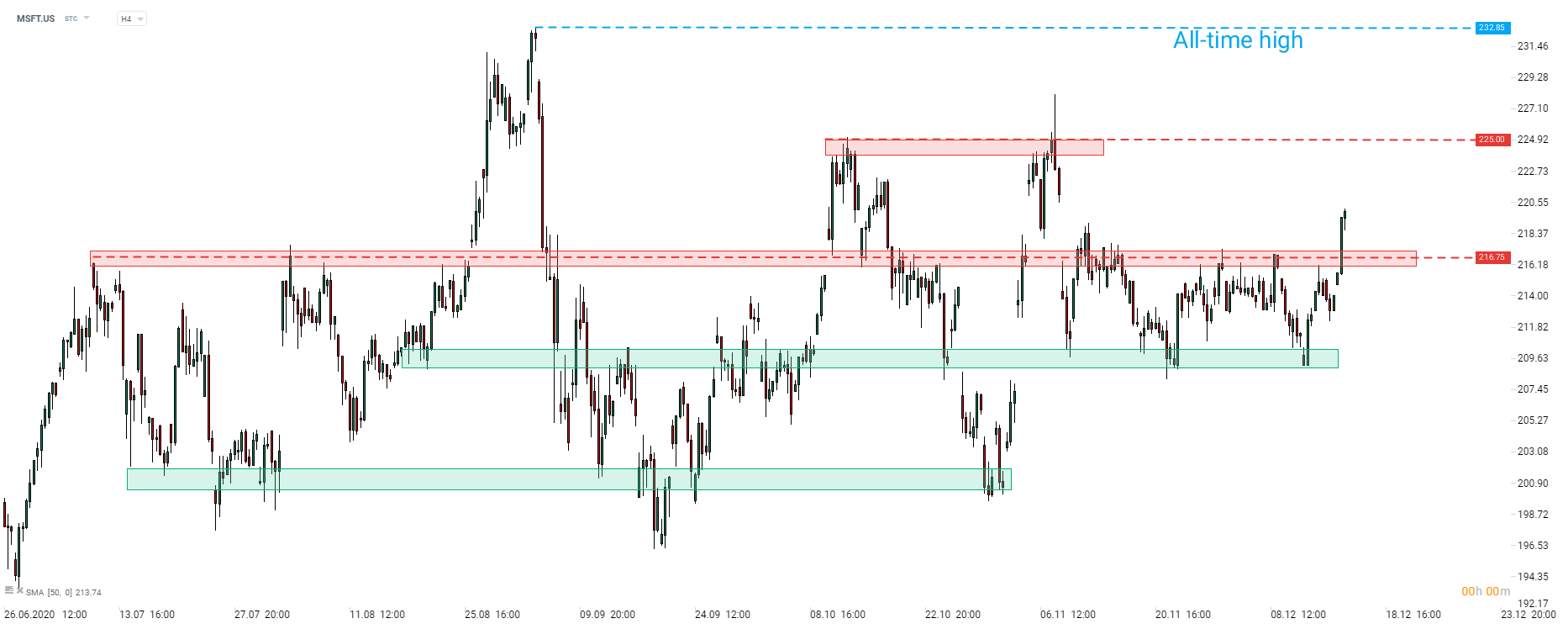

Stock broke above the resistance zone at $216.75

Microsoft (MSFT.US) is one of four trillion-dollar companies and the second highest valued US stock (losing only to Apple). The company for a long time has been and still is associated with Windows software. However, it has recently undertaken actions aimed at boosting share of recurring revenue in its business with cloud computing playing a key role.

Solid fundamentals

Microsoft has been trading in a strong upward move since the global financial crisis. Share price increased from around $15 in early-2009 to over $200 now. Steep gains were made on the back of solid fundamentals with Microsoft beating the S&P 500 index in terms of sales growth on a regular basis. The company has also beat the index in terms of earnings growth for the past few years. However, executives recognized that a new business model may be needed to maintain a solid pace of growth and decided to focus on increasing share of recurring revenue and scaling back reliance on hardware sales.

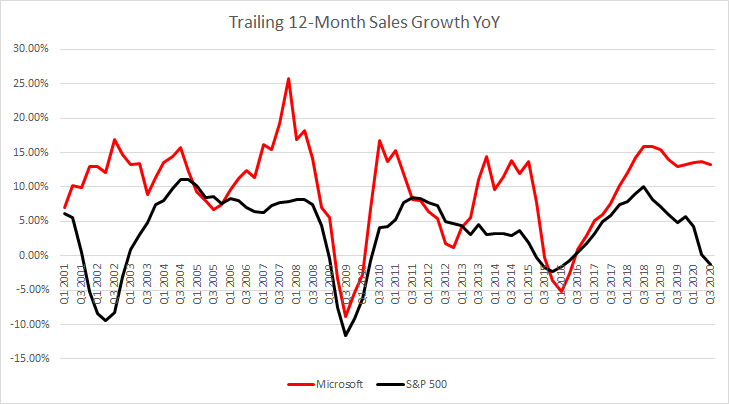

Microsoft has managed to beat S&P 500 in terms of sales growth on a regular basis. Company maintained a high pace of revenue growth in recent quarters while average sales growth for the index decelerated significantly. Source: Bloomberg, XTB

Microsoft has managed to beat S&P 500 in terms of sales growth on a regular basis. Company maintained a high pace of revenue growth in recent quarters while average sales growth for the index decelerated significantly. Source: Bloomberg, XTB

Cloud is a key

Cloud computing became one of key areas of interest for the company. Microsoft launched Azure Services Platform back in 2008 but its development has accelerated after Satya Nadella took over as company's Chief Executive Officer in 2014. Nadella is one of the main advocates of transitioning the company towards cloud and after over 5 years in charge, he has managed to make substantial progress in the field - revenue from Intelligent Cloud segment increased to 35% of sales mix in the latest quarterly filing compared to less than 23% at the beginning of 2015. At the same time, the share of the More Personal Computing segment, which includes most of the hardware sales, dropped from 50% at the end of 2015 to 32% now.

Share of service revenue across all segments reached 57.4% in Q3 2020, up from 52.3% in Q3 2019.

More Personal Computing segment that includes most of the hardware sales has been gradually losing importance since Satya Nadella took over as Microsoft's CEO. However, it still accounts for around a third of revenue. Source: Bloomberg, XTB

More Personal Computing segment that includes most of the hardware sales has been gradually losing importance since Satya Nadella took over as Microsoft's CEO. However, it still accounts for around a third of revenue. Source: Bloomberg, XTB

Why is cloud revenue so important?

Cloud revenue is important because it is a recurring type of revenue. This means that it is expected to continue into the future and thanks to this it is a highly predictable source of revenue. Such a predictability is important for the company as it allows more accurate forecasting and planning, which can help make the business as a whole more resilient. This stands in complete opposition to hardware sales that often have a one-off nature and may fail to translate months or even years of development process into profits should the company develop a faulty product. Companies with predictable and recurring revenue are also desired in investment portfolios as their cash flows can be easier analyzed and projected and they have a higher ability of sharing profits on a regular basis, via for example dividends.

Microsoft (MSFT.US) has been trading in a more or less sideways move since summer. However, the stock has managed to break above the resistance zone range around $216.75 yesterday. The nearest resistance to watch is marked by a double top at $225 and is the final hurdle blocking the way towards all-time high at $232.85. Source: xStation5

Microsoft (MSFT.US) has been trading in a more or less sideways move since summer. However, the stock has managed to break above the resistance zone range around $216.75 yesterday. The nearest resistance to watch is marked by a double top at $225 and is the final hurdle blocking the way towards all-time high at $232.85. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.