Home Depot (HD.US) has been underperforming broad market indices, like S&P 500 or Dow Jones, so far this year. Stock is down 1.6% year-to-date and is among underperformers in the Dow Jones index. Company struggled to grow sales during fiscal-Q2, which tends to be the strongest quarter for the company in seasonal terms. Let's take a quick look at company's valuation.

Strongest seasonal quarter failed to spur revival

Start investing today or test a free demo

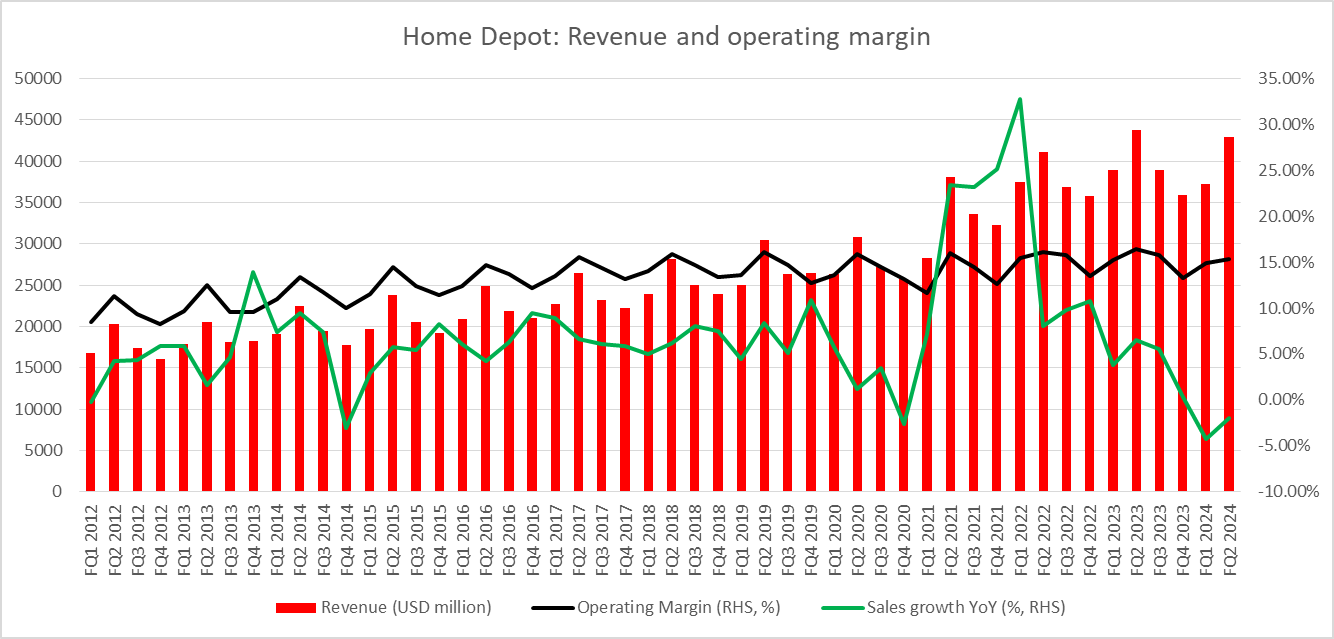

Open account Try demo Download mobile app Download mobile appHome Depot has been struggling with slowing sales growth since the post-pandemic boom in home improvement goods sales faded. In fact, the company has even experienced a negative sales growth in recent quarters with the latest data for fiscal-Q2 2024 (calendar May - July 2023) showing a revenue drop of 2.0% YoY. While this was an improvement compared to 4.2% YoY drop reported in fiscal-Q1 2024, it is also a source of concern as fiscal-Q2 is seasonally the best quarter for the company.

Nevertheless, it should be noted that the company managed to beat expectations with its latest quarterly release and upheld its full-year forecasts.

Home Depot failed to grow sales in fiscal-Q2 2024 which tends to be the strongest seasonal quarter. Source: XTB Research

Home Depot failed to grow sales in fiscal-Q2 2024 which tends to be the strongest seasonal quarter. Source: XTB Research

A look at valuation

Let's take a quick look at Home Depot's valuation with 3 often used valuation methods - DCF, multiples and Gordon Growth Model. We want to stress that those valuations are for presentation purposes only and should not be viewed as recommendations or target prices.

Discounted cash flow method

Let's start with the Discounted Cash Flow method (DCF), which is probably the most popular valuation method for companies with established businesses. This model relies on a number of assumptions for revenue growth, operating margin, effective tax rate, depreciation, capital expenditures or weighted average cost of capital (WACC).

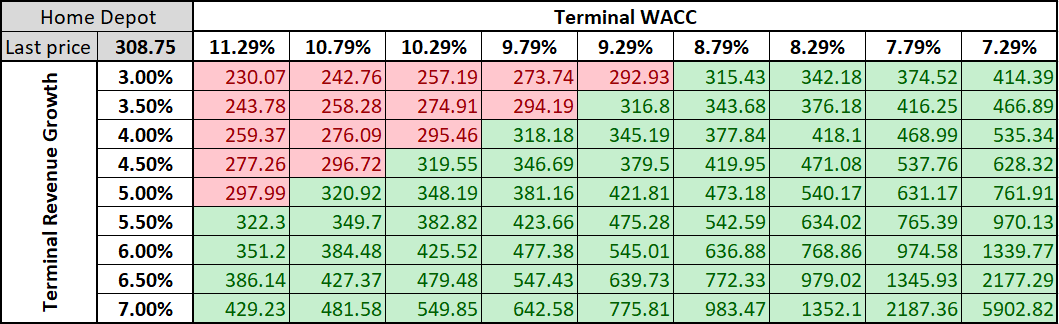

For simplicity, we have used averages for the past 5 years as assumptions as well as a 5% terminal revenue growth assumption. Such a set of assumptions leads us to a valuation of $421.81 - or around 35% higher than current market price. While this would suggest that the company has some upside as far as fundamentals are concerned, this model is highly sensitive to the assumptions used and small changes in those can lead to very different results. Two sensitivity matrices are provided below - one for operating margin and revenue growth assumptions and the second one for terminal revenue growth and terminal WACC assumptions.

Source: XTB Research

Source: XTB Research

Source: XTB Research

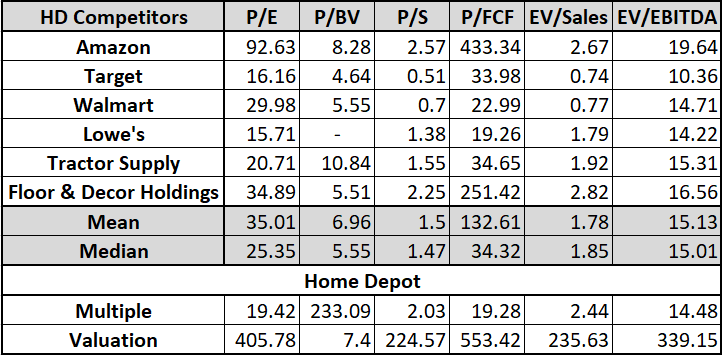

Multiples method

Let's move to the next very often used valuation method - multiples. A peer group for comparison is needed and it was constructed with retailers who are selling home improvement goods, like Home Depot. The group includes:

- Lowe's (LOW.US)

- Tractor Supply (TSCO.US)

- Floor & Decor Holdings (FNR.US)

- Amazon (AMZN.US)

- Walmart (WMT.US)

- Target (TGT.US)

While all of those companies have home improvement goods in their offering, it should be said that Lowe's, Tractor Supply and Floor & Decor Holdings are 'pure play' home improvement retailers while the remaining 3 companies have home improvement goods as part of their wide product offering.

An upper-section of the table below shows 6 different multiples for 6 Home Depot's peers, with means and medians calculated at the bottom. A bottom-section shows multiples for Home Depot as well as Home Depot valuations calculated with use of peer group means. As one can see, range of obtained valuations is very wide. Taking a trimmed mean of those (excluding lowest P/BV and highest P/FCF valuations) leads us to a valuation of $301.20, or around 3% below current market price.

Source: XTB Research

Gordon Growth Model

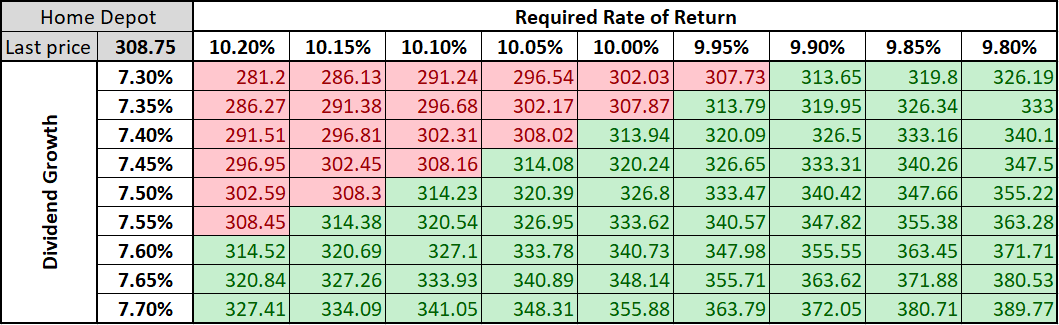

Home Depot has been paying out dividends regularly for the past 35 years. While payout was increased in most years, it was not always the case - the last time dividend was held unchanged was as recently as in fiscal-2022. As a company with a good track record of paying dividends, Home Depot can be valued using Gordon growth model. Two assumptions are needed here - required rate of return and perpetual dividend growth. Using a cost of equity of 10.00% as required rate of return and 7% dividend growth leads us to a valuation of $326.8, or around 5% above current market price.

However, it should be noted that the valuation is highly sensitive to assumptions used. A sensitivity matrix can be found below and it shows that how much valuation changes by changing each of the assumptions in 5 basis point steps.

Source: XTB Research

Source: XTB Research

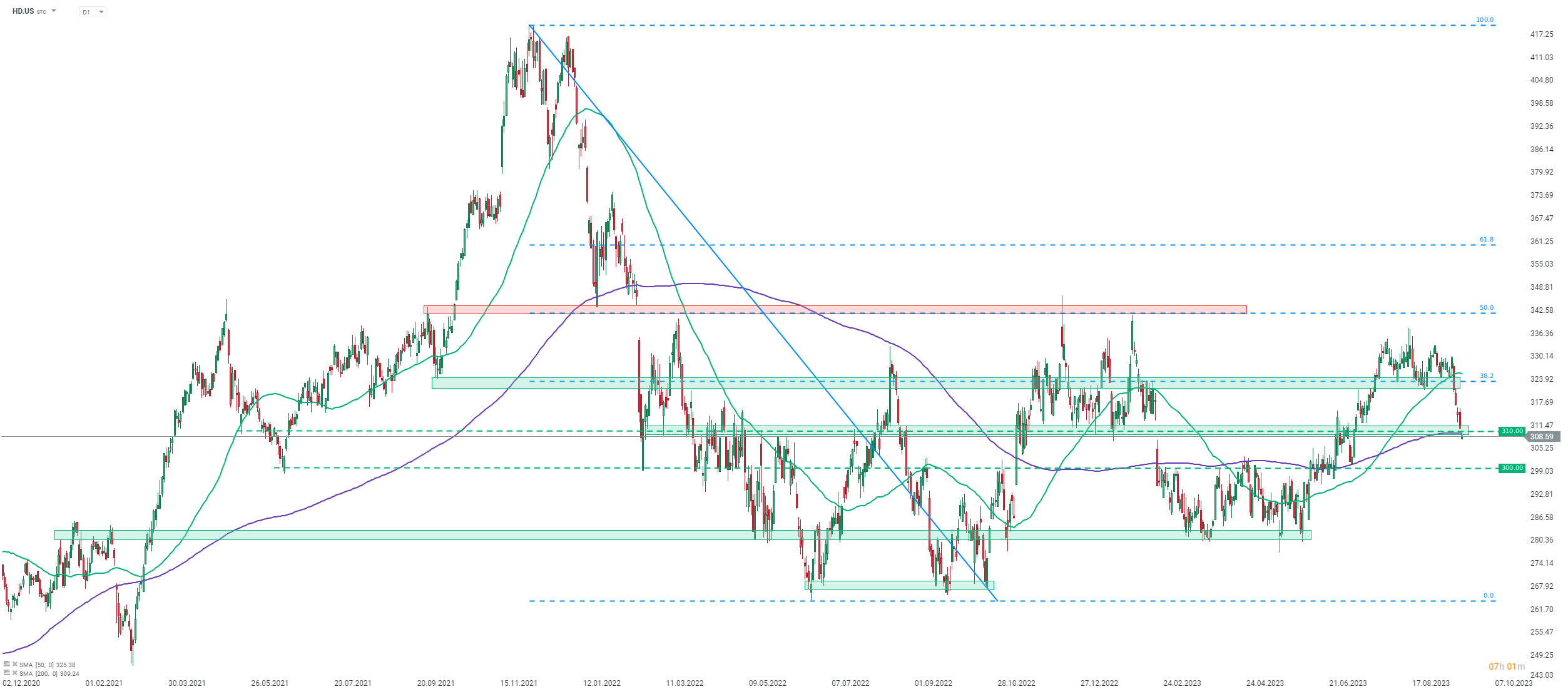

A look at the chart

Taking a look at Home Depot (HD.US) chart at D1 interval, we can see that the stock has been struggling recently and declines accelerated following a drop below the support zone marked with 38.2% retracement of the 2021-2022 sell-off. Stock dropped below another important support following today's lower opening - $310 area marked with previous price reactions and the 200-session moving average. While an attempt is being made to climb back above this hurdle, no success can be spotted yet. Should slide resume, the next support to watch can be found in the psychological $300 area.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.