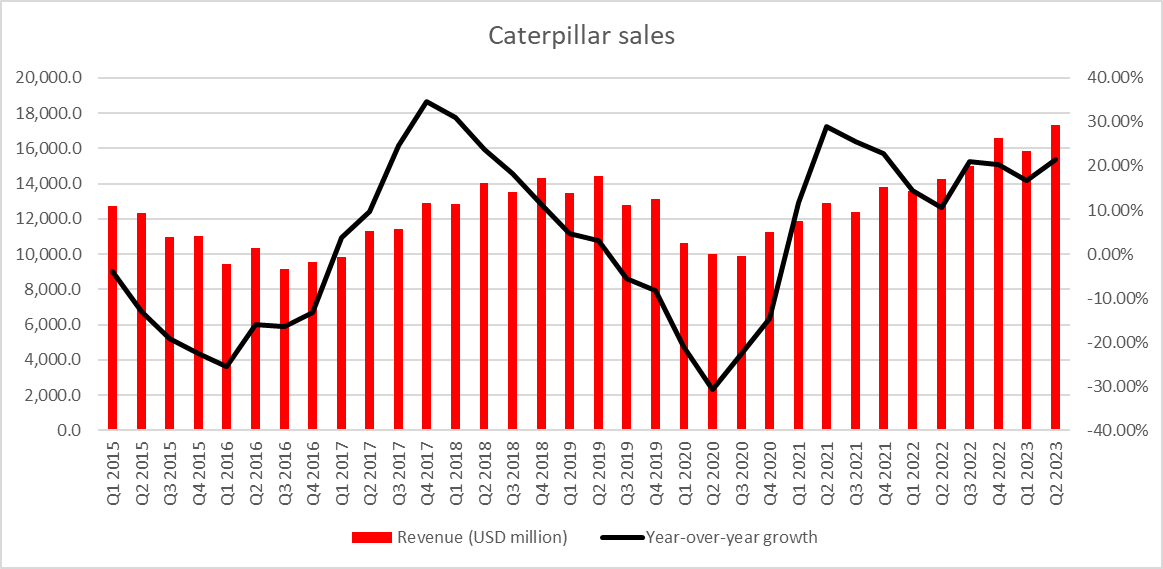

- Caterpillar reported Q2 2023 earnings on Tuesday

- Company beat revenue and profit expectations

- Strong performance across all 3 key industries

- Weaker-than-expected demand recovery in China

- Company remains optimistic about future

- Share price surged to fresh all-time highs

Shares of Caterpillar (CAT.US), US manufacturer of heavy machinery, surged to record highs earlier this week after the company reported solid Q2 2023 earnings. Stock jumped over 8% to fresh all-time highs as optimistic outlook on the future defied global slowdown fears and rather poor picture painted by macro economic data. Let's take a closer look at the company and a recent release!

Bellwether for the US and global economy

Caterpillar is the world's largest machinery equipment manufacturer and because of that is one the stocks that should be watched closely by all investors. Company is often seen as a bellwether not only for the US economy but also for the global economy. While Caterpillar is a US company, more than half of its sales come from abroad and this makes it an indicator for global manufacturing - weaker sales of Caterpillar machines often herald weakening demand in the global industry.

Taking a look at the chart below plotting 12-month Caterpillar share price return with US manufacturing ISM index, we can see that turns in Caterpillar return often heralded turns in ISM trends. Current divergence between the two as well as strong results reported by Caterpillar suggest that we may see a turn in ISM trend soon.

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

Impressive Q2 results

Earnings report for the second quarter of 2023 from Caterpillar was released on Tuesday ahead of the Wall Street session open and turned out to be a positive surprise. Company reported sales that were almost $1 billion higher than market's expectations. This was driven by strong sales in ME&T division, which experienced a 22% YoY growth. Operating income jumped 88% YoY. Adjusted EPS at $5.55 was 75% YoY higher than a year ago and also 22% higher than median estimate. Interestingly, dealer inventory increased during the quarter in spite of a strong demand.

Caterpillar explained that such solid results were achieved thanks to higher sales volumes as well as favorable price mix. Company returned $2 billion to shareholders during the quarter - $1.4 billion via buybacks and $0.6 billion via dividends.

Caterpillar Q2 2023 earnings

-

Revenue: $17.32 billion vs $16.39 billion expected (+22% YoY)

-

Machinery, Energy & Transportation: $16.55 billion vs $15.65 billion expected (+22% YoY)

-

Financial Products: $773 million vs $756 million expected (+9.2% YoY)

-

-

Operating income: $3.65 billion vs $2.94 billion (+88% YoY)

-

Machinery, Energy & Transportation: $3.55 billion vs $2.83 billion expected (+97% YoY)

-

Financial Products: $257 million vs $227 million expected (+9.8% YoY)

-

-

Adjusted operating income: $3.68 billion vs $2.94 billion expected

-

EPS: $5.67 vs (+81% YoY)

-

Adjusted EPS: $5.55 vs $4.54 expected, $3.18 a year ago (+75% YoY)

-

Research & Development expenses: $528 million vs $530.5 million (+10% YoY)

-

Dealer inventory: +$0.6 billion

-

Order backlog: +$0.3 billion

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

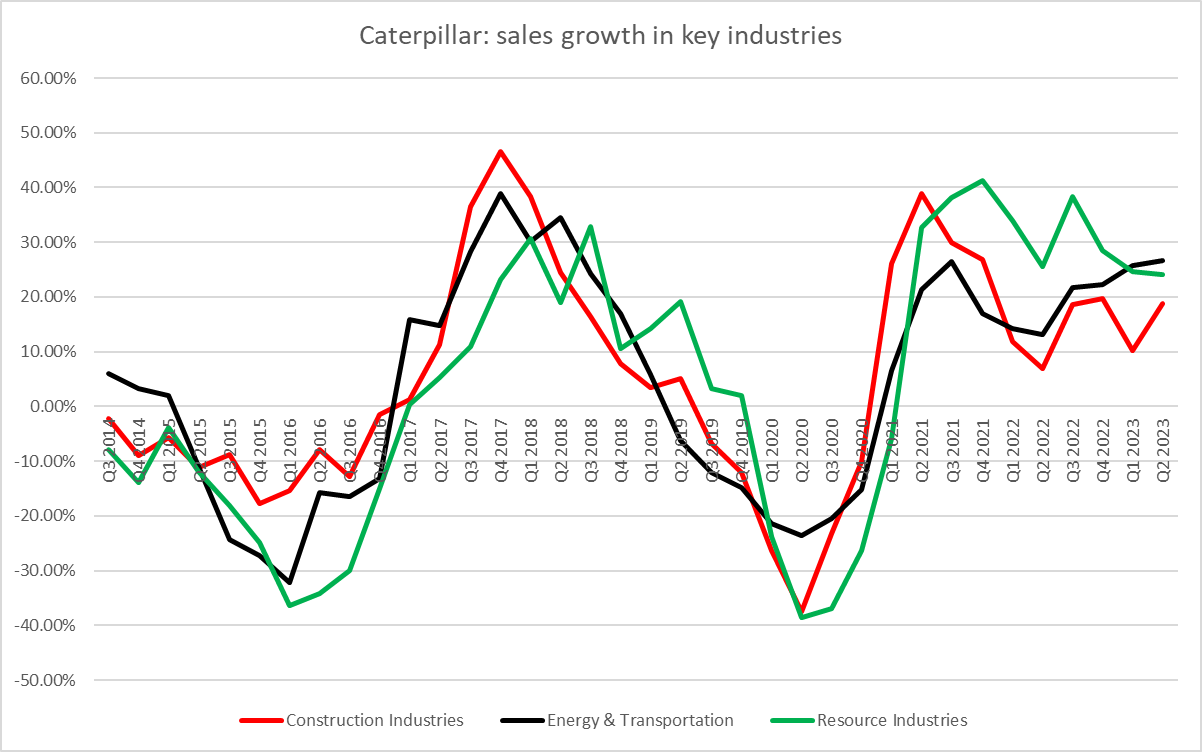

Strong performance across all 3 key industries

What makes Q2 2023 from Caterpillar even better is the fact that improvement in business was broad-based. Company reported an over-20% revenue growth in each of 3 key industries, with Energy & Transportation achieving the highest growth. Construction Industries was the most profitable industry with profit margin jumping from 16.4 to 25.2%, and accounted for almost a half of the company's profit during the quarter.

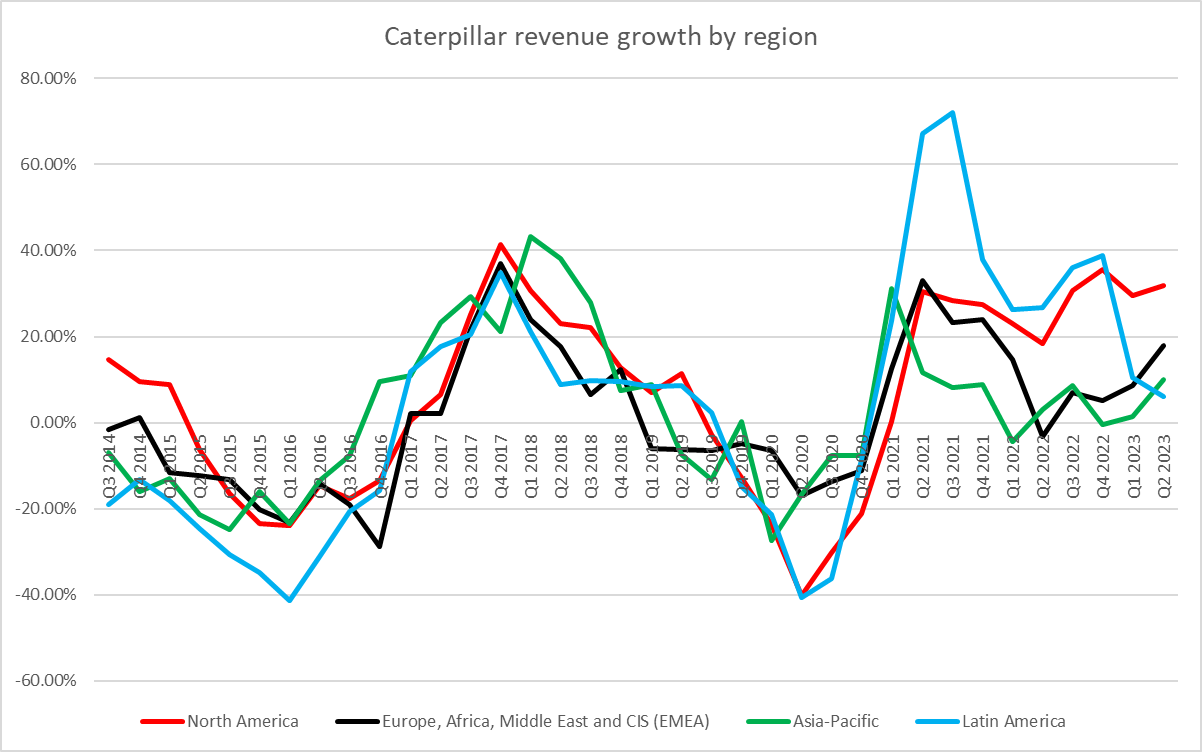

Company reported improved performance all across the board - from Industrial through Oil & Gas and to Power Generation and Transportation businesses. Strong sales, especially in North America and EMEA regions, drove results.

Machinery, Energy & Transportation (ME&T) breakdown

-

Revenue

-

Construction Industries: $7.2 billion (+20% YoY)

-

Resource Industries: $3.6 billion (+20% YoY)

-

Energy & Transportation: $7.2 billion (+26% YoY)

-

-

Segment Profit

-

Construction Industries: $1.803 billion (+82% YoY)

-

Resource Industries: $740 million (+108% YoY)

-

Energy & Transportation: $1.269 billion (+92% YoY)

-

-

Segment Profit Margin

-

Construction Industries: 25.2% vs 16.4% a year ago

-

Resource Industries: 20.8% vs 12.0% a year ago

-

Energy & Transportation: 17.6% vs 11.6% a year ago

-

Note: Segment data includes inter-segment sales and therefore does not sum up to data for ME&T combined.

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

Optimistic about future

Apart from announcing solid results, Caterpillar also voiced optimism about the future. Company said that it expects full-year adjusted operating profit margin to be near the top end of target range with second-half margin and sales being higher than a year ago. Sales and adjusted operating profit margin in Q3 2023 are expected to be higher than in Q3 2022 but lower than in Q2 2023.

Capital expenditures in ME&T segment increased to $0.3 billion from $0.2 billion a year earlier. Caterpillar expects full-year CapEx to be around $1.5 billion and restructuring expenses to amount to around $700 million. Company generated $2.6 billion in free cash flow during the Q2 2023 quarter from ME&T segment and expects full-year cash flow to be around the top end of the $4-8 billion target.

Demand in China disappoints

However, not everything was so rosy. Company noted that sales in the Asia-Pacific region were flat year-over-year in Q2 2023. Caterpillar warned that sales in China have been softer than previously anticipated with further weakness in sales of machinery most often used in Chinese construction projects. Company's CEO said that he expects further weakness as the post-pandemic rebound in China fades. This follows his comments from back in April when he said that he expects the share of revenue from China to drop below the usual 5-10% range.

Nevertheless, it should be said that this drop in Chinese share is driven not only by weaker than expected business performance in China but also by strong sales elsewhere. After all, Latin America was the only major region in which Caterpillar reported slower growth than in Q1 2023.

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

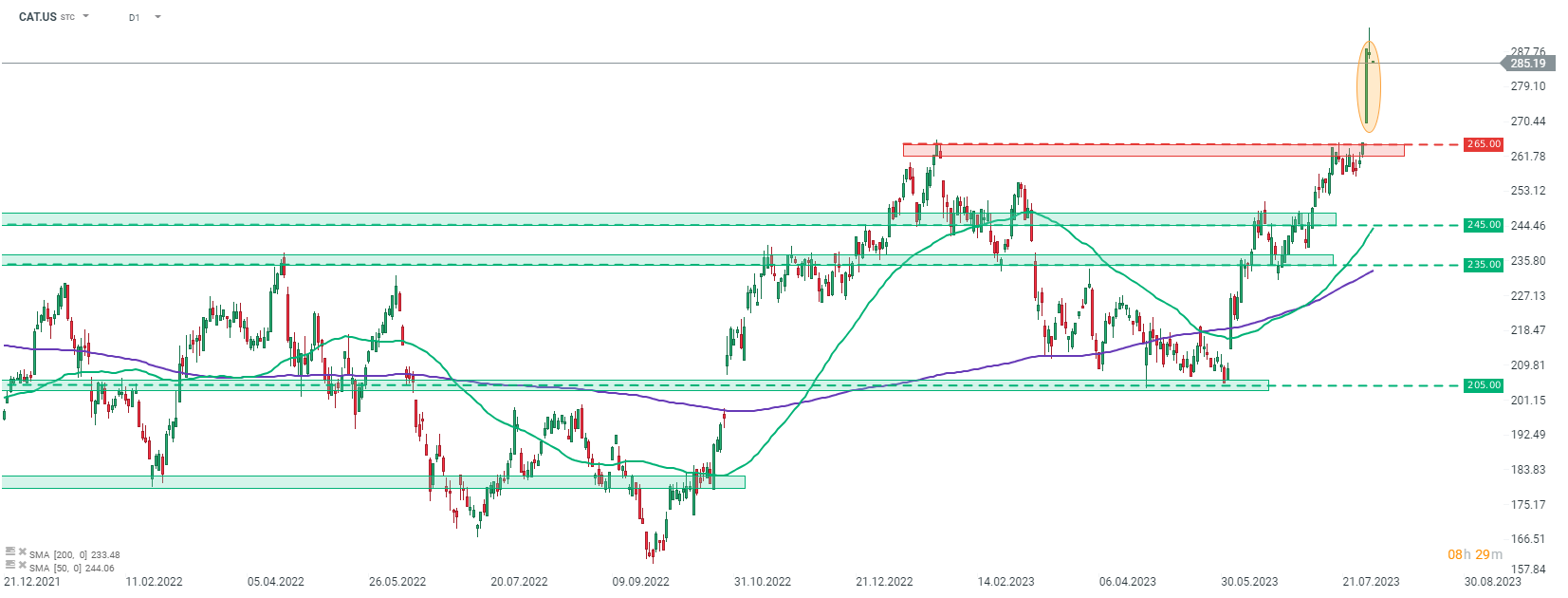

Caterpillar at fresh record highs!

Results for the second quarter were very strong and so was the market's reaction to them. Caterpillar's shares jumped over 8% on Tuesday after earnings were released with stock moving to fresh all-time highs! Strong earnings that stood in contrast to a rather poor picture of the economy painted by macro data show that feared slowdown may not be as severe. Optimism of the company about the second half of the year is encouraging. Weakness in China is a source of concern but when it comes to Caterpillar, China does not account for a big part of the business so impact may not be as big.

Taking a look at Caterpillar (CAT.US) chart at D1 interval, we can see that the stock was testing $265.00 resistance zone prior to earnings release (orange circle). This zone was marked with previous all-time highs and bulls struggled to break above it since mid-July 2023. Post-earnings surge pushed the stock above and after a higher opening on Tuesday, share price continued to rally and closed at a record high above $288. An intraday all-time high was reached yesterday slightly below the $294 mark. Upward momentum seems to have slowed with stock launching today's trading a touch lower. Nevertheless, some profit taking should not come as a surprise given recent steep gains.

Source: xStation5

Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.