Summary:

- Carrefour (CA.FR) announced the sale of majority stake in the Chinese unit

- Carrefour China was a drag for the whole group in the previous years

- Company plans to focus more on the core French market

- Restructuring process started last year provides company with cost savings

- Stock price bounced off the long-term support zone

Carrefour (CA.FR), the French retailer with broad international presence, announced at the beginning of the week that it will divest major part of its Chinese business. The move may seem strange given that China is the fastest growing grocery market in the world. In this short analysis we will take a look at the rationale behind it as well as the company’s ongoing restructuring.

Carrefour’s revenue barely grew compared to the beginning of the millennia. However, company’s earnings greatly deteriorated in the aftermath of the global financial crisis. Solid improvement in EBITDA margin in the second half of 2018 hints that company’s cost-cutting restructuring is working. Source: Bloomberg, XTB Research

Carrefour’s revenue barely grew compared to the beginning of the millennia. However, company’s earnings greatly deteriorated in the aftermath of the global financial crisis. Solid improvement in EBITDA margin in the second half of 2018 hints that company’s cost-cutting restructuring is working. Source: Bloomberg, XTB Research

An announcement surfaced at the beginning of the week saying that Carrefour will sell 80% stake in its Carrefour China subsidiary to Sunning.com, one of the largest Chinese retailers. The French company will receive €620 million for its stake, valuing the subsidiary at €1.4 billion including debt. Carrefour will also get the option of selling the remaining stake at a later date. The EV/EBITDA multiple for the transaction is a stellar 21x. However, it is not the great price but poor earnings that make it so high. In fact, sales multiple (Price/Sales) of the subsidiary is less than 0.2, compared to industry average of 0.8. Looking at things this way we can see that Carrefour is actually selling majority stake in its Chinese unit at a huge discount. As China is such a fast growing market does it make sense to sell a unit there at such a low price? Taking a look at the circumstances - it does.

Asia is a promising market for the Western companies due to its rapid economic growth and high population. Nevertheless, Carrefour struggled to capture this potential. As one can see on the chart above, Asia was the region that generated the least revenue for the French retailer. Moreover, it was also the region that saw declining same store sales in almost every year during the past decade. Source: Bloomberg, XTB Research

Asia is a promising market for the Western companies due to its rapid economic growth and high population. Nevertheless, Carrefour struggled to capture this potential. As one can see on the chart above, Asia was the region that generated the least revenue for the French retailer. Moreover, it was also the region that saw declining same store sales in almost every year during the past decade. Source: Bloomberg, XTB Research

Carrefour is not the only Western retailer that gave China a try. Giants like Walmart or Tesco also looked to the World’s most populated country for an opportunity to make profits. At start it was even looking that they may succeed there. However, foreign firms in China are often victims of diplomatic spats. It was the case in 2008 when France addressed China-Tibet conflict during the Olympics Games. In response, Chinese decided to boycott Carrefour in order to punish the European country. However, this is not the only reason that makes competing in China hard for the Western retailers. Online groceries that offer the same-day deliveries and competitive pricing won appeal of the Chinese people. Walmart, Tesco or Carrefour found it hard to compete with those firms online and maintain their brick-and-mortar hypermarkets. Hypermarkets now hold a 20% share of the Chinese retail market, down from around 25% at the start of the decade. In turn, all of the aforementioned Western retailers made a decision to withdraw from China.

Situation looks even worse when we take a look at the operating income figures. Asia not only lagged every other region but even saw operating losses in a few periods. Unsurprisingly, it is also the region with the weakest margins. Source: Bloomberg, XTB Research

Situation looks even worse when we take a look at the operating income figures. Asia not only lagged every other region but even saw operating losses in a few periods. Unsurprisingly, it is also the region with the weakest margins. Source: Bloomberg, XTB Research

It seems justified given that Carrefour’s business in China generated losses in the previous years. The company launched a restructuring plan in 2018 and withdrawal from China is a part of it. The company will now be able to focus more on its core markets, like for example France. In its homeland the company is struggling with growing competition from domestic retailers as well as increasing market share of Amazon, the US e-commerce giant. The company delivered significant job cuts during the first year of its restructuring what help it achieve savings of €1.05 billion. This was more than the company initially expected and, in turn, it has decided to raise cost-reduction goal to €2.8 billion on a full-year basis by 2020 from the previous €2 billion. Additionally, the company has entered into purchasing agreements with other retailers like Tesco or Systeme U. Thanks to this agreement the companies will now have a greater bargaining power and may secure lower pricing from suppliers. According to the company, favourable effects of these agreements should be visible starting from 2019.

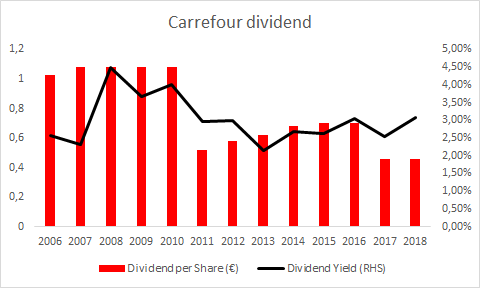

Carrefour was forced to slash its dividend payout early in the decade as the company struggled with the fallout of the global financial crisis. However, as the company’s share price dropped as well the dividend yield in 2018 was actually higher than in the pre-crisis period. Source: Bloomberg, XTB Research

Carrefour was forced to slash its dividend payout early in the decade as the company struggled with the fallout of the global financial crisis. However, as the company’s share price dropped as well the dividend yield in 2018 was actually higher than in the pre-crisis period. Source: Bloomberg, XTB Research

Carrefour is a dividend paying company. The French retailer has been sharing profits with shareholders each year for over 2 decades. Prior to the global financial crisis the dividend payout per share was also raising every year. Nevertheless, in the fallout of the financial crisis Carrefour was forced to slash its dividend by more than half in 2011 as the previous payout would be hard to maintain. However, the company’s share price saw a decline of similar scale during the financial crisis and, in turn, current dividend yield is even higher than in pre-crisis times. The ongoing restructuring as well as withdrawal from China hints that the company is likely to maintain its dividend paying ability in the future making it an interesting pick for the long-term investors, especially at times of low or even negative yields on the European sovereign bonds.

Carrefour (CA.FR) stock price bounced off the long-term support zone ranging €16.35-16.65 recently and climbed back above the 200-session moving average. The stock is trading within a symmetrical wedge pattern. Price range narrows and a break should occur no later than in August-September. Direction of the break may define the trend for the nearby future. Source: xStation5

Carrefour (CA.FR) stock price bounced off the long-term support zone ranging €16.35-16.65 recently and climbed back above the 200-session moving average. The stock is trading within a symmetrical wedge pattern. Price range narrows and a break should occur no later than in August-September. Direction of the break may define the trend for the nearby future. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.