- Bunge agreed to purchase Viterra

- Transaction finance with 75% in stock and 25% in cash

- Bunge to repurchase own shares worth $2 billion

- Merger will combine world's largest oilseed crusher and one of top grain traders

- Combined entity will be able to compete with heavyweights like ADM or Cargill

- Surprisingly, Bunge does not seem to be strongly correlated with grains market

- Bunge's share price gained 3% after merger announcement but failed to break above $97 resistance

Recent rally on stock markets was driven by the AI craze as well as short covering on meme-stocks. Given all the buzz around those stocks, it was easy for traders to miss other noteworthy stock news, like for example one of the biggest agribusiness merger announcements in history! Bunge (BG.US), US agribusiness company, announced this Tuesday that it will buy Viterra, a grain handling business, from Glencore (GLEN.UK).

Bunge agrees to buy Viterra

Bunge announced on Tuesday, June 13 that it has agreed to purchase Viterra, a grain handling business, from Glencore, Swiss commodity trading and mining company. Bunge will pay around 65.6 million of its own shares worth $6.2 billion as well as additional $2 billion in cash to Viterra shareholders. Bunge also plans to repurchase its own stock worth $2 billion in order to enhance EPS accretion. As a result, shareholders of Viterra will own around 30% of the combined entity after the transaction closes and around 33% of the combined entity once Bunge's stock repurchases are completed. Deal is expected to close in mid-2024 and result in $250 million annual pre-tax synergies within three years.

However, whether the deal goes through or not will depend on regulatory approvals. It is expected that significant antitrust concerns will be raised by regulators in Argentina, world's biggest exporter of soymeal and soy oil, as combined Bunge-Viterra will have a dominant share of the soy processing market in the country.

Viterra sale is not a surprise

Merger between Bunge and Viterra is not entirely surprising. Glencore was approaching Bunge previously over a possibility of friendly takeover of Viterra as Viterra grain business does not synergies well with Glencore's metals business. While Bunge has rejected Glencore's offers in previous years, Bloomberg reported as recently as last month that the two are once again discussing potential merger.

Combination to create agribusiness heavyweight

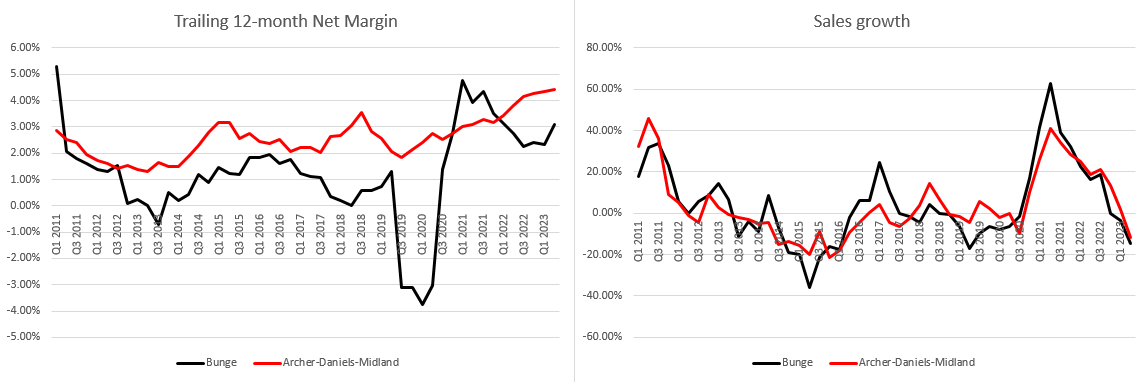

Merger between Bunge and Viterra will be one of the biggest in the agribusiness sector in history and will create a $34 billion heavyweight company that will be able to compete with its top rivals - Archer-Daniels-Midland (ADM.US) and privately-held companies - Cargill and Louis Dreyfus. While data for Cargill or Louis Dreyfus is unavailable, comparing financial data for Bunge and Archer-Daniels-Midland we can see that the two have a very similar profile. Sales growth of the two companies moves in tandem but net interest margins of Bunge are much more volatile. It should be noted that the combination of Bunge and Viterra is a combination of the biggest oilseed crusher in the world (Bunge) with one of top grain traders (Viterra) and therefore should help diversify business and make it more resilient. Assets of the two companies are said to be complementary and Bunge's CEO said that merger will create more capability for the company in down cycles.

While Archer-Daniels-Midland and Bunge enjoyed similar growth in sales in recent years, Bunge's net margin was much more volatile and usually lower than ADM's. Source: Bloomberg, XTB

While Archer-Daniels-Midland and Bunge enjoyed similar growth in sales in recent years, Bunge's net margin was much more volatile and usually lower than ADM's. Source: Bloomberg, XTB

Indirect exposure to the grains market?

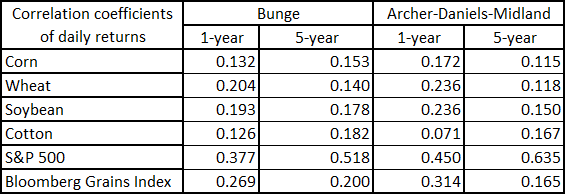

As Bunge is an agribusiness company heavily involved in grains trading, one could think that its shares may offer an indirect exposure to the grains market. Taking a look at the chart below, which plots Bunge share price against Bloomberg Grains Index, one may rule that the stock is indeed highly correlated with the grains market and may be used to obtain exposure to grains. However, a look at the table below with correlation coefficients shows that it is not necessarily the case. Over the past year as well as over the past 5-year period, correlation between daily returns of Bunge and grains has been very weak. The same can be said about Bunge's biggest publicly traded rival - Archer-Daniels-Midland. In fact, those two stock showed moderate correlation (0.4-0.6) only with the broad stock market (S&P 500 in this case).

Bunge (BG.US) seems to have a strong correlation with Bloomberg Grains Index. Source: Bloomberg

Bunge (BG.US) seems to have a strong correlation with Bloomberg Grains Index. Source: Bloomberg

However, correlation between daily returns over 1- and 5-year periods suggest that shares have more stock-like characteristics and are rather weakly correlated with the grain market. Source: Bloomberg, XTB

A look at the chart

Shares of Bunge (BG.US) gained over 3% on Tuesday after the deal was announced. While the upward move continued yesterday, bulls failed to push the stock above a $97.00 resistance zone. A long upper wick of yesterday's daily candlestick suggest that there is a strong bear camp in the area and a catalyst may be needed for a move above the zone and regulatory clearance for the deal could be such a catalyst. However, regulators are likely to take time to assess the impact on the merger. Unless such a catalyst surfaces, stock may remain locked in the $89.50-97.00 trading range.

Bunge (BG.US) at D1 interval. Source: xStation5

Bunge (BG.US) at D1 interval. Source: xStation5

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.