-

Coronavirus vaccines brighten outlook for aviation sector

-

US and Brazil regulators approve return of 737 MAX planes to service

-

European approval may be issued for early-January

-

737 MAX makes up a majority of order backlog

-

Stock price approached post-pandemic highs

Boeing (BA.US), the biggest US planemaker, had a hard time past year. Not only it had to deal with depressed demand for planes due to the coronavirus pandemic but also with a backlash following fatal crashes of its flagship 737 MAX jets. However, light can be spotted at the end of a tunnel and both issues could be resolved soon.

Coronavirus vaccine brightens outlook for airlines and planemakers

Airlines have been hit particularly hard by the coronavirus pandemic as governments of numerous countries banned air travel to and from Covid-19 hotspots. Even as restrictions began to be lifted, passengers remain reluctant as being locked in a limited space with dozens of other people for a few hours greatly increases risk of contracting coronavirus. However, as more and more vaccine candidates show promising results there is a high chance that vaccination will begin in 2021. Demand for air travel should start to pick-up along.

As airlines will start to see increased demand for their services, they may start expanding their fleet once again. Of course, it will take time to return to pre-pandemic traffic levels but recovering air travel volumes should at least incentivize airlines not to cancel more orders for new planes.

Commercial Airplanes was the biggest business segment for Boeing for years. However, following 737 MAX grounding in late-Q1 2019 its revenue slumped. Source: Bloomberg, XTB Research

Commercial Airplanes was the biggest business segment for Boeing for years. However, following 737 MAX grounding in late-Q1 2019 its revenue slumped. Source: Bloomberg, XTB Research

737 MAX ungrounding

Demand for Boeing planes was hit even before the coronavirus pandemic arrived, as aviation regulators around the world grounded its 737 MAX planes, following two fatal crashes with combined death toll of 346, in March 2019. However, after a year and a half of being out of service, the Federal Aviation Administration announced on Nov. 18 that 737 MAX will be able to return to commercial flights. Moreover, European regulators published a report on Nov. 24 hinting that 737 MAX planes may be cleared for take-off by early-January 2021. Approval to return to service was also issued by Brazilian aviation watchdog.

This is great news for Boeing. Why? Company had a backlog of 5,146 planes by the end of Q3 2020, out of which 4,114 were 737 MAX planes! Boeing said that grounding costs will be split across 3,100 planes meaning that the programme is likely to have a lower profit margin compared to pre-grounding times. Nevertheless, as the US planemaker will start to realize orders, the chance of them being cancelled will shrink and, more importantly, it may stop losing market share to its main rival, Airbus.

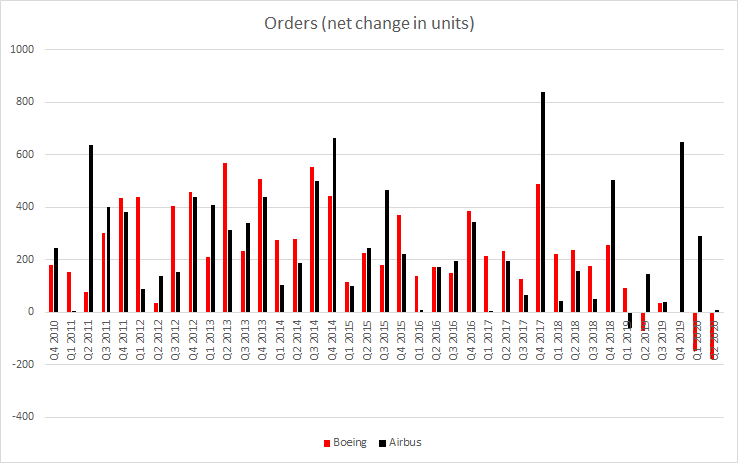

Boeing saw negative net orders change in the aftermath of 737 MAX grounding. At the same time, its main rival Airbus continued to book new orders for its planes, often at the expense of Boeing order cancellations. Source: Bloomberg, XTB

Boeing saw negative net orders change in the aftermath of 737 MAX grounding. At the same time, its main rival Airbus continued to book new orders for its planes, often at the expense of Boeing order cancellations. Source: Bloomberg, XTB

Stock approaches post-pandemic highs

Of course, it will take time until Boeing operations recover to pre-grounding levels. However, stock started to benefit from some positive price action as of late. Stock price broke above the upper limit of the upward channel earlier this month. News of 737 MAX ungrounding allowed stock to reapproach post-pandemic highs at 38.2% retracement of a drop from the all-time highs. Return of 737 MAX to service may prompt a decision to restore dividend payments (they were suspended after Q1 2020) and this could attract additional demand from income investors. Breaking above the resistance at 38.2% would pave the way towards the next major resistance zone marked by 61.2% retracement ($310 area).

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.