Summary:

-

Barrick Gold (ABX.US) announced a merger with a major gold mining company

-

Combined entity will become the biggest gold mining company by market cap and output

-

Analysts stay optimistic about third quarter performance of both companies

-

Barrick’s shares bounced off the lower limit of price channel following the news

The gold mining industry is about to experience a major change of landscape. Barrick Gold (ABX.US), the largest gold mining company in the World, announced that it had agreed with other major gold producer on the merger. In this analysis we will provide the details of the deal, discuss operations of two involved companies and take a look at the latest earnings report of Barrick Gold.

Gold mining revenues are dependant on gold prices. However, notice that Barrick Gold failed to benefit from the latest rise in precious metal prices. Source: Bloomberg, XTB Research

Gold mining revenues are dependant on gold prices. However, notice that Barrick Gold failed to benefit from the latest rise in precious metal prices. Source: Bloomberg, XTB Research

In a press release dated September 24, Barrick Gold announced that it had agreed with Randgold Resources (RRS.UK) on the merger deal that is expected to be concluded by the first quarter of 2019. Under the agreement Barrick will merge with Randgold in a $6 billion deal through an all-share merger. The combined entity will own five out of the 2017 top ten so-called “Tier One Gold Assets”. Under that expression one can find gold mines with stated life of over 10 years, annual production exceeding 500 thousand troy ounces of gold and total cash cost of an ounce of gold in the bottom half of all mines according to Wood Mackenzie research company (less than $748/ounce in 2017). The deal is viewed as an opportunity for both companies to complement their asset bases. Barrick has most of its gold mines located in more stable regions like North America or Australia while Randgold has its operations focused mainly in Africa which is viewed as a more riskier continent. Apart from that, previous attempts by Barrick to expand to Africa saw limits mostly in terms of expertise what will not be an issue with Randgold. In a press release companies stated that the main focus of the combined entity would be return on capital and free cash flow per share growth.

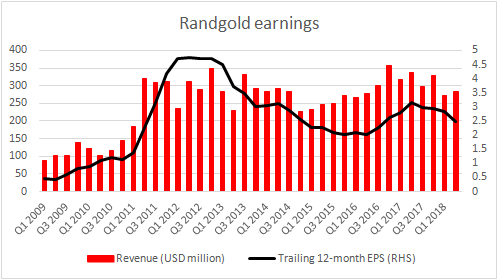

Randgold Resources earnings and revenues show stronger correlation with gold prices than Barrick’s due to the fact that the latter company is also involved in the copper industry. Source: xStation5

Randgold Resources earnings and revenues show stronger correlation with gold prices than Barrick’s due to the fact that the latter company is also involved in the copper industry. Source: xStation5

While Barrick Gold is the biggest gold mining company by output (5.32 million ounces in 2017) its advantage over Newmont Mining (NEM.US), the second largest gold miner, shrank to just 50k ounces in the previous year. As Barrick’s production has been declining since 2012 merger Randgold will help the company to reinforce its position at the top of the list. Combined output of two companies in 2017 exceeded 6.6 million ounces and accounted to around 6.5% of the global output. In the press release companies said that using the 2017 data the estimated total cash cost per ounce of the combined entity would be $538 and it would be the lowest among major gold producers. Additionally, it should be noted that as the companies operate in the same industry the merger will result in elimination of some overlaps and thus contribute to decline in overhead costs. Despite gold production being the main business of Barrick, company also accounted for almost 1% of the global copper output in 2017. Following the merger Barrick Gold will become the biggest gold mining company by market capitalization surpassing the current leader - Newmont Mining.

Barrick Gold experienced significant drop in revenue following 2013. The latest bounce higher in the gold market met with similar response from company’s EPS reflecting increase in operating margin from 21% in late-2015 to around 40% in the second quarter of 2017. Source: xStation5

Barrick Gold experienced significant drop in revenue following 2013. The latest bounce higher in the gold market met with similar response from company’s EPS reflecting increase in operating margin from 21% in late-2015 to around 40% in the second quarter of 2017. Source: xStation5

Barrick Gold released its latest earnings report on July 25 and it turned out to be a huge disappointment. The company failed to meet analysts’ consensus in all categories. Revenue turned out to be $1.71 billion (5.29% below estimates) while the EPS missed median projection of $0.116 by coming in at $0.07. Randgold resources also disappointed in the second quarter of the year and missed EPS estimate by 4.1% (actual EPS at 2.92). On the other hand, Randgold managed to provide slightly better-than-expected revenue in the period. However, analysts are optimistic when it comes to the third quarter. Operations at Randgold are expected to improve due to Tongon mine returning to normal operational level and Barrick is said to increase its production to 1.2 million ounces of gold in the third quarter of 2018. However, it should be noted that a drop in the gold prices in the July-September period may put pressure on earnings. Barrick will announce its earnings on October 24 while Randgold’s earnings report will see daylight on November 6.

Barrick Gold (ABX.US) has been trading within the downward price channel since February 2017. News of incoming merger with Randgold Resources (RRS.UK) allowed company’s share price to bounce off the lower bound of the channel and support level at $10.05. Source: xStation5

Barrick Gold (ABX.US) has been trading within the downward price channel since February 2017. News of incoming merger with Randgold Resources (RRS.UK) allowed company’s share price to bounce off the lower bound of the channel and support level at $10.05. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.