- US semiconductor stocks dropped on reports of tougher export restrictions to China

- AMD and Nvidia among exposed stocks

- Impact on AMD's business may be limited however

- China is no longer driver of AMD growth

- Company has significantly reduced reliance on China over the past decade

- Stocks halts sell-off at 50% retracement

US semiconductor companies took a hit this week after Wall Street Journal hinted that new restrictions on chip sales to China may be coming. Advanced Micro Devices (AMD.US) was one of the stocks negatively impacted by the news but the impact of new measures on the company's business may be limited. Let's take a closer look at the situation of AMD!

US considers new restrictions on China

Wall Street Journal came out with a report on Tuesday evening saying that a group of US lawmakers wants to tighten restrictions on chip exports to China further. According to WSJ, new restrictions would target AI chips in an attempt to prevent China from using them in weapons development or hacking. Nvidia and Advanced Micro Devices are leaders in the industry when it comes to AI chips therefore the ban was seen as a threat to the results of the two companies. Nvidia has developed a less-capable AI chip earlier this year that would be allowed to be exported to China under current restrictions after obtaining a license from the US Department of Commerce. However, WSJ claims that new law would prevent even those lower-powered chips from being sold to China and that it could be adopted as soon as next month. However, new measures may not have as much impact on AMD as some fear.

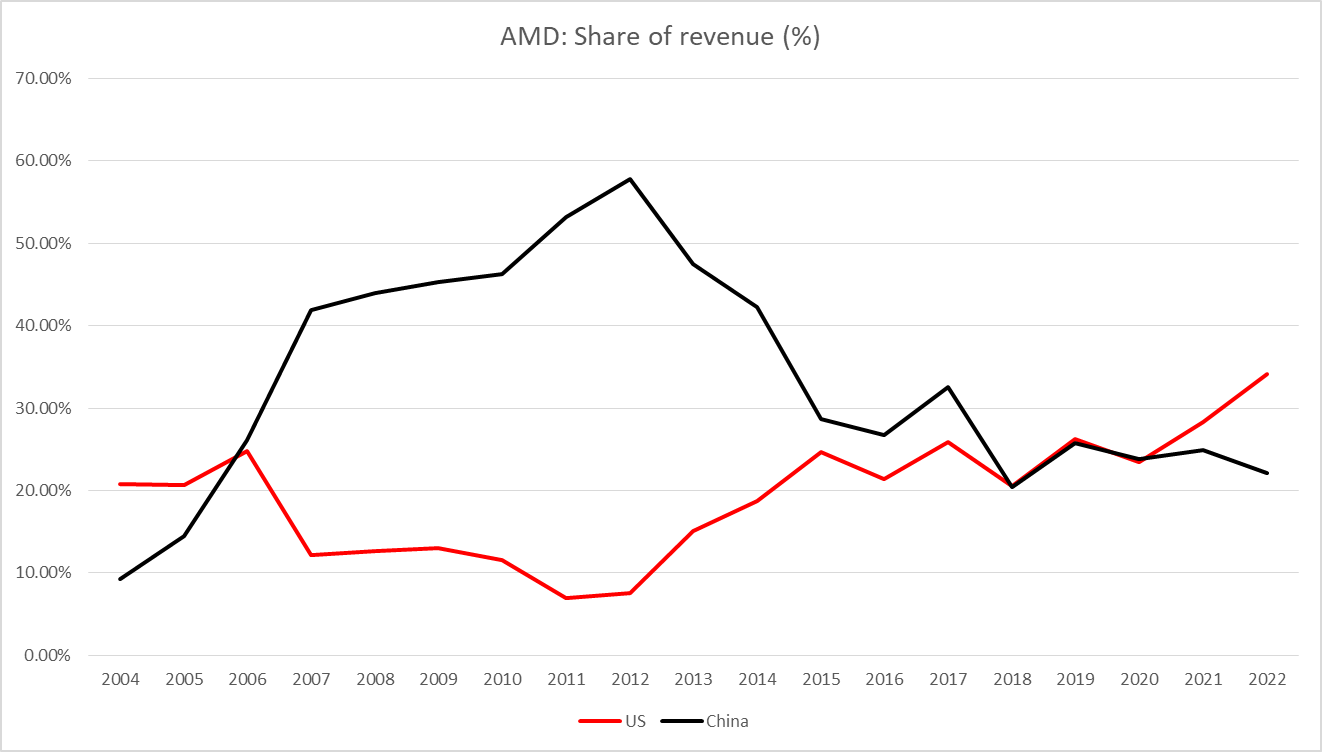

While China is an important market for semiconductor companies, AMD managed to decrease China's share of revenue in its total revenue from almost 60% in 2012 to below 25% in 2022. Source: Bloomberg, XTB

While China is an important market for semiconductor companies, AMD managed to decrease China's share of revenue in its total revenue from almost 60% in 2012 to below 25% in 2022. Source: Bloomberg, XTB

China no longer a driver of AMD business

As we have already said in the previous section, new measures against China are seen as indirectly targeting Nvidia and AMD as the two companies are leaders in so-called data center accelerator chips used in AI. However, Nvidia has an over-80% share in the market for these chips therefore negative impact of those measures will likely be better seen in Nvidia's results. China has been an important driver of AMD sales but this began to change in 2012 as the share of China in AMD's total revenue began to drop noticeably. Moreover, China is no longer the fastest growing market for AMD with sales growth in the country slowing below global sales growth in 2022 again.

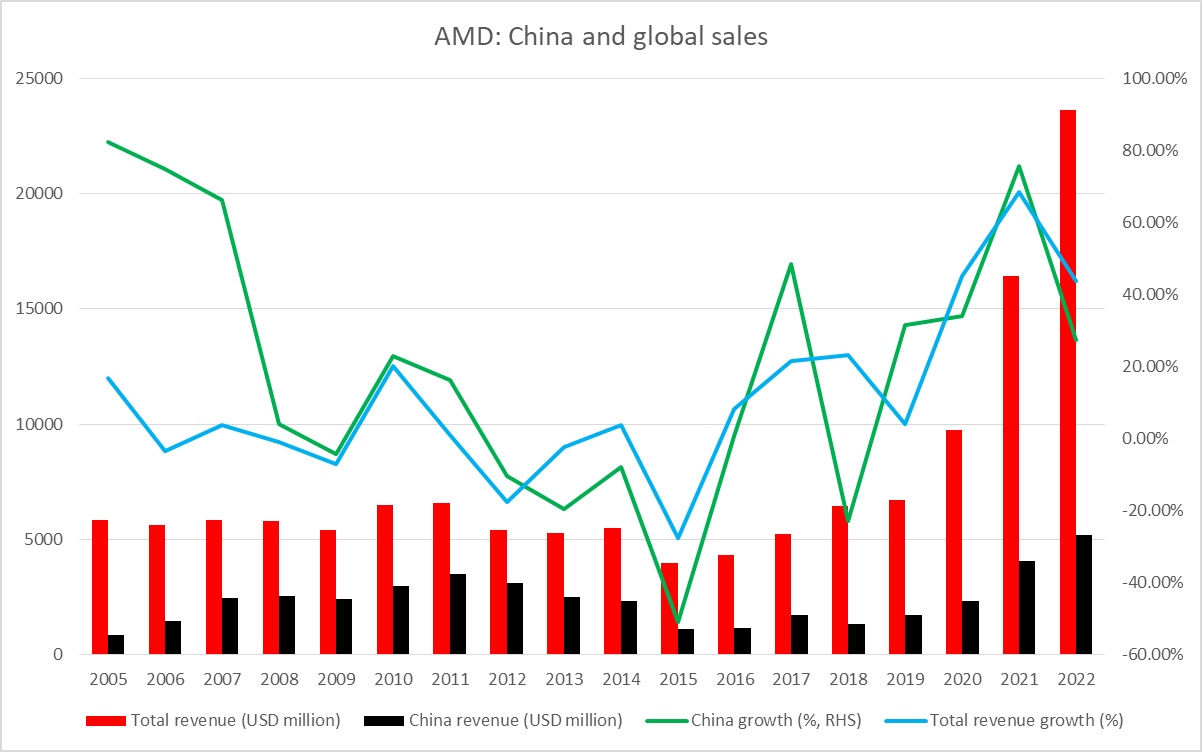

Not only China's share in AMD revenue has been dropping but also sales growth in the country slowed below total revenue growth of the company in 2022. Source: Bloomberg, XTB

Not only China's share in AMD revenue has been dropping but also sales growth in the country slowed below total revenue growth of the company in 2022. Source: Bloomberg, XTB

Impact depends on quality of sanctions enforcement

Impact of new US measures, if implemented, may be limited when it comes to AMD's business. While the company generated around 22% of its sales from China in 2022, those were not only sales of AI chips. Moreover, it should be said that effectiveness of the ban would depend on the quality of enforcement. China has proved to be creative when it comes to circumventing sanctions therefore any new ban would likely see Chinese companies attempting to source chips from third party countries, instead of directly from US chipmakers. As alternatives to Nvidia and AMD chips are scarce, this means that sales of AI chips from those companies that are made to China would likely switch direction rather than disappear completely.

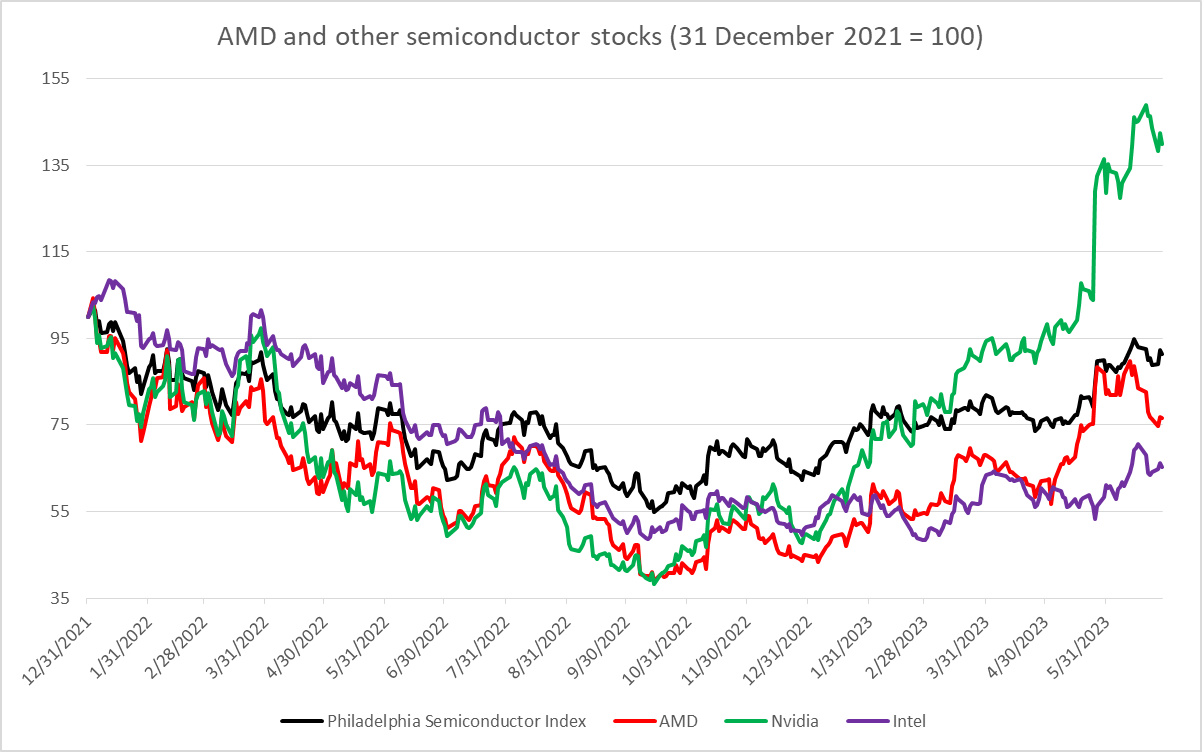

AMD gains lag Nvidia's rally

Companies involved in Artificial Intelligence enjoyed a strong rally this year. Nvidia is an unquestionable leader when it comes to AI chips right now and this outperformance is clearly pictured by share price - stock is trading around 180% year-to-date higher. However, AMD also performed strongly so far this year and is trading 70% YTD higher, outpacing a 42.5% YTD gain made by Philadelphia Semiconductor Index and 27% YTD gain of Intel.

Nevertheless, it should be noted that Nvidia is the only one of the mentioned stocks that has managed to fully recover from the 2022 sell-off. AMD continues to trade around 23% below end-2021 levels while Intel trades 35% lower compared to December 31, 2021.

While Nvidia has fully recovered from a 2022 sell-off already, AMD and Intel continue to trade below end-2021 levels. Source: Bloomberg

While Nvidia has fully recovered from a 2022 sell-off already, AMD and Intel continue to trade below end-2021 levels. Source: Bloomberg

A look at the chart

Shares of Advanced Micro Devices (AMD.US) launched yesterday's trading lower in response to Wall Street Journal report on new US chip export restrictions on China being considered. However, declines were erased during the Wall Street cash trading session and the stock finished the day slightly higher. Taking a look at the chart at D1 interval, we can see that the situation is not clear.

Stock has recently dropped below the lower limit of the market geometry which, according to the Overbalance methodology, hints at a bearish trend reversal. Nevertheless, declines were halted slightly below this hurdle in the $110 support zone, marked with previous price reactions and the 50% retracement of the downward move launched in December 2022. Stock is trading around 2% higher in premarket today so we may see an attempt to bounce off the $110 area today and recover part of recent losses. In such a scenario, the first resistance zone to watch can be found in the $122.50 area, marked with 61.8% retracement.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.