-

S&P 500 earnings growth turned positive

-

Revenue growth stands at around 4% YoY so far

-

Big Tech is major driver of earnings and revenue increase

-

Majority of S&P 500 members managed to increase revenue and earnings

Wall Street earnings season has already peaked and it could be a good moment to take a look at how major US companies coped in the final quarter of 2019. At the beginning of 2020 earnings decline of S&P 500 companies was forecast at 1.7% YoY while sales were expected to be 2.5% YoY higher. Let us take a look at how things stand after reports from over 70% of S&P 500 members and how those results compare to results of major tech companies.

S&P 500 may report earnings growth for the first time since Q4 2018

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appSo far, the Q4 2019 earnings season on Wall Street can be seen as a major positive surprise. For those who already reported results, an average sales surprise stands at +1.2% while earnings surprise stands at 5.4%. When we take a look at year-over-year numbers, we can see that companies who have already reported earnings managed to increase net income by 8.6% YoY on average. This is especially pleasing as, at the beginning of 2020, S&P 500 was expected to report a drop in earnings. Should the situation continue until the end of the season, it would mark the first quarter of rising earnings since Q4 2018.

Net income jumps 8.6% YoY after 365 reports

While increase in earnings is desirable after three consecutive quarters of declining profits, details are not too encouraging. As of the morning of February 13, 365 companies from the S&P 500 index have reported their earnings for Q5 2019. Those companies generated a combined net income of $265.24 billion, marking an 8.6% YoY or $20.95 billion increase. 5 major tech companies (Alphabet, Amazon, Facebook, Apple and Microsoft) generated combined net income of $55.17 billion, marking a 16.8% YoY or $7.93 billion increase. This shows that if it was not for those 5 companies, the remaining 360 companies would increase their combined net income by less than 5% YoY. EPS growth for Q4 2019 stands at around 1% YoY currently.

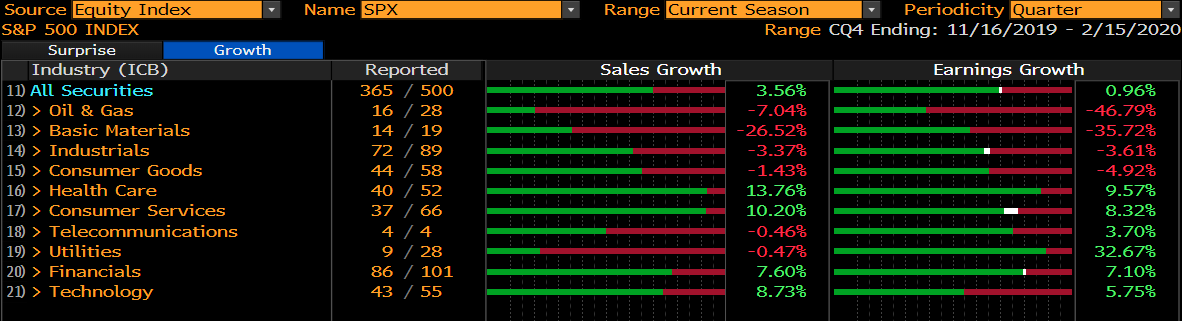

Revenue and earnings growth for the S&P 500 is positive following reports from over 70% of the index members. Reports from refiners and miners were particularly poor as those companies suffered from lower commodity prices. Source: Bloomberg

Revenue and earnings growth for the S&P 500 is positive following reports from over 70% of the index members. Reports from refiners and miners were particularly poor as those companies suffered from lower commodity prices. Source: Bloomberg

Big Tech helps S&P 500 beat revenue estimates

Companies from the S&P 500 index managed to increase revenue by 4% YoY, more than 2 times smaller increase than in net income. Sales surprise is also smaller than earning surprise as reported revenue is just 1.2% higher than expected on average. Sticking to the previous playbook, let's take a look at how increase in sales of big tech companies compares to total increase for the S&P 500. The 5 tech companies mentioned earlier managed to increase revenue by 15.5% YoY or $37.965 billion in Q4 2019. This compares to $99.2 billion increase in combined sales of all S&P 500 members that have already reported Q4 results. Again, should it not be for those 5 stocks, revenue growth for the index would be around 1.5 percentage point slower. Moreover, if it was not for those 5 companies, the S&P 500 index would likely be showing a negative sales surprise.

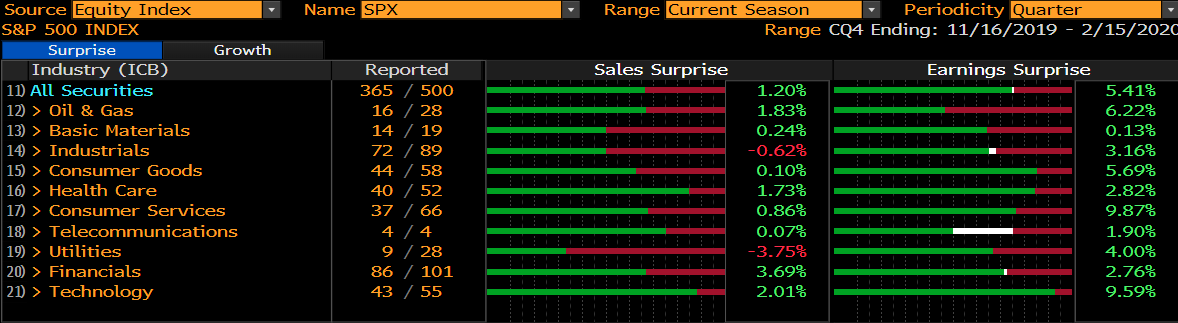

Earnings and revenue of S&P 500 companies are higher than expected on average. However, it should be said that if it wasn’t for 5 Big Tech stocks (Amazon, Apple, Alphabet, Microsoft and Facebook), the index would likely be showing a negative sales surprise. Source: Bloomberg

Earnings and revenue of S&P 500 companies are higher than expected on average. However, it should be said that if it wasn’t for 5 Big Tech stocks (Amazon, Apple, Alphabet, Microsoft and Facebook), the index would likely be showing a negative sales surprise. Source: Bloomberg

Big Tech with outsized contribution to index growth

The key takeaway from the previous two paragraphs is that earnings and revenue growth of S&P 500 index are highly concentrated on those 5 companies. To picture this concentration let us take a look at how Big Tech contributes to S&P 500 net income and revenue growth compared with its share in the index (based on market cap at the end of 2019). Capitalization of the 5 discussed tech companies accounted for 21% of capitalization of all 365 companies that reported earnings. However, share of Big Tech in net income and revenue increase stood at around 37-38%, showing that last year’s rally on those stocks was more than justified. Of course, there are still 135 companies left to report and Big Tech contributions may change but current mismatch looks worrying.

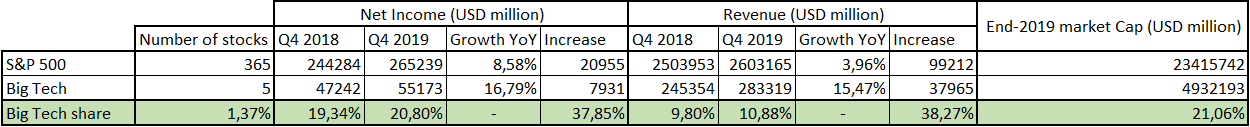

Big Tech contribution to index' net income and revenue increase outpaces its share in the S&P 500 capitalization by a huge margin. Stocks in Big Tech category: Amazon, Apple, Alphabet, Microsoft and Facebook. Source: Bloomberg, XTB Research

Big Tech contribution to index' net income and revenue increase outpaces its share in the S&P 500 capitalization by a huge margin. Stocks in Big Tech category: Amazon, Apple, Alphabet, Microsoft and Facebook. Source: Bloomberg, XTB Research

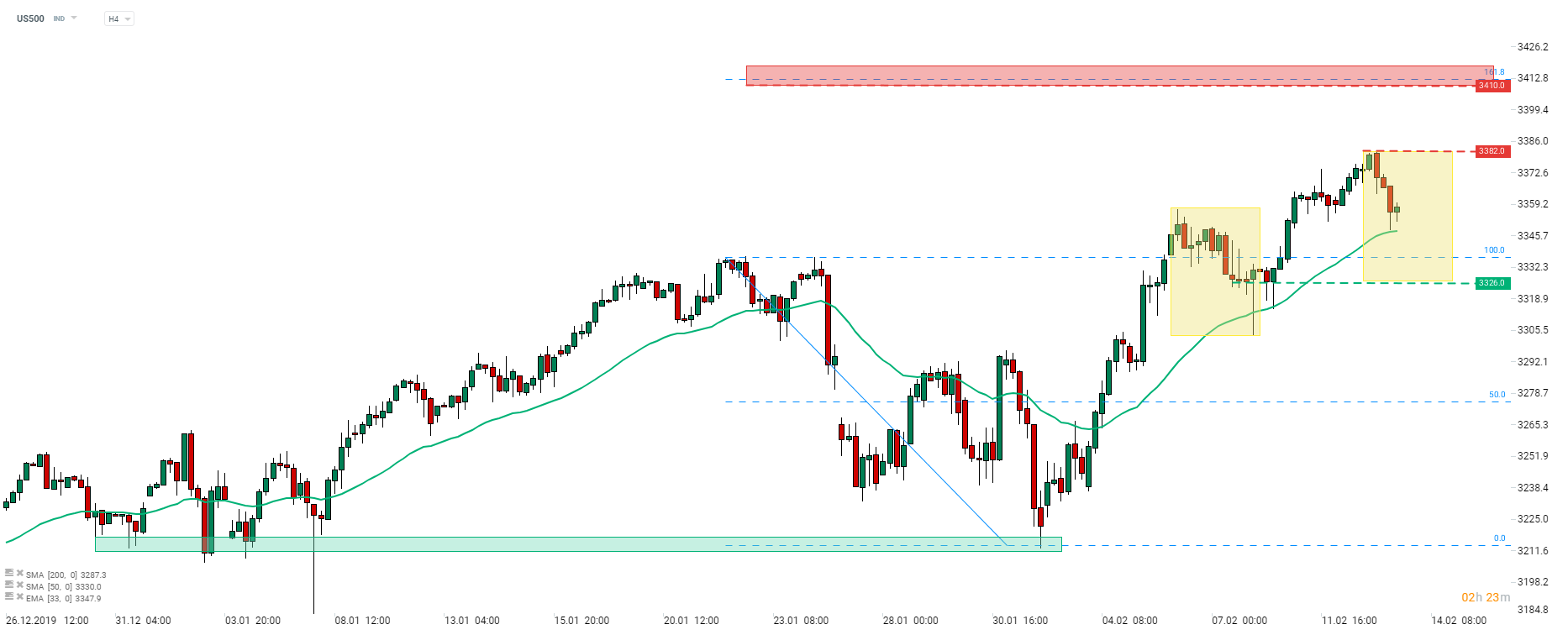

The picture painted above may look a bit grim but there are also some green shots in the ongoing earnings season. 70% of the aforementioned 365 S&P 500 members showed higher year-over-year revenue and earnings. Around 65% reported higher than expected revenue and around 75% showed earnings beat. High share of companies beating estimates helps S&P 500 index extend upward move in the first months of 2020. The index remains vulnerable to coronavirus news and we can see it today. However, previous such dips were quickly recouped and it may also be the case this time. The ongoing decline seems to have been halted by the 33-period exponential moving average (green line, H4 interval), just as it was the case at the beginning of the week. Should bulls regain control this time, the index may look towards the nearest resistance levels - 3382 and 3341 pts.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.