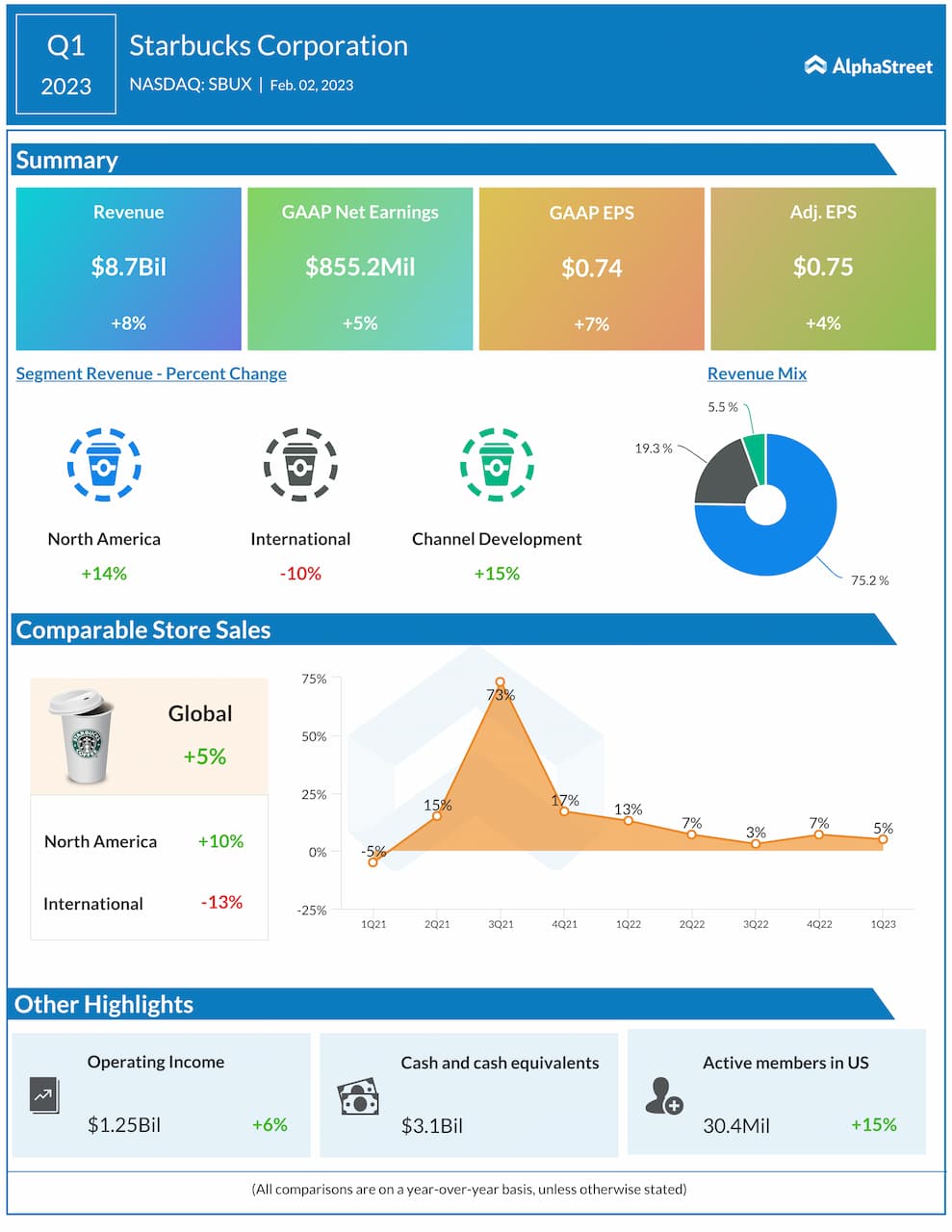

Starbucks (SBUX.US) shares lost over 3.5% on Friday after the coffee chain reported weak financial figures for Q1 2023. Company earned 75 cents per share slightly below analysts’ estimates of 77 cents. Revenue rose 8.0% to $8.71 billion, however came in below Refinitiv projections of $8.78 billion due to dwindling demand especially in China, which is the second-largest market.

-

U.S. same-store sales: 10% versus 9.26% expected

-

International sales: -13% versus -3.87% expected

-

China sales: -29% versus -13.31% expected

-

Global comparable store sales rose by 5% YoY

-

The company opened 459 net new stores in the previous quarter, ending the period with 36,170 stores worldwide.

Highlights of Starbucks Q1 2023 earnings report. Source: Alpha Street

Highlights of Starbucks Q1 2023 earnings report. Source: Alpha Street

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appAccording to interim CEO Howard Schultz recent figures reflect "challenging global consumer and inflationary environments, a soft quarter for retail overall and the unprecedented, COVID-related headwinds that unfolded in China in Q1."

Chief Financial Officer Rachel Ruggeri said "excluding China, we had tremendous growth across markets." She also said the company's fiscal 2023 outlook remains unchanged.

Starbucks (SBUX.US) stock launched today's session sharply lower, however sellers struggle to break below 50 SMA (green line). As long as price sits above, resumption of upward move is possible. On the other hand, should break lower occur, next support to watch can be found around $100.85, which is marked with lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the last upward wave. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.