The coronavirus outbreak in China is the key theme on the financial markets these days. While it spreads fear across China, market reaction has been limited so far, partly also because it’s so hard to estimate the consequences. This analysis points out statistics worth keeping an eye on, as well as key markets to watch.

A long wait for the data

The most obvious source of information should come from the Chinese government, which releases statistics on sales, output and international trade. However, there are two problems with their information. Firstly, markets have always been a bit cautious when it comes to Chinese data that looks incredibly smooth. In this particular case, there are even more reasons for extra caution. Secondly, the reports containing the information on the initial impact of the virus are scheduled to be released between 29 February (the first PMI) and 16 March (output, sales). This is a long wait and investors are anxious to find out more now.

China is now a much bigger economy than it was during the SARS outbreak, and the initial transport statistics are worrisome. Source: XTB Research

This means that traders at the moment need to rely solely on anecdotal evidence, and there's a lot of it. First of all, we’ve all heard about the closures of many multinational companies with offices in China, including Apple, General Motors, Ikea, Starbucks, McDonald’s and Toyota. Moreover, 18 Chinese steelmakers from four key provinces decided to curb their output by 30%. Macau gambling centres were asked to close for at least two weeks. Many universities will delay the start of the semester until at least March. The Japanese shopping malls reported a 5-15% y/y sales decline during the Lunar New Year. There’s a lot of evidence, but it’s very hard to generalise it. Perhaps most striking are the Lunar New Year travel statistics, reported by the Transport Ministry. Initial estimates saw railway transport down by around 40% but for the whole 10-day holiday period it deteriorated to -67% y/y, while air transport was down by 57%.

Two parameters to track

While there is a lot of evidence flowing from China every day, the challenge is to put it all together. This is clear in the first estimates for the GDP impact that vary from 0.6 to 1.1 percentage points. In our view, investors should focus on two things: infection numbers and production outages. Our first assumption is that a spread beyond China will be limited and other economies will not be paralysed by the transport and production limitations. If that assumption fails, the consequences could be dire. If it holds, the situation in China will start to return to normal. Watching the number of infections also makes a lot of sense - if the increase of infections slows down (so far it has not), this will be a sign that the virus could be contained. Production outages are very dangerous for the Chinese economy, as well as for trading partners. Korean Hyundai already announced a stoppage due to a shortage of parts. Korean economy, while not big, plays an important role in the Asian value added chain. At the moment, the Hubei province faces a stoppage until 14 February, while other provinces are supposed to return to work on 9 February. Extension of stoppages would have a meaningful impact and investors should track such information closely.

A shortage of supplies could be very painful for Vietnam and South Korea, and trigger a domino effect in the global economy. Source: XTB Research

A shortage of supplies could be very painful for Vietnam and South Korea, and trigger a domino effect in the global economy. Source: XTB Research

Markets to watch

The economic impact of the virus will have a global impact, and it will affect most of the market in a more or less direct way. However, the following four markets are especially worth keeping an eye on. All four have already seen major sell-off and they’ll likely move sharply depending on the direction of the parameters we discussed above.

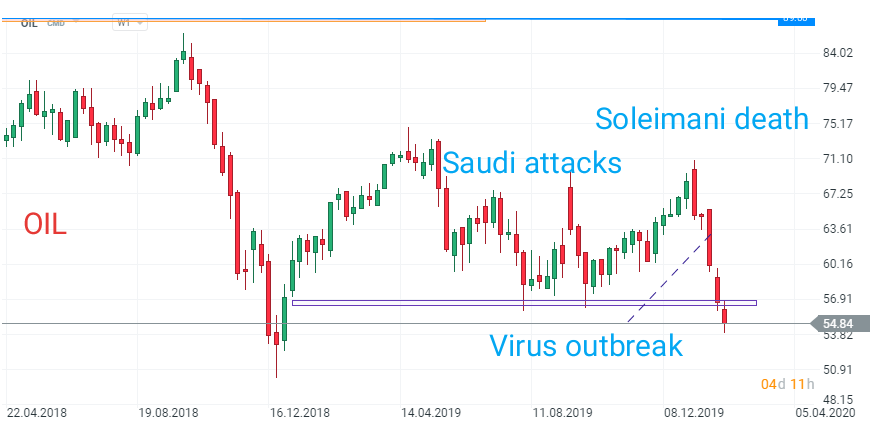

OIL, OIL.WTI - oil prices tumbled heavily, as the oil market is very sensitive to changes in balance. China is by far the biggest net oil importer, responsible for more than 20% of global imports. Demand is set to decline on lower business activity and collapse of tourism. This might force the OPEC to consider additional supply cuts.

Copper - the Chinese residential market already looked challenging and if the economy suffers a setback, construction activity can decline and lower the demand for copper. China was responsible for around 50% (!) of global demand for copper in 2019, so if this translates into a full-blown economic crisis, prices are set to crater.

CHNComp - profits of the Chinese companies declined by 6.3% y/y in December, even before the virus broke out. The index is the most direct exposure to the Chinese economy. Key level to watch in this case is 9800.

KOSP200 - the Korean economy could be badly affected by manufacturing stoppages in China. The Korean market was rebounding nicely as the semiconductor sector started to recover, but now this outlook has suddenly darkened. 273 is the key support to watch.

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Wall Street extends gains; US100 rebounds over 1% 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.