Silver futures are trading with a significant sell-off of almost 4% today, and along with the sell-off in the metals market, we are also seeing noticeably weaker sentiment in the stock markets. The rationale for this move lies in the massive profit-taking, following a spectacular rally in silver prices above $30 per ounce and a mostly lower risk appetite. In recent weeks, we have seen growing concerns around the strength of the U.S. economy, and data from China has put pressure on industrial metals quotes.

- It would seem that the recent drop in yields on 10-year U.S. Treasury securities (down 5 basis points in the last 24 hours) should support silver prices, along with noticeably weaker U.S. macro data. However, silver is largely an industrial bullion and does not have a 1:1 safe haven asset status similar to gold, making it more sensitive to changes from macro readings

- Weaker data reported on both sides of the Atlantic and a disappointing China are putting pressure on industrial metals, including silver. What's more, the Federal Reserve is likely still a long way off from its first-rate cuts, and while the odds of policy easing in 2024 have risen recently, it doesn't come without a cost, which we're seeing in a slowly slowing economy.

- Today's JOLTs data came out disappointing, indicating declining job openings in the US, and yesterday's May manufacturing ISM also disappointed negatively. Volatility on silver may increase tomorrow, when at 3 PM BST investors will learn the eagerly awaited ISM services data, for May. What's more, the European Central Bank will probably cut rates on Thursday, 1:15 PM BST.

SILVER (D1 interval)

Despite 'overbought' conditions on silver futures, prices are falling to $28.5-29 per ounce, losing important $30 support. As long, as SILVER is still well above SMA50 and main support line, changing the selling trend is still possible.

Source: xStation5

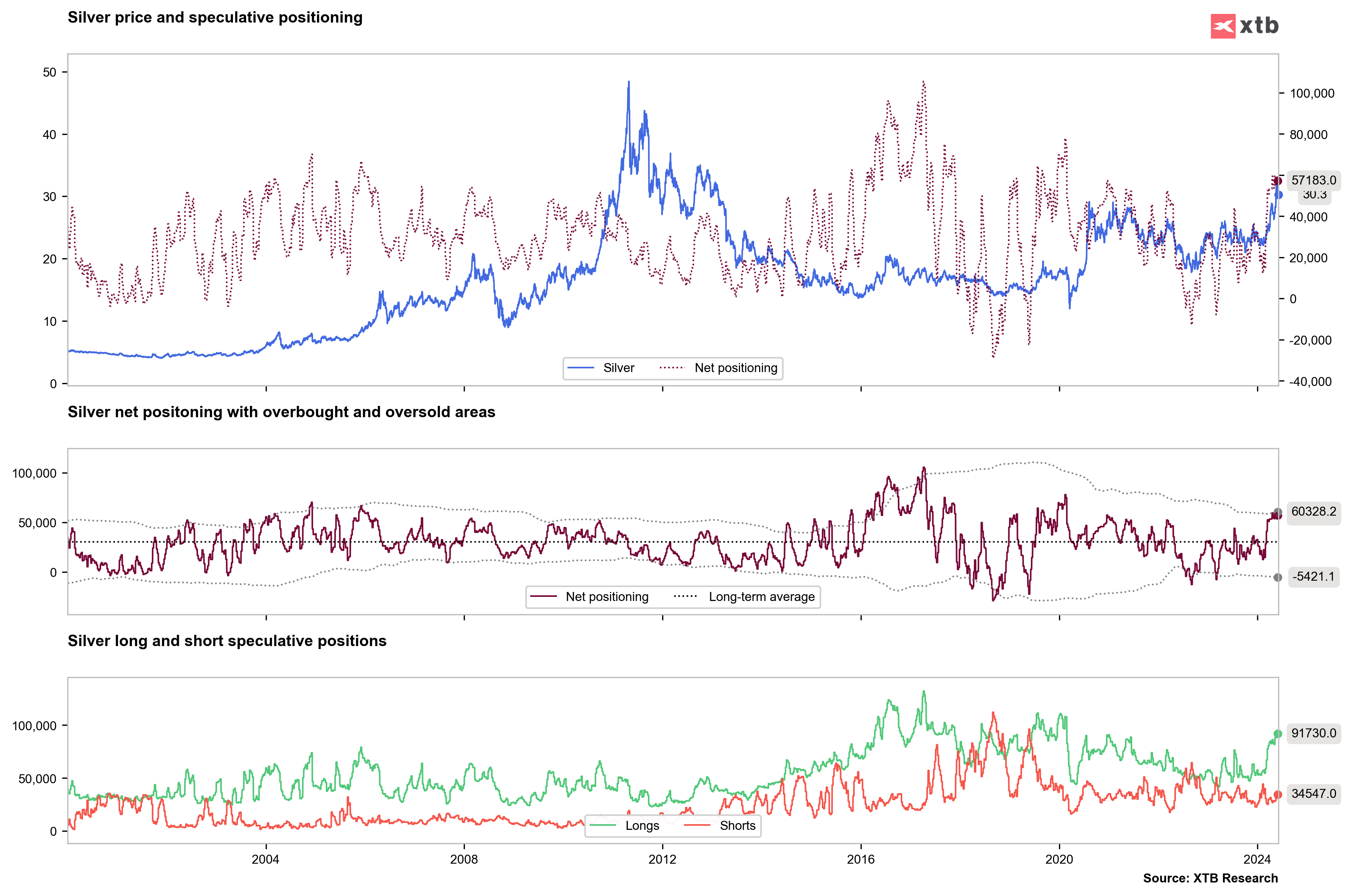

Despite net long positions rising, we are observing clearly price correction. It's worth to remember that positioning reported on Friday are in fact positions from Tuesday, so we may see some speculative try of reversing it. Source: Bloomberg Finance LP, XTB

Despite net long positions rising, we are observing clearly price correction. It's worth to remember that positioning reported on Friday are in fact positions from Tuesday, so we may see some speculative try of reversing it. Source: Bloomberg Finance LP, XTB

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.