Silver continues its strong rebound for the second week in a row and is on track to close above $30 per ounce barrier, the highest point since February 2013. Metals continue to rise, despite China's mixed data, although at the same time the promise of more support for consumers and the real estate market is creating a positive impact on the overall metals market.

Source: xStation5

Silver and other precious metals are moving in pursuit of gold, and sustained high levels in the price of gold bullion should provide chances for a continuation of the bull market in the other precious metals. Where to look for important levels?

The ratio of gold and silver prices has already fallen to the 10-year moving average, which can be considered the first important milestone. The next could be the 20-year static average, which is close to the 2017 and 2021 lows. This average is located at level 68. Assuming a gold price of $2,400, this would give a valuation for silver of $35.3 per ounce, or more than 15% of the implied move from current levels. It would also mean a test of the local peaks of September 2012. Source: Bloomberg Finance LP, XTB

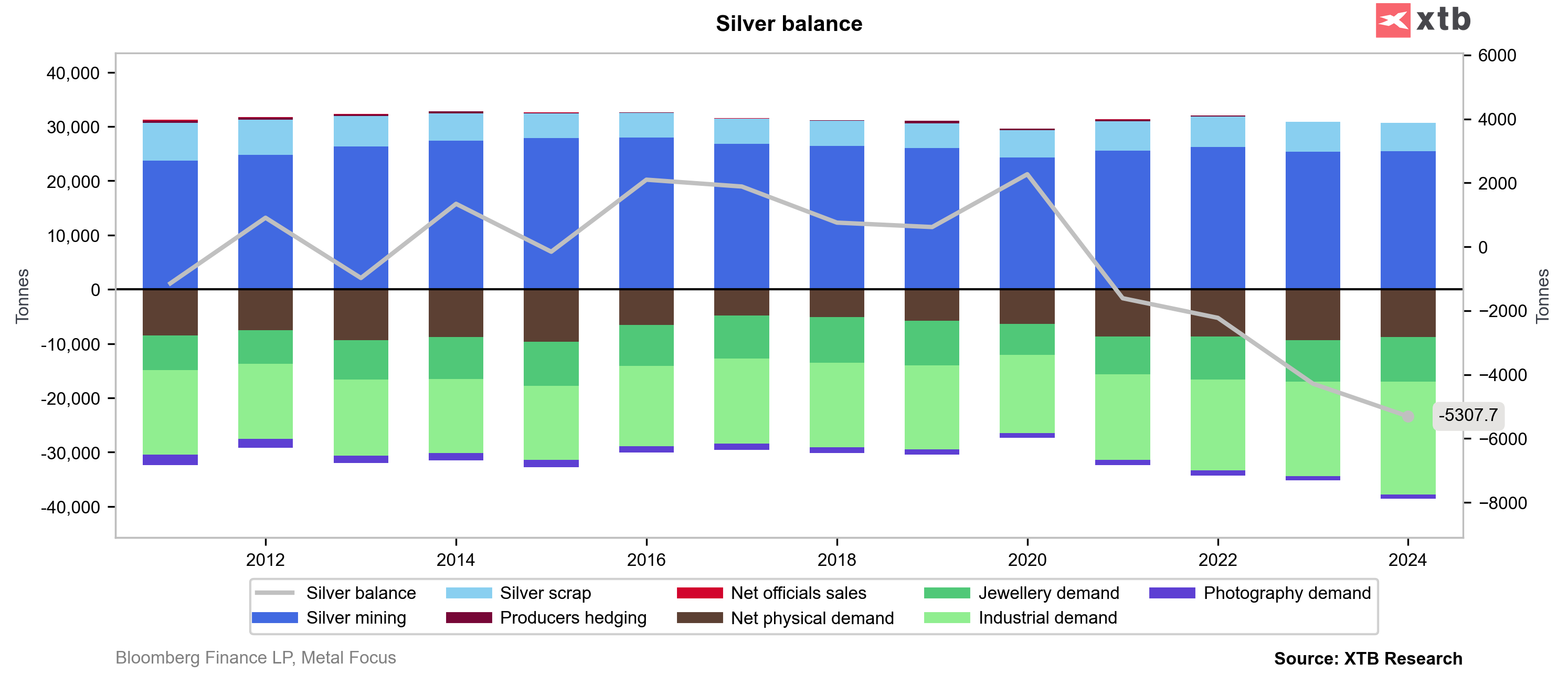

However, it is worth remembering that silver, in addition to the sheer pressure from gold, also has a fundamental basis in terms of growth. It is preparing for the 4th consecutive major shortage in the market, and the metal is used in new technologies, primarily related to energy.

Source: Bloomberg Finance LP, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.