Last week, we witnessed hawkish signals from many central banks. Some of them raised interest rates more aggressively than expected, and in the case of the Fed, we could hear confirmation of the intention to raise rates twice this year. In light of this tone, precious metals remained under pressure, though at this point, it is clear that the precious metal market has likely priced in most of these "negative information".

Despite the one-day coup in Russia, which ended even before the markets opened in the last week of June, the markets remain exceptionally calm. This allows for making up for losses in many markets. Yields in the US finally began to decline slightly, trying to break out of the narrow consolidation that formed in mid-June.

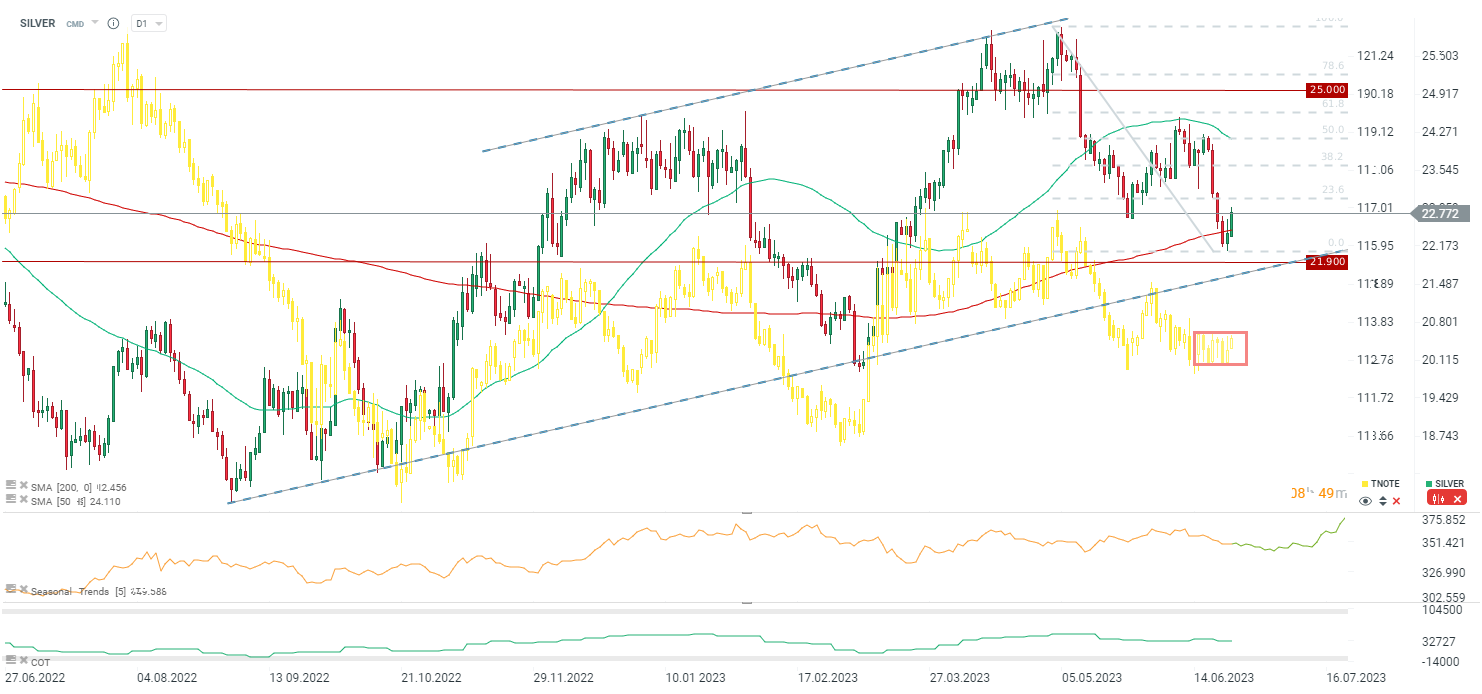

Silver is up 1.5% today and is recording its highest levels since June 21. At the moment, only palladium is registering slightly higher increases in the precious metals market. Another important resistance level is around the 23 USD per ounce mark. It is worth noting that silver reacted when trading near to this important support level at 22.0 USD, where the lower limit of the upward trend channel and the 200-session average are located. However, it is also necessary to pay attention to the fact that seasonality suggests possible further moderate declines or consolidations at low levels approximately until mid-July. Later, seasonality indicates increases.

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.