- The Baltic Dry Index soared to 5-week highs and has risen more than 80% in the past 7 days

- The increases were fueled by iron ore shipments to China, which are opening up the economy after several years of 'covidzero' languor

- Dry freight spot rates for all major commercial vessels saw improvement

- Capesize bulk carriers benefited the most, with a set of average rates on five key shipping routes rising 135% to $5271

Stocks of ocean freight companies are extending their gains in response to improved sentiment. These companies are cyclical and remain heavily dependent on global economic conditions and global trade volumes. The key risks continue to be the prospect of a looming economic recession and geopolitical issues with deglobalization in the background, which could dampen sentiment and put downward pressure on maritime trade volumes.

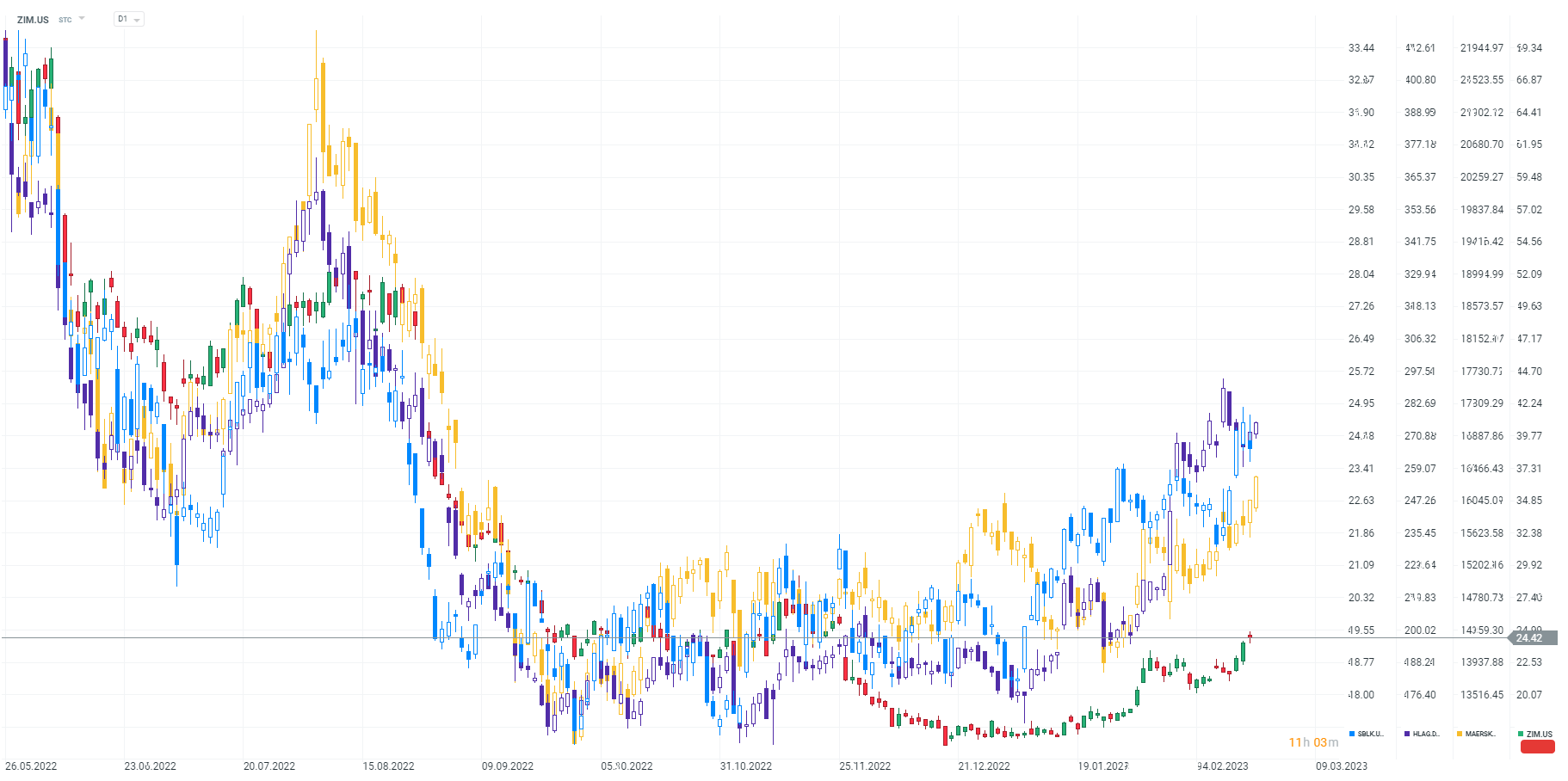

Recent gains include the shares of ZIM Integrated Shipping (ZIM.US), Maersk (MAERSKA.DK),German giant Hapag-Lloyd (HLAG.DE) and Greece's Star Bulk Carriers (SBLK.US), which has a branch in Singapore and a fleet geared mainly to transport dry commodities such as iron. Most of these companies have been under tremendous selling pressure until recently with freight companies losing the hardest as they put in place an aggressive business model in 2020 to reap as much profit as possible from global supply problems with high consumption of goods.

The BDI index tracking freight prices for dry and dry bulk commodities on the world's 20 largest trade routes rebounded from around 500 points, not far from historical lows. Source: Bloomberg

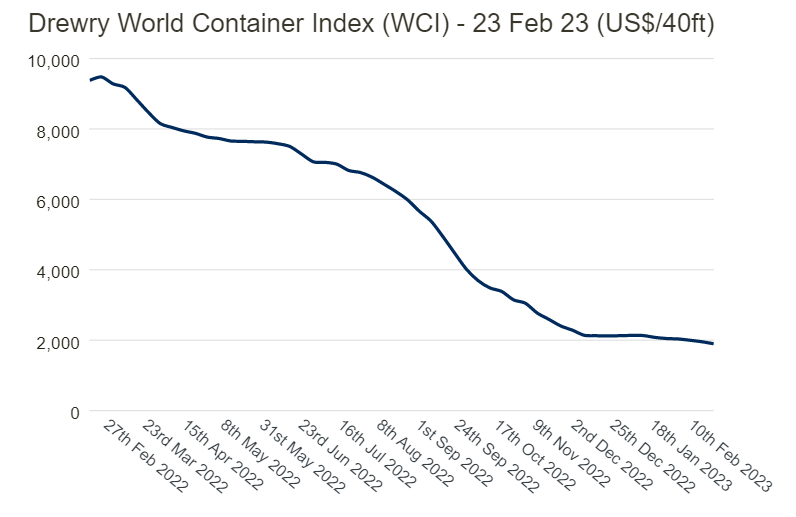

The average freight price of a standard 40-foot container continues to fall. As recently as February 2022 it was nearly $10,000, today it is around $2,000. For the moment, the index for containers has not rebounded on par with the index for bulk goods - mainly raw materials. Source: Drewry

Average rates for the transport of ordinary containers on the 8 largest sea lanes, unlike rates for the transport of dry commodities are still under pressure, making a more sustained rebound in the companies' shares still in question. Source: Drwery  Shares of ocean freight companies are trading up and climbing to new year lows after record lows in the fall of 2022. Most of the companies have healthy fundamental valuation ratios and are one of the cornerstones of global economic exchange by which they can be seen as interesting, for long-term investors. Source: xStation5

Shares of ocean freight companies are trading up and climbing to new year lows after record lows in the fall of 2022. Most of the companies have healthy fundamental valuation ratios and are one of the cornerstones of global economic exchange by which they can be seen as interesting, for long-term investors. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.