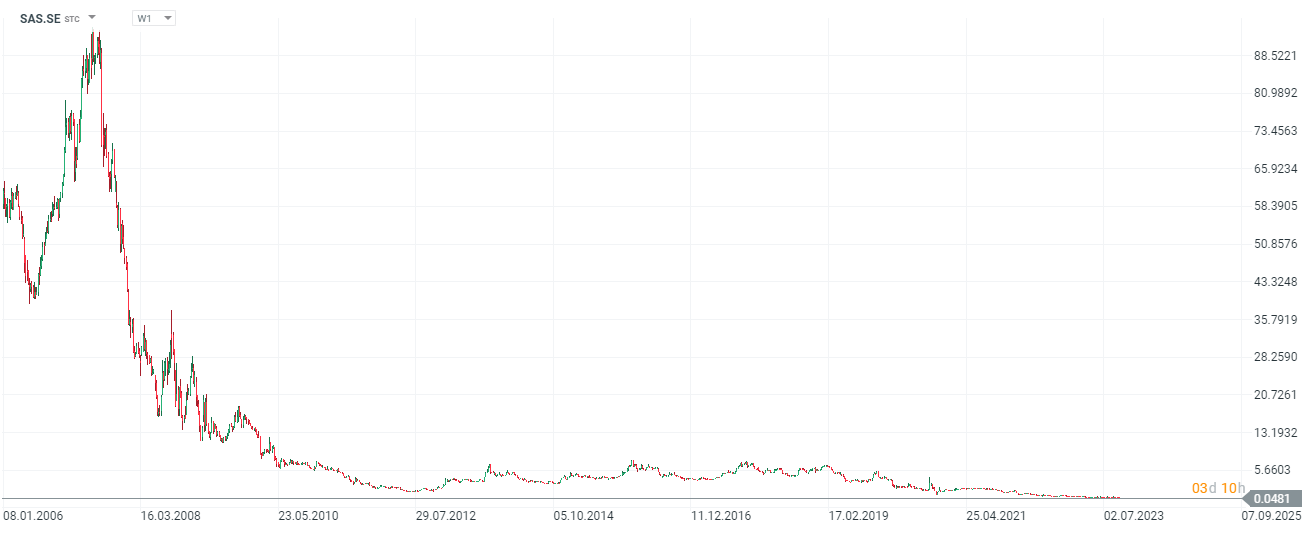

Scandinavia's largest airline SAS (SAS.SE) today informed the market that it will restructure under 'Chapter 11' of US bankruptcy law. This will result in the group being delisted from the stock exchanges and wiping out the current shareholder structure. The capital remaining after the restructuring, according to the company's announcement, is likely to be distributed exclusively to creditors. In effect, SAS shares loses 83%.

What's next for SAS?

-

After the bankruptcy proceedings, investment firm Castlelake (32%), Lind Invest (8.6%) and Air France airline KLM (20%, $1.2 billion investment) along with the Danish Treasury (26%) will become the company's new major shareholders. The company filed for bankruptcy protection in a US court in the middle of last year. It was unable to survive in an environment of rising costs and muted demand, which was also negatively affected by the pandemic.

- The agreed transaction structure valued SAS at $175 million, including $475 million in new unlisted shares and $700 million in secured convertible debt. SAS is expected to eventually join the SkyTeam group (KLM - Air France) and leave the Star Alliance, subject to relevant approvals and finalizing of the 'Chapter 11' process.

SAS shares (SAS.SE), W1 interval. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.