Salesforce (CRM.US) stock is trading 10.0% higher as the software company posted better than expected quarterly results and issued upbeat guidance. CEO Marc Benioff said that company will aim to boost profits to fend off pressure from a host of activist investors including Elliott Capital Management and Starboard Value,.

-

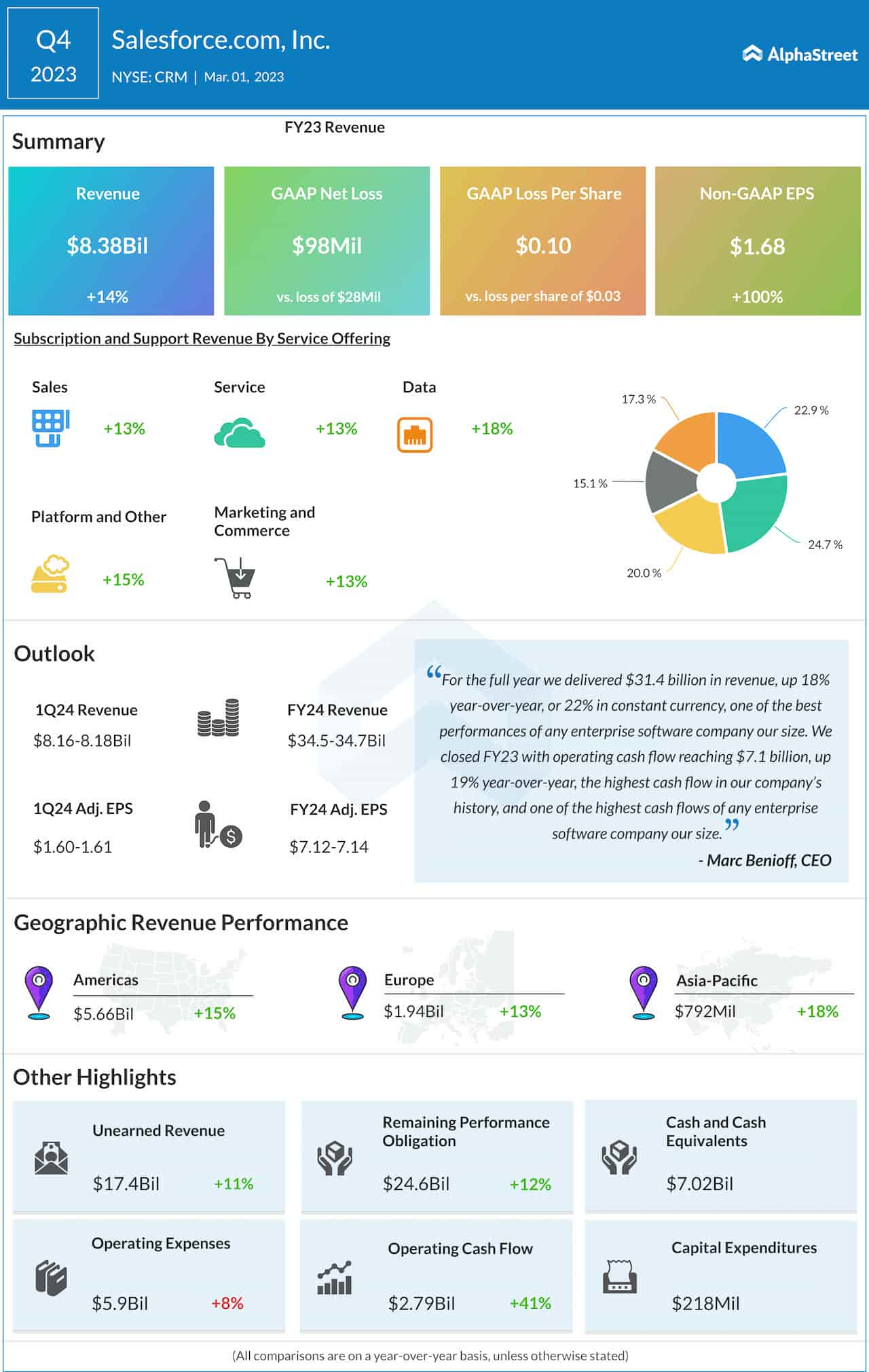

Earnings rose 100% to $1.68 per share on an adjusted basis amid cost-cutting and one-time items vs $1.36 per share as expected by analysts.

-

Revenue increased 14% to $8.38 billion, boosted by improved results at the MuleSoft business vs. $7.99 billion as expected by Refinitiv analysts.

-

Salesforce also said it is expanding its share buyback program to $20 billion from $10 billion.

-

Upbeat results came just in time as hedge fund Elliot Management put forward several board director nominations on Wednesday morning. The Wall Street Journal reported in January that Elliot had created a multi-billion-dollar position in CRM stock and had joined other activist investors in negotiations with the current board in order to further cut costs. In January, CEO Marc Benioff said it was cutting 10% of its workforce or about 7,000 employees.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appAll the key operating segments registered growth in the final three months of fiscal 2023. Source: Alpha Street

-

Company forecasts earnings of up to $7.14 per share and revenue of $34.7 billion in 2024 fiscal year. Analysts had been anticipating earnings of $5.84 per share and revenue of $34 billion.

Salesforce (CRM.US) stock has surged more than 15% on the news, however buyers failed to stay above key resistance at $191.30 which is marked with previous price reactions and 61.8% Fibonacci retracement of the upward wave started in March 2020. If sellers manage to regain control, a correction move may deepen towards the earlier broken downward trendline. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.