Global stock markets are mostly neutral as we move into the US session, US equities have given back early gains, as Alphabet weighs on the market, although the oil price is backing away from the highs of the day at $74.00 per barrel. Bitcoin is approaching $100,000 and Nvidia is reversing losses after last night’s earnings release. US economic data has been mixed so far on Thursday, but the bounce back in Nvidia could be triggering the better tone for risk sentiment, as all eyes remain on events in Russia and Ukraine.

As we mentioned last night, the markets have had an unusually mild reaction to Nvidia’s latest earnings reports. The average move in Nvidia’s share price in the day after earnings has been 8% in the last 8 quarters, so the 1.5% gain so far today suggests that the reaction to the Q3 report could be less volatile than we are used to, unless it gains momentum throughout the day.

Is the Nvidia rally due a pause?

The meat of the Nvidia results were strong, the forecast was decent, although it was not as strong as some expected. The company is extremely bullish about the outlook for its next generation Blackwell chip, which will start shipping in Q4. Thus, the company’s conservative forecast for Q4 revenues could be a deliberate attempt to lower the bar and make outperformance more likely down the line. Or it could be a sign that the company is concerned about supply constraints that could limit their ability to fulfil all the demand for Blackwell chips. This may explain the market’s lukewarm reaction to these results. However, we do not think that this will herald the start of a downturn in the stock price, largely because Nvidia has a monopoly on the GPU market. Even if it cannot meet all the demand, its customers cannot get these chips anywhere else, so Nvidia will eventually benefit.

Nvidia’s narrowing customer base

Nvidia’s customer base has been an object of fascination for many years now. On its earnings call, the CEO was extremely bullish, and said that every industry in the world will be impacted by its technology. However, there was a slight decline in the number of Nvidia’s customers’ last quarter. It fell to 752 from 757 in August. This is only a small decline; however, it does make Nvidia’s customer base more concentrated, and Microsoft, Meta, Super Micro, Google and Amazon make up approx. 50% of all revenues. This suggests that Jenson Huang’s enthusiasm for the uptake of AI might be a bit of an exaggeration.

A 2% bounce back in the stock price on Thursday is a good result compared to other firms, however, we do not see an 8% move on the back of these results, as investors start to scrutinize Nvidia with a finer tooth comb than it has done in the past.

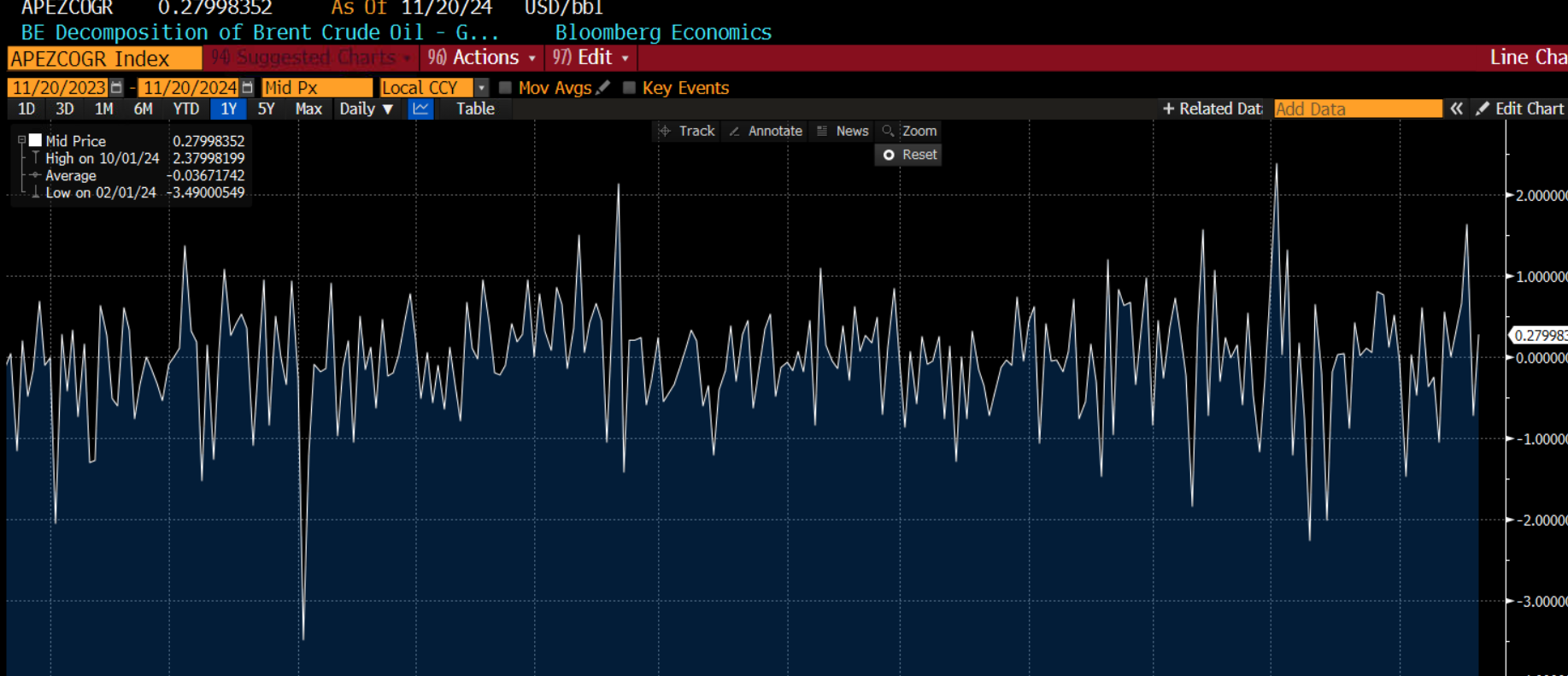

Oil price remains sensitive to Ukraine

Geopolitics is having an impact on the commodity space. The Blomberg geopolitical risk contribution to the Brent crude oil price, has spiked, has risen on the back of news that Russia launched antiballistic missiles inside Ukraine for the first time, as retaliation for Ukraine using foreign missiles inside Russia. There has been a clear increase in the impact of geopolitics on the oil price, as you can see below. Thus, the latest stage in the Ukraine conflict could ensure that Brent crude oil does not fall below $70 per barrel anytime soon. It also suggests that there is upside risk for the oil price if the situation escalates further.

Chart 1:

Source: XTB and Bloomberg

Bitcoin surges as Trump places it in the heart of Washington

Bitcoin is surging once again, and is higher by more than $3000 on Thursday, as it approaches the key $100,000 level. The move has been driven by news that Trump could set up an official Crypto department that would sit in the heart of US government. Crypto has been the biggest beneficiary of the Trump election victory so far, and its fortunes are tightly associated with the President elect. His enthusiasm for crypto is driving the market higher. Could Trump be the President that allows crypto to go mainstream? Will Americans be able to use crypto to pay their taxes in future? There is a bigger possibility of this happening now than before the election, which is why Bitcoin is approaching this key level.

Bond yields are lower across Europe, and UK yields did not react to the news that public sector borrowing hit its second highest ever level for October, as Rachel Reeves’ fiscal headroom gets rapidly eroded. This could be a sign that the market is willing to wait until the tax rises announced in last month’s budget start to fill up the coffers from 2025.

The USD starts to look overbought

In the FX space, the dollar and the yen were the chief beneficiaries of the risk off sentiment earlier today. The pound and the euro are both lower on the day, GBP/USD could attempt a recovery back above $1.2650 if risk sentiment continues to improve. The dollar is starting to look overbought, after the dollar index rose by 5% YTD. However, the longer-term outlook for the USD will be dependent on the Fed. The market expects a slower pace of rate cuts, and today’s economic data is unlikely to shift the dial on this. Initial jobless claims were lower last week, and although the Philly Fed index slumped for November, there were some pockets of strength including in employment, and the outlook surged to its highest reading since June 2021.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.