Deterioration in sentiment on the markets is clearly visible today. Risk-off moods can be seen all across the globe. There is no clear reason behind the flight for safety but among factors that may have contributed are:

- Weak data from China. Chinese trade data for July was weak with exports and imports dropping more than expected. This hints at a weaker demand for Chinese goods but also weaker demand within China as well

- Italian banks dragging peers lower. Italian banks are slumping today after the Italian Senate approved a 40% windfall tax on 2023 banks' profits. However, declines were not limited to Italian shares only and banks from other European countries trade lower today

- Moody's downgrading US banks. Moody's ratings agency downgraded 10 small- and mid-sized US banks, put some other banks under review (including Bank of New York Mellon and US Bancorp) and put 11 banks on negative outlook. Agency noted that mild recession is on the horizon in early-2024 and banks' asset quality is likely to deteriorate further after recent banking sector issues

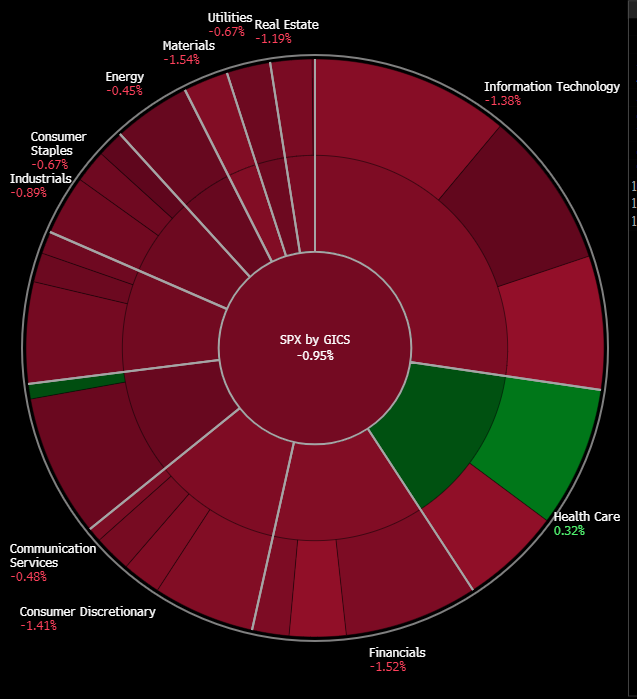

Financials are one of the worst performing group of stocks in US today. Source: Bloomberg Finance LP

An important point to note is that deterioration in moods can be seen across different asset classes:

- Equities, oil and industrial metals are dropping

- Commodity currencies (AUD, CAD, NZD) and EM currencies (ZAR, MXN, PLN) are pulling back

- Safe haven currencies (USD, CHF and JPY) are on the rise

- Yields are plunging as investors flee to bonds. 10-year US yield is down 7 basis points, German yields drop 13 basis points

Precious metals are dropping today, pressured by a rise in the USD. However, while silver drops 1.5% and platinum plunges 2.5%, gold trades 'only' 0.5% lower showing that there may also be some safe-haven inflows into this market. Cryptocurrencies seem to be the only class that bucks the 'risk-off' trend as gains can be seen almost all across the digital assets market.

US100

US100 plunged below the lower limit of a recent short-term trading range and is continuing to move lower. The textbook range of a breakout signals the possibility of a drop to 15,130 pts area. However, a key support zone to watch can be found slightly lower at 15,050 pts. Source: xStation5

US100 plunged below the lower limit of a recent short-term trading range and is continuing to move lower. The textbook range of a breakout signals the possibility of a drop to 15,130 pts area. However, a key support zone to watch can be found slightly lower at 15,050 pts. Source: xStation5

EURUSD

EURUSD failed to break back above the 1.1025 resistance zone, marked with previous local highs and 50-sesion moving average (green line). The pair is diving today as USD gains on safe have flows. Should we see a break below the recent local lows in the 1.0920 area, the next target for the bears will be 1.0875 support zone. Source: xStation5

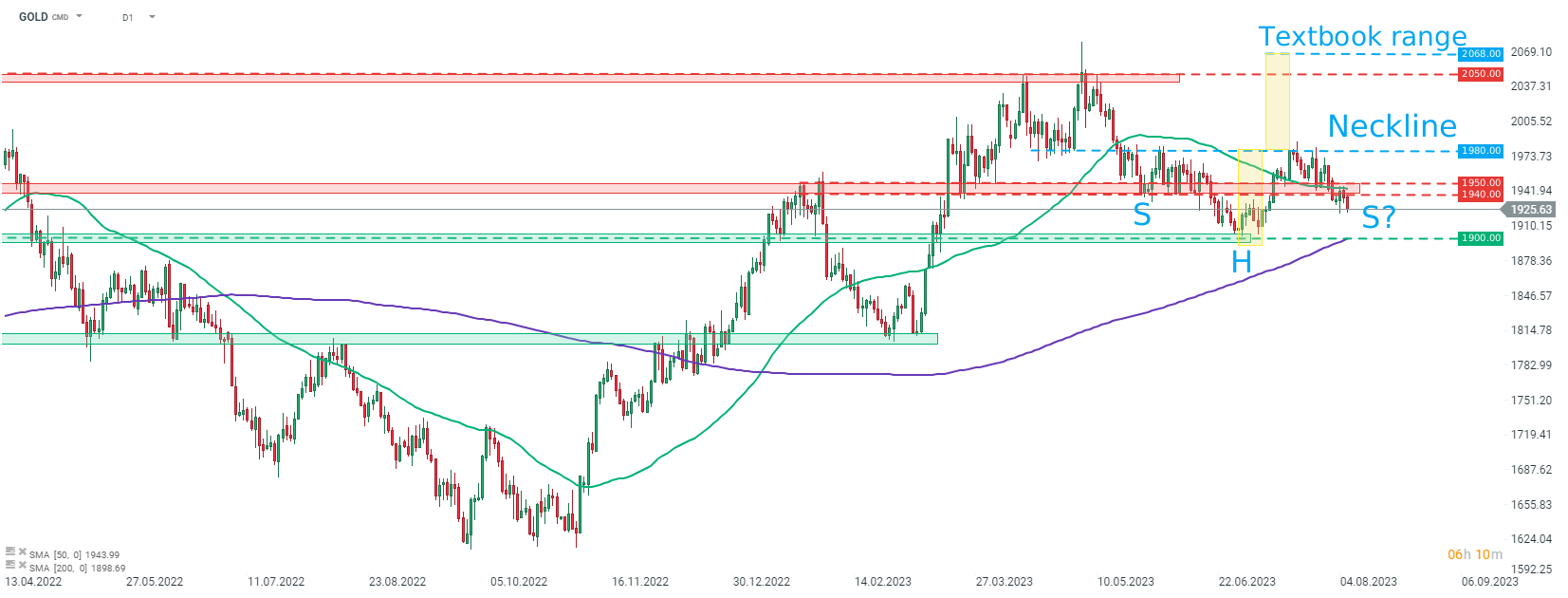

GOLD

Gold is plunging below the $1,940-1,950 price zone today, likely invalidating a potential inverse head and shoulders pattern on D1 chart. If declines are not stopped there, the $1,900 support zone, marked with previous price reactions and 200-session moving average (purple line) may be in danger. On the other hand, should bulls manage to regain control and recover from losses, the aforementioned inverse head and shoulders pattern may still materialize. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.