It is strongly expected that the RBA (Reserve Bank of Australia) will decide to keep interest rates unchanged during tomorrow's meeting, making it the third such move in a row. Additionally, this will be Philip Lowe's last meeting as the head of the RBA. Michele Bullock will take over the reins of the central bank on September 18. What should you know before the meeting?

-

The latest available inflation data for July showed a drop in inflation to 4.9% year-on-year from a level of 5.4% year-on-year. The RBA's target for the end of this year is 4.1% year-on-year.

-

Recent labor market data for July were somewhat weaker, but a rebound is expected for August. Key wage data will be known in November for Q3.

-

The RBA has already indicated that with the current level of interest rates, the inflation target can be achieved within the forecast.

-

Deviation from RBA's forecasts in the upcoming publications may prompt the central bank to return to rate hikes.

-

The new head has already indicated that the AUD is weak and the risk of inflation remains.

-

Given that key quarterly data will be known in November, the November meeting could potentially bring changes in interest rates. This could also depend on the decisions made by the Fed by that time. In November, the RBA will also have new macroeconomic projections.

-

The RBA will most likely maintain the status of the possibility of returning to hikes, as the AUD is a relatively weak currency in the G10 and the RBA is unlikely to want to be one of the first banks to "officially" end the rate hike cycle.

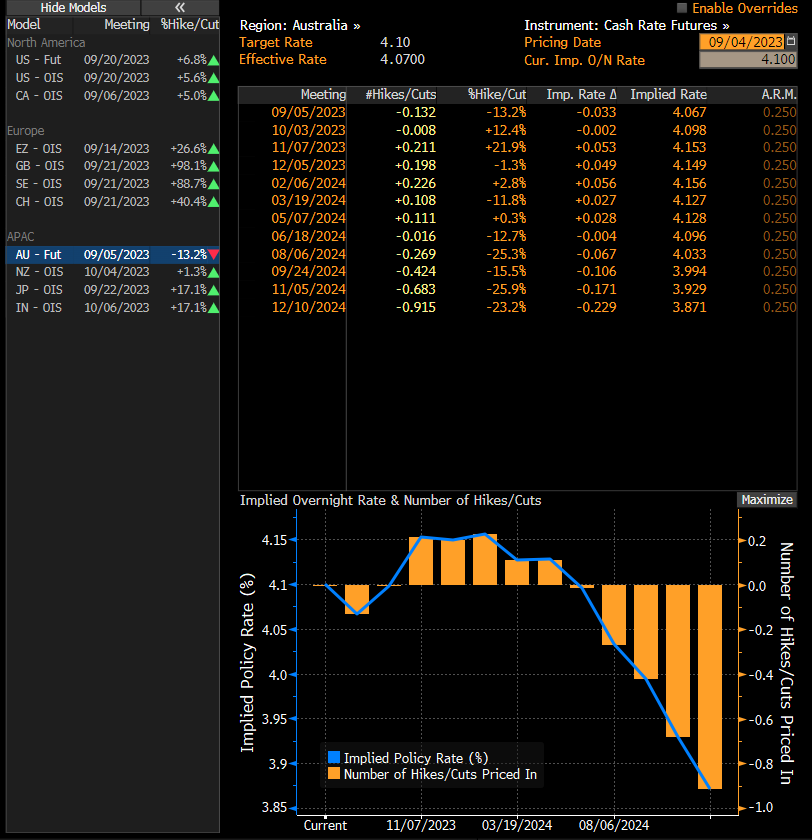

The highest probability of rate hikes is seen in November. Tomorrow's decision should not change much, especially since it's Lowe's last meeting. Source: Bloomberg Finance LP

The highest probability of rate hikes is seen in November. Tomorrow's decision should not change much, especially since it's Lowe's last meeting. Source: Bloomberg Finance LP

AUDUSD has broken out of the downtrend but encountered resistance around the 0.65 level, where the 23.6% retracement of the last downward wave also resides. Copper indicates potentially higher levels for the AUD, but at the same time, a bearish signal has appeared on copper. The yuan has gained recently, but remains weak and does not give a strong signal for the AUD. In the best case, one could expect a retest of the 0.65 level if the RBA statement is more hawkish than before. Source: xStation5

AUDUSD has broken out of the downtrend but encountered resistance around the 0.65 level, where the 23.6% retracement of the last downward wave also resides. Copper indicates potentially higher levels for the AUD, but at the same time, a bearish signal has appeared on copper. The yuan has gained recently, but remains weak and does not give a strong signal for the AUD. In the best case, one could expect a retest of the 0.65 level if the RBA statement is more hawkish than before. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.