- Reserve Bank of Australia to announce policy decision on Tuesday, 3:30 am GMT

- Bank expected to hold rates unchanged

- Inflation slow but remains above the target

- Potential for a hawkish statement

- AUDUSD trades 6% above late-October lows

Economists and money markets see no move

Reserve Bank of Australia (RBA) is scheduled to announce its next monetary policy decision on Tuesday at 3:30 am GMT. Economist polled by Bloomberg and Reuters expect Australian central bank to leave rate unchanged, with the main cash rate staying at 4.35%. No rate move is also expected according to money market pricing, with interest rates futures actually pricing in a 8% chance of a 25 basis point rate cut for the upcoming meeting. A rate hike last month was expected but is now see as likely being the last on in the current cycle, which saw cash rate increase over 400 basis points since Q2 2022. While money markets do not expect more rate hikes from RBA, they also expect the bank to start cutting them in Q4 2024 - later than in case of other G10 central banks.

Money markets price in around 8% chance of a 25 basis point RBA rate cut tomorrow. Source: Bloomberg Finance LP

Inflation eases but remains above target

Inflation data shows that monetary tightening that was already deliver by Reserve Bank of Australia proved effective in reducing inflation. The latest report showed inflation easing to 5.4% YoY in Q3 2023, down from a peak of 7.8% YoY in Q4 2022. Monthly reading for October showed CPI slowing further to 4.9% from 5.6% YoY in September. Nevertheless, it is still significantly above RBA target (2-3%). Because of that, RBA is expected to maintain a hawkish tone in its statement. This is especially true following a hawkish narrative from RBNZ last week, which has revised rate forecasts higher and discussed a rate hike before deciding to keep rates unchanged.

Australian inflation continues to drop, with CPI easing from a high of 7.8% YoY in Q4 2022 to 5.4% YoY in Q3 2023. Source: Bloomberg Finance LP, XTB

Australian inflation continues to drop, with CPI easing from a high of 7.8% YoY in Q4 2022 to 5.4% YoY in Q3 2023. Source: Bloomberg Finance LP, XTB

Yields shift lower

Still, a lot suggests that a rate hike delivered by RBA last month was a preemptive move to ensure that inflation remains on the downward path. RBA has also been more conservative then other central banks, with cumulative tightening in Australia being around 100 basis points smaller than in the United States or New Zealand. Also, RBA has stood on hold during all meeting in the second half of this year, except for the November meeting. Australian yields have shifted lower across the curve over the past week and month.

Australian yields have dropped all across the curve over 1-week and 1-month periods, spare for an increase in very short-term yields. Source: Bloomberg Finance LP, XTB

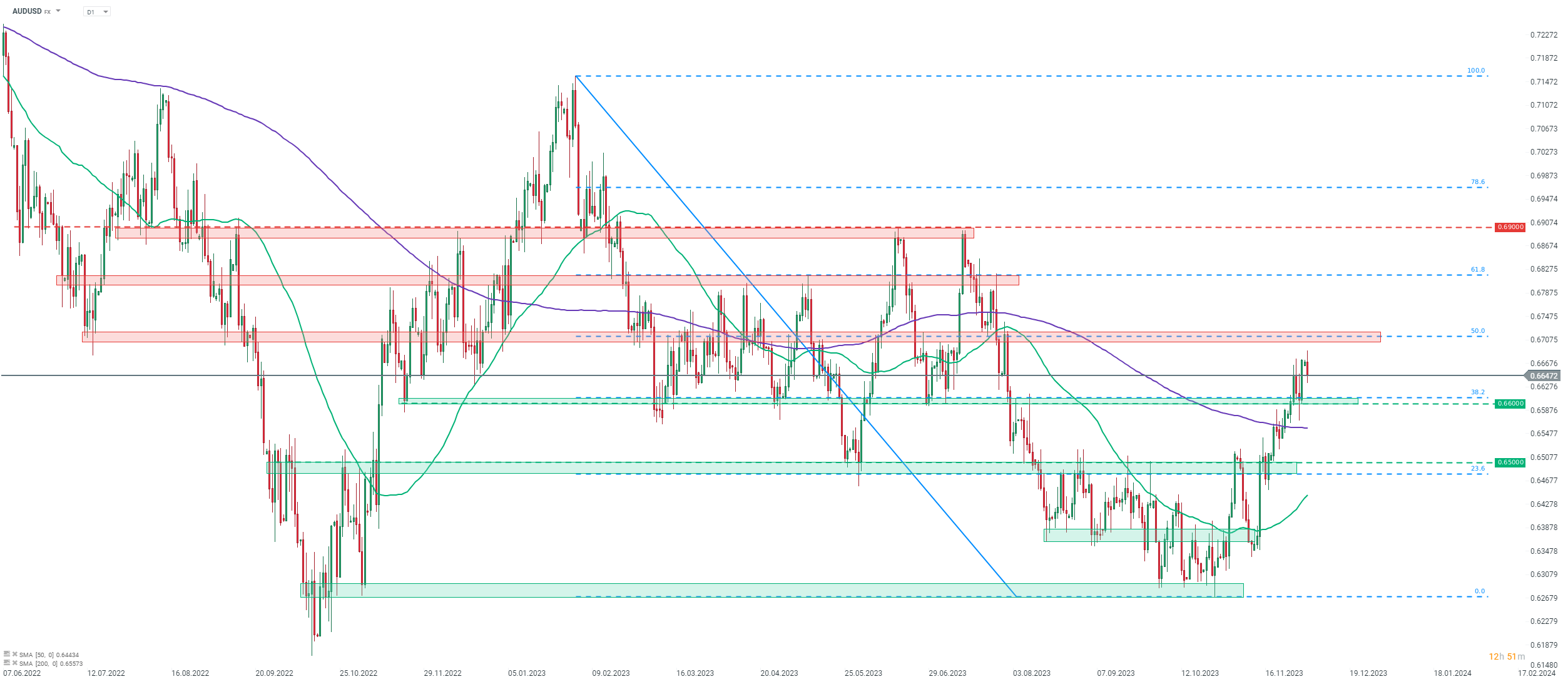

A look at AUDUSD chart

While markets are positioning for a no change in rates, traders should be wary that a hawkish twist in RBA statement may boost AUD. RBA Governor Bullock said as recently as last week that inflation still remains too high and warned about second-round inflation effects. This leaves the door open to saw hawkishness in the statement.

Taking a look at AUDUSD chart at D1 interval, we can see that the pair experienced a strong upward move recently, which was driven to a huge extent by USD weakening. Pair is trading 6% above late-October 2023 lows. A pullback can be spotted on the pair today. The pair has been recently driven by the USD and this is likely to remain the case. However, should RBA provide some hawkish remarks in its statement tomorrow, gains on the pair may accelerate. In such a scenario, the first near-term resistance zone to watch can be found ranging around 50% retracement of the downward move launched at the beginning of February 2022.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.