The Reserve Bank of Australia is scheduled to announce its next monetary policy decision tomorrow at 5:30 am BST. Economists polled by Bloomberg expect the Australian central bank to deliver a 25 basis point rate hike this week, following a pause at the meeting at the beginning of July. However, weaker CPI print for Q2 2023 puts this hike into question.

RBA expected to hike one more time

The Reserve Bank of Australia has increased interest rates by a cumulative 400 basis points in 15 months, which is the fastest pace of tightening in RBA's history. Bank delivered a 25 bp rate hike back at the beginning of June, putting the cash rate at 4.10%, and then decided to keep rates unchanged at a meeting at the beginning of July.

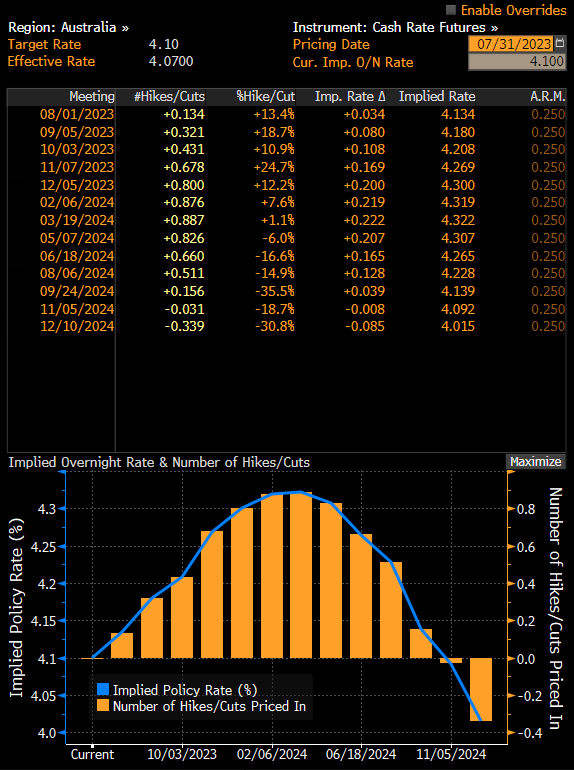

Expectations among economists are for RBA to resume hiking and decide on a 25 bp rate hike, that will put the main interest rate at 4.35% - the highest level since November 2011! However, it looks like it may be the final hike in the cycle with money markets seeing a rate peak around 4.35%. However, it should be noted that money markets do not fully price in a rate hike at a meeting tomorrow and a peak is priced in for Q4 2023/Q1 2024.

Source: Bloomberg

Inflation slows, labor market remains strong

Data that was released since the last meeting has been mixed from monetary policy's viewpoint. Australian CPI inflation slowed from 7.0% YoY in Q1 2023 to 6.0% YoY in YoY. This was below the market's forecast of 6.2% and below the RBA's forecast of 6.3% YoY. Meanwhile, jobs data for June came in strong with the unemployment rate staying unchanged at 3.5% (exp. 3.6%) and almost 40k full-time jobs being added. This was another strong jobs report from Australia in a row after May data showed an almost 76k total increase in employment, driven by 61.7k full-time jobs.

While inflation is dropping faster than expected, it is still significantly above target and combined with other solid data from the Australian economy, it makes a 25 basis point rate hike tomorrow highly likely. Question is what guidance will RBA give to investors. Will it hint that the rate hike cycle is still live and another move could be expected later into the second half of the year? Or will it hint that given the extent of the already delivered tightening, a pause would be reasonable in order to assess impact.

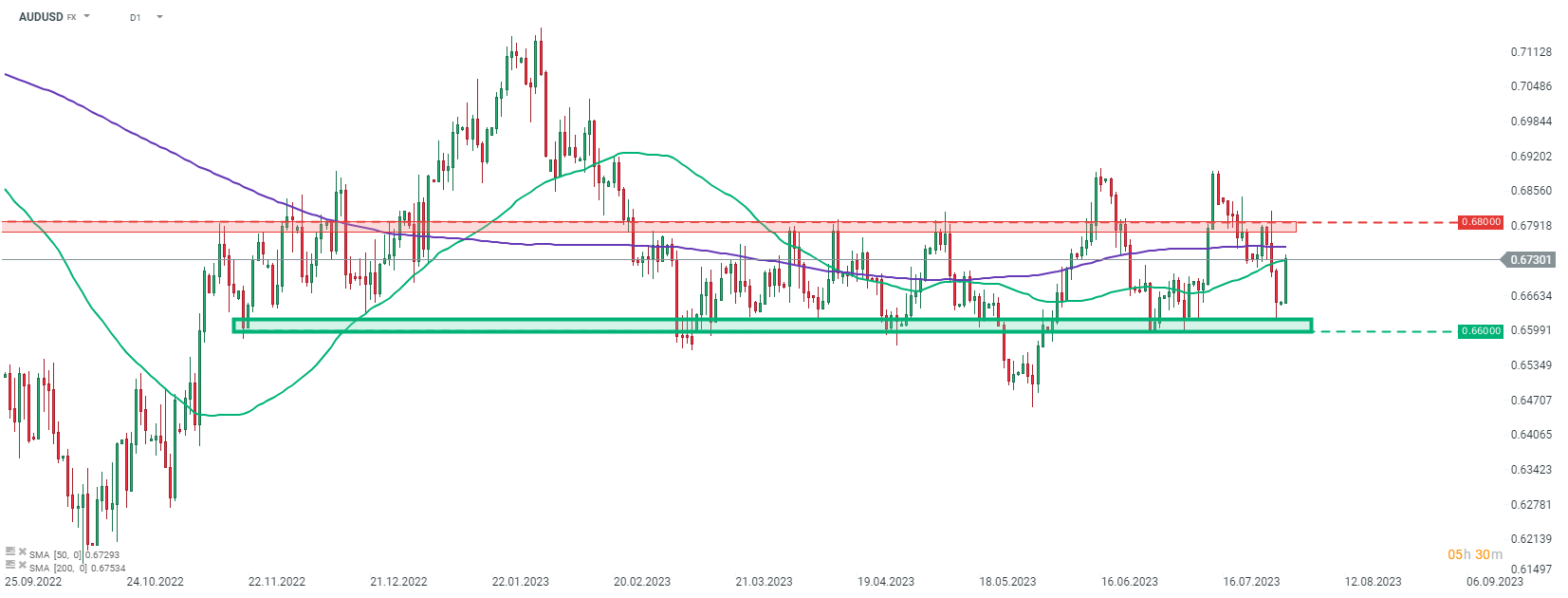

A look at AUDUSD

Taking a look at AUDUSD chart at D1 interval, we can see that the pair has been trading in a sideways move for the past half a year. A recent pullback was halted at the support zone ranging above the 0.6600 mark, which serves as the lower limit of the trading range. A strong recovery move can be observed this week with the pair climbing to and testing the 50-session moving average in the 0.6730 area (green line).

A dovish message from RBA like for example no hike or a move smaller than 25 basis points would likely see AUD lose some ground. Also the currency may experience some weakness if RBA delivers a hike but strongly hints that this was the final move. Nevertheless, such a clear forward guidance is unlikely to be offered and instead, some rather vague comments on data-dependency and need to assess impact of the already delivered tightening seem more likely. However, a 25 bp rate hike and no changes in the statement that would signal that cycle is over, could see a hawkish reaction on AUD. Still, the balance of risks for AUD seem to be tilted to the downside ahead of the meeting with RBA having it much harder to deliver a hawkish surprise than dovish surprise.

AUDUSD at D1 interval. Source: xStation5

AUDUSD at D1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.