Summary:

- Australian Treasury signals the RBA could start buying bank bonds to take downward pressure off their profitability

- The RBA could also offer cheap funding to banks

- These measures are intended to help banks as they struggle to pass on subsequent rates cuts to customers

Australian Treasury warned that rate cuts delivered by the Reserve Bank of Australia are squeezing bank profit margins and that it why the central bank may soon have to resort to some measures intended to help banks deal with such downward pressure. What could be the most interesting point here is the fact that according to Josh Frydenberg, the head of Treasury, the central bank could initially start buying bank bonds and residential-mortgage backed securities (RMBS) to lower borrowing costs for households and businesses. This notion differs substantially from the RBA’s message that government bonds should be bought first. Also, other central banks like the Fed or the ECB focused largely on this part of bond markets. Frydenberg says that such a possibility could be needed in the case of reaching by the RBA a zero lower bound and if the government does not loosen the purse strings. In its report the Treasury also warned of risks arising from extremely low rates such as “excessive growth in asset prices, including house prices” and difficulty unwinding the measures, according to AFR.

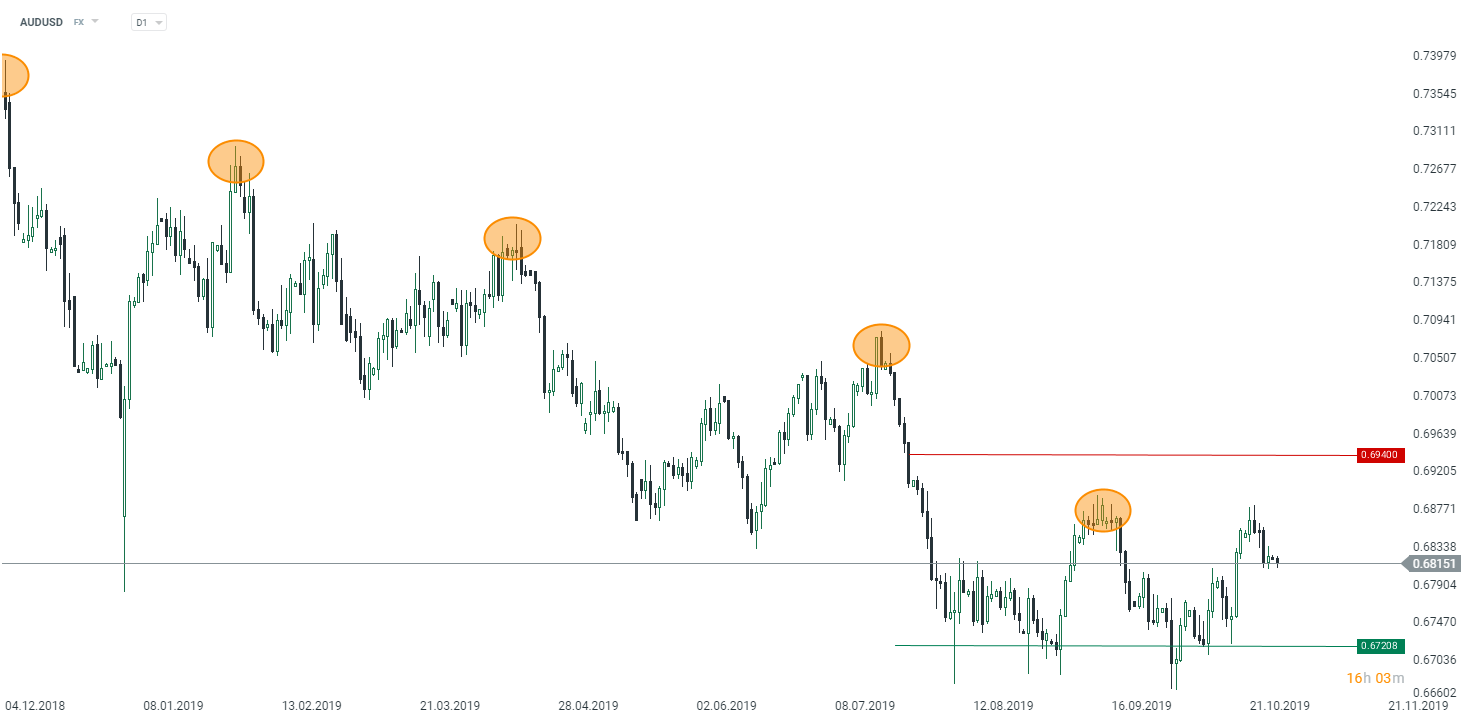

The Aussie dollar remains again under selling pressure as the new week kicks off. Source: xStation5

The Aussie dollar remains again under selling pressure as the new week kicks off. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.