Summary:

-

Government pause WAB after defeat on timetable

-

EU expected to offer an extension

-

GBP dips but selling remains fairly contained

Tuesday’s votes in UK parliament were pretty much in keeping with the consensus forecast as Boris Johnson chalked up his first victory in the House of Commons as MPs backed his Brexit deal. However, any joy for the PM was short lived as the failure to pass the program motion has effectively ruled out the chances of meeting his “do or die” pledge in delivering Brexit by October 31st.

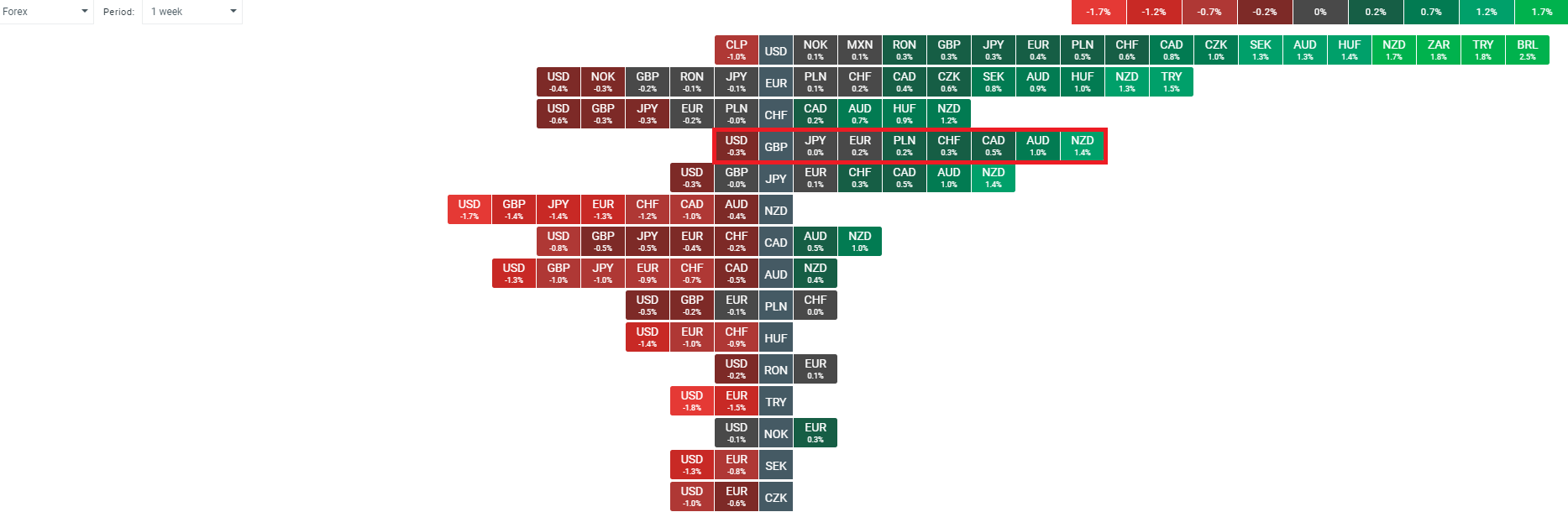

The past week has been fairly mixed for the pound on the whole, with the largest drop seen against the antipodean currencies. Sterling has pulled back as the optimism that Boris’s deal would pass anytime soon has been checked, but the currency still remains not too far from recent peaks. Source: xStation

The failure in the second vote of the evening means that the path of the bill has now been paused, residing in a state known as limbo. It is now up to the EU in deciding whether to offer an extension and for how long and Donald Tusk has wasted little time in suggesting a 3-month flextension which would move the deadline to January 31st but also allow for an earlier exit if the Withdrawal Agreement Bill could be ratified. There has been some suggestion that the EU27 members may not back such a move, with French president Macron seen as the most likely to object, but on balance this remains improbable and the base case now becomes an extension.

US investment bank JP Morgan have claimed that if an extension is offered to PM Johnson he would probably succeed in passing his Withdrawal Agreement Bill. This may be a little presumptuous however, as there is a good chance that it received additional support last night due to the belief of several swing voters that the program motion would not pass and therefore they could afford to back it under the premise that it would not proceed anyhow.

A general election looks a likely way out of the current stalemate, and although the Fixed Term Parliament Act requires a two-thirds majority to pass, a vote of no confidence would need just a simple majority and looks the more plausible path.

The pound dipped lower in response to the latest events, although the selling has been fairly contained and with the prospects of a no-deal still remaining remote in the extreme, the case for a significant depreciation is fairly weak for the time being.

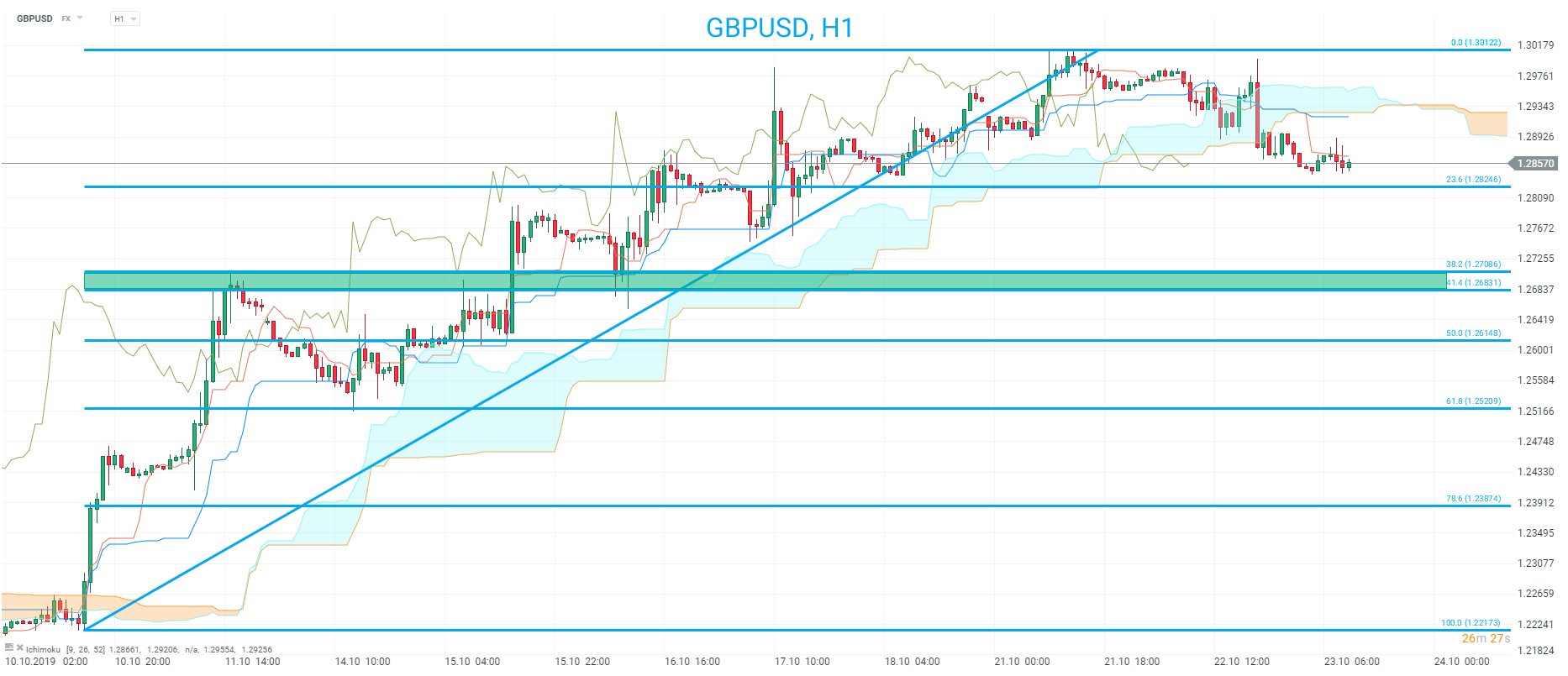

The GBPUSD rate may have turned lower in the short term, according to the H1 Ichimoku cloud. Fib retracements offer potential levels to look to below should the declines continue with the 23.6% at 1.2825 and the 38.2-41.4% region spanning 1.2683-1.2709. As for potential resistance the cloud itself around 1.2935 and recent highs of 1.3012 are levels to keep an eye on. Source: xStation

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.