Summary:

-

ISM manufacturing PMI: 54.1 vs 57.7 exp

-

Lowest reading since Nov 2016; Several components also weak

-

USD falling back vs most of its peers as Gold pushes higher

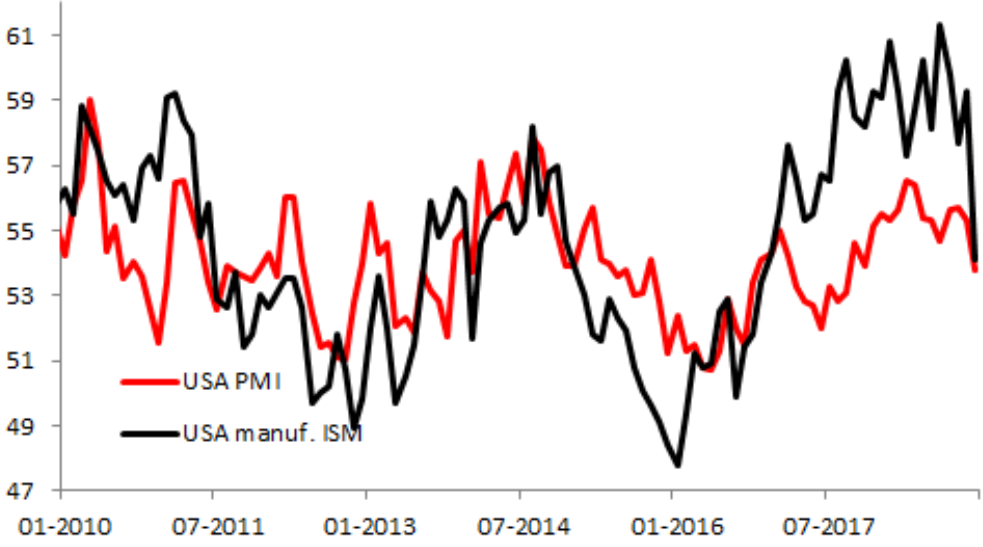

After a better than expected reading from the ADP employment change earlier this afternoon, the latest look at the manufacturing sector has delivered a sobering message with the ISM PMI dropping to its lowest level in more than two years. For December the print of 54.1 was the lowest since November 2016 and well below the 57.7 expected, while the fall from the prior reading of 59.3 marks the largest month-on-month plunge for this metric since Lehman’s failure in 2008!

The US PMI reading has been providing warning signals for the manufacturing sector for a while now and the ISM today seems to have caught up in a pretty dramatic fashion. Source: XTB Macrobond

Looking at the components of the report, it doesn’t make for pretty reading with several areas of weakness. The following are listed in the form of actual vs prior:

-

Employment: 56.2 vs 58.4

-

Prices paid: 54.9 vs 60.7

-

New orders: 51.1 vs 62.1

-

Backlog of orders: 50.0 vs 56.4

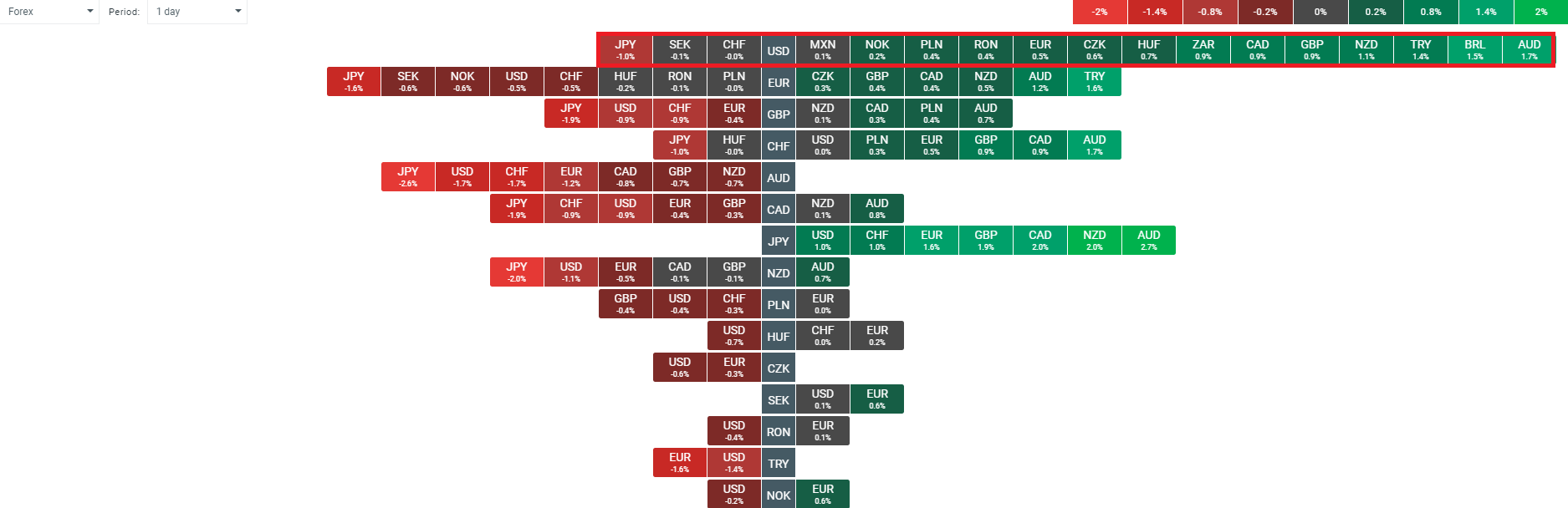

The US dollar is coming under some pressure today, falling back against the majority of its peers. The only real gains of note come against the Japanese Yen and these are simply a retracement after the large losses seen in USDJPY last night. Source: xStation

The depreciation seen in the greenback has boosted the price of Gold, with the precious metal reaching its highest level since last June today. Price traded briefly back above the 1290 handle overnight but fell back a bit before seeing some more buying on the ISM report. The market is on track for a 5th consecutive daily gain and is up by around $50 since the Fed delivered their December hike. The region from 1292-1309 could now be seen as a possible resistance zone but if we get further risk-off moves such as the one seen in the JPY overnight or another rout in equities then this could well be broken above in the not too distant future.

Gold has reached its highest level in over 6 months today and the market is back near the prior consolidation zone from 1292-1309. This could offer resistance for now unless we get another bout of risk-off flows. The market could be highly sensitive to tomorrow’s NFP report. Source: xStation

Gold has reached its highest level in over 6 months today and the market is back near the prior consolidation zone from 1292-1309. This could offer resistance for now unless we get another bout of risk-off flows. The market could be highly sensitive to tomorrow’s NFP report. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.