📊The decline in US bond yields has a positive effect on precious metals prices

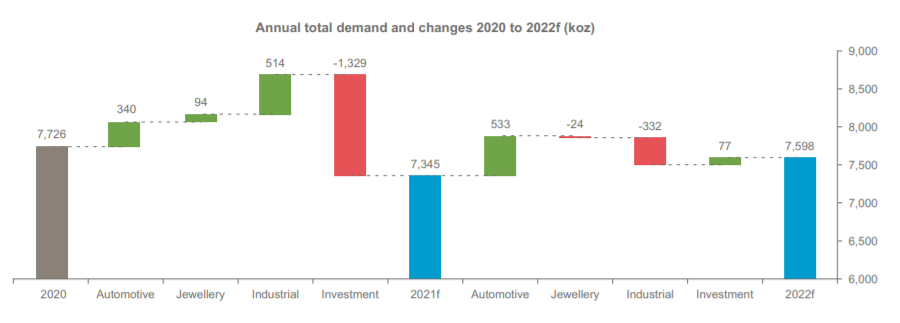

Precious metals continue to rebound, which is related to a significant decline in US bond yields. The latest data from the US are not impressive, especially today's data from the labor market. Initial applications for unemployment benefit increased to 286,000 which is the highest publication since October, and a bit of a surprise given the recent readings around 200,000. Yesterday, the gold price rose sharply and reached its highest level in 2 months, which also supported other precious metals. Today, platinum is gaining almost 3% and is not only the best performing precious metal, but leads the way in the industrial metal category. It is worth mentioning that platinum is mostly used in industry, primarily in the automotive sector. A very strong demand recovery is expected to take place in 2022.

The price of platinum is breaking above the 38.2% Fibonacci retracement and the downward trendline during today's session. Next major resistance is located around $ 1,150 an ounce. Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app

Demand for platinum is expected to rebound in 2022, mainly thanks to demand from the automotive sector. On the other hand, demand from the glass industry is expected to be much worse. Source: Platinum Investment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.