Pinterest (PINS.US) stock trades over 8.0% higher on Friday after the image-sharing platform beat quarterly revenue estimates and its monthly user numbers also topped expectations.

-

Company earned $ 0.11 per share, topping market expectations of 6 cents per share. However, the figure came in lower than the prior-year quarter's adjusted earnings of $ 0.28 per share.

-

Revenue jumped 8% YoY to $ 684.55 million and analysts’ projections of 666.7 million. However today's figure was considerably lower than the 43% growth rate it reported the prior year in the same quarter.

-

Global MAUs increased slightly to 445 million from 433 million recorded in the second quarter. However, global average revenue per user (ARPU) soared 11% to $ 1.56. Pinterest's latest earnings report has defied the trend of online advertising companies posting results that haven't met analyst expectations.

-

"Despite the challenging macro environment, we are delivering performance and a distinct value proposition to advertisers, reaching users across the full funnel," Pinterest's new Chief Executive Bill Ready said in a statement.

-

Pinterest expects that Q4 revenue will "grow mid-single digits on a year-over-year percentage basis." Analysts on average expected adjusted earnings of 6 cents a share on sales of $667 million, according to FactSet.

-

Operating expenses are expected to grow around 35% YoY for 2022.

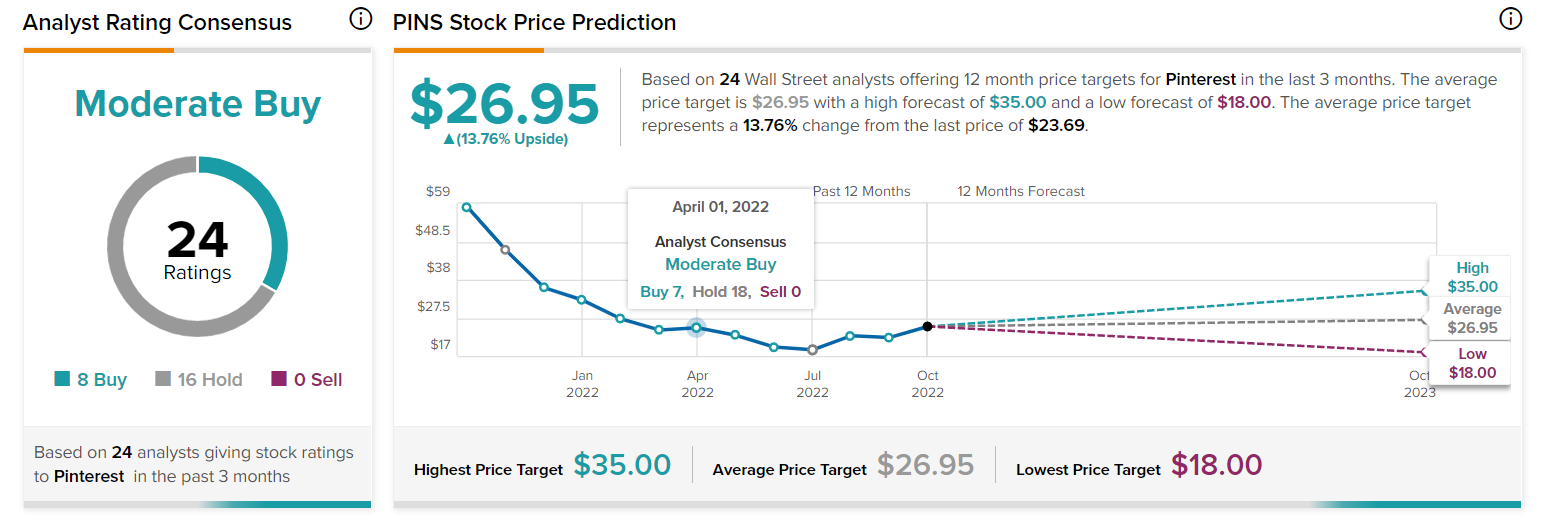

Pinterest has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average price target of $26.94 implies 16.0% upside potential to current levels. Source: tipranks.com

Pinterest has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average price target of $26.94 implies 16.0% upside potential to current levels. Source: tipranks.com

Pinterest (PINS.US) stock fell nearly 40.0% so far this year. In recent weeks the price has been moving sideways. Perhaps fresh earnings will be a catalyst for a bigger move. Nearest resistance to watch is located around $27.10 and coincides with 78.6% Fibonacci retracement of the upward wave started at the beginning of the pandemic. Nearest support can be found at $16.00 where lows from July are located. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.