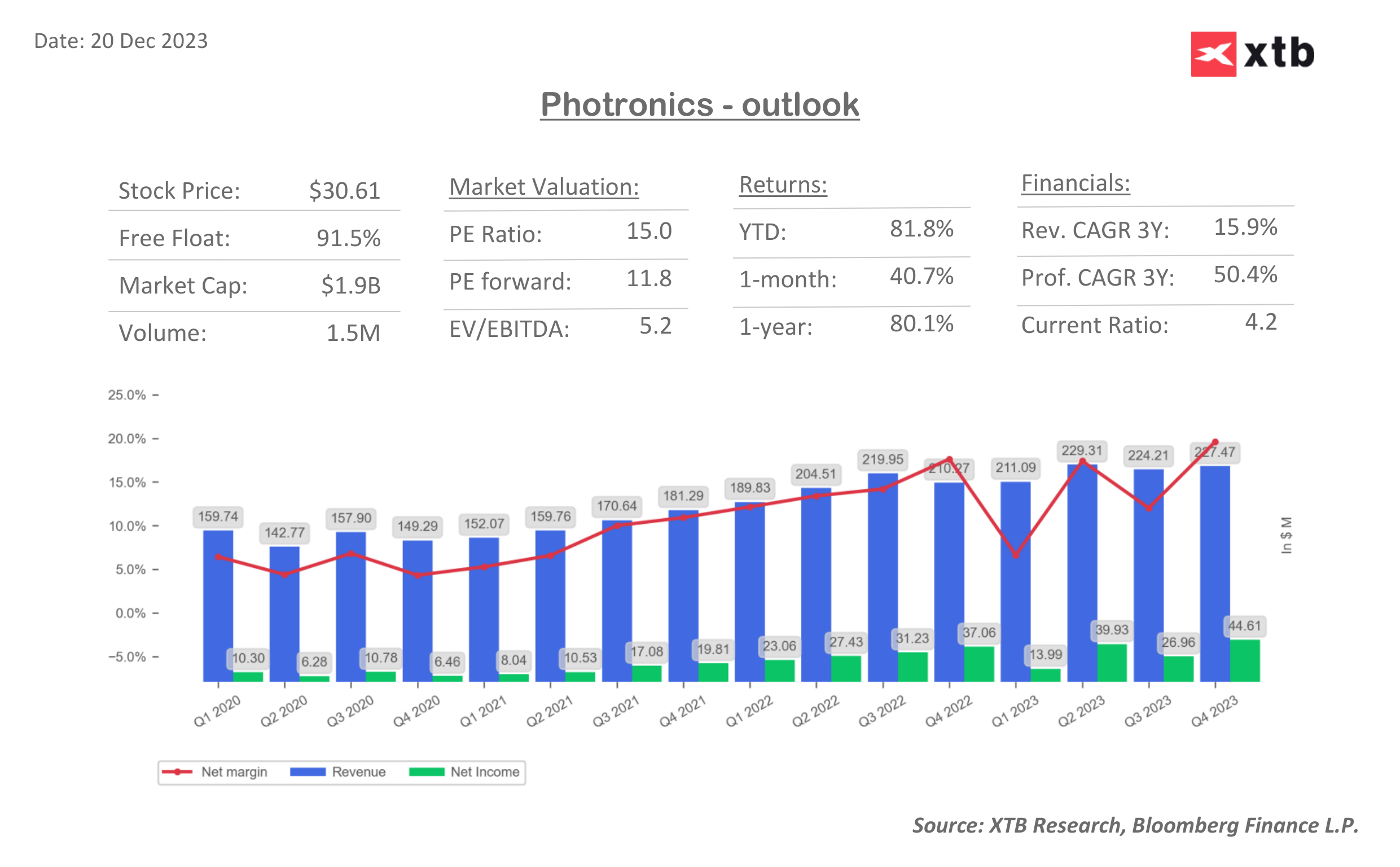

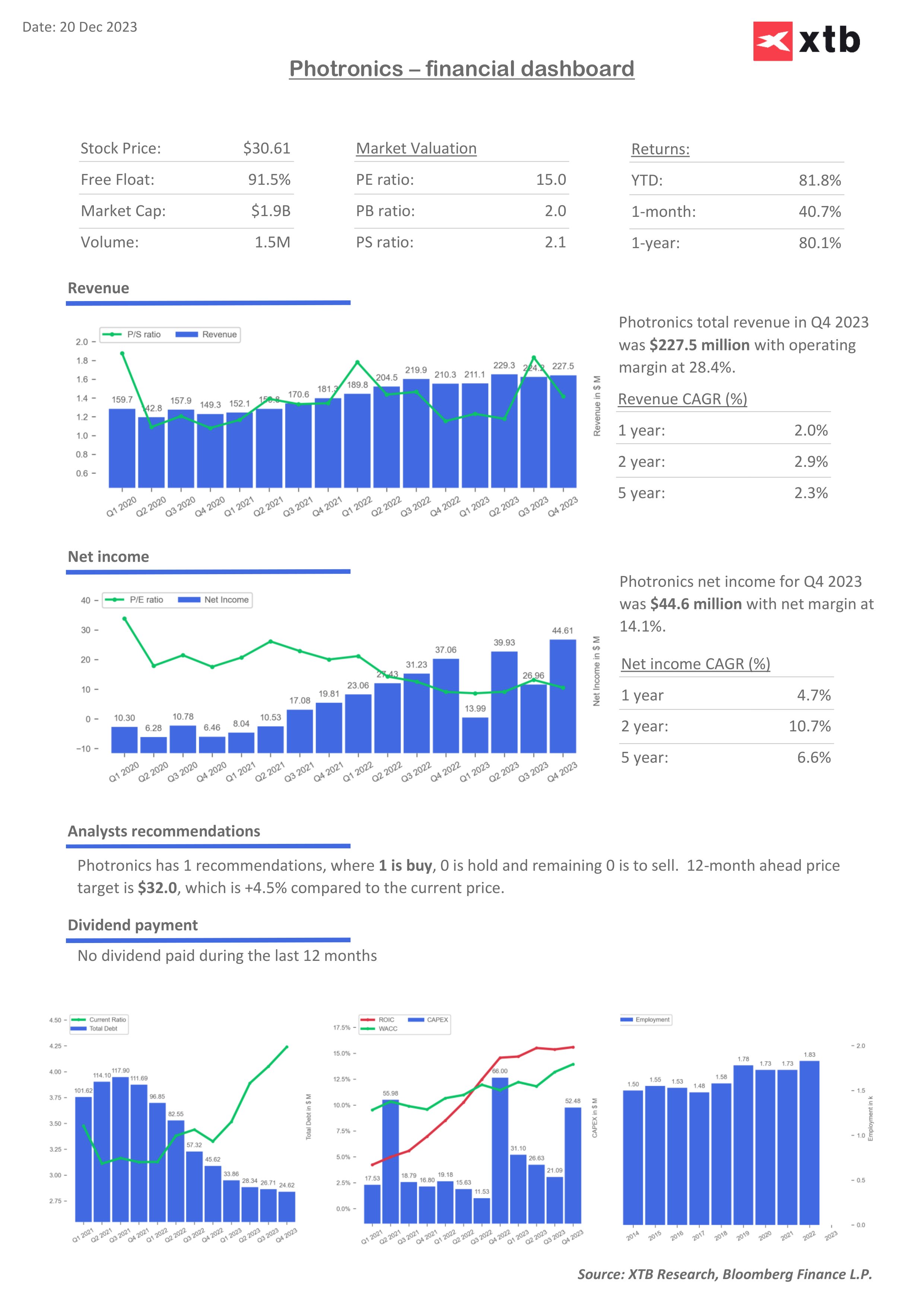

Shares of U.S. Photronics (PLAB.US), which specializes in photomasks and integrated circuits (ICs) production, rose, up more than 40% during the month. The company reported record revenues for the sixth consecutive year, posting 8% year-on-year growth, at a time when the photomasks market remained virtually flat this year. The company reported financial results, including earnings per share ($0.6 vs. $0.53 forecasts) well above projections, reporting an all-time record operating margin of 28.5%.

- The company cut operating expenses, which accounted for less than 9% of revenue, in Q4 Net income was $37.2 million. During the year, Photronics' total revenues amounted to $892.1 million, 8% higher than the $824.5 million reported in fiscal 2022 (an average annual growth rate of 12% over the past six years). Revenues in fiscal 2023 were almost double those of fiscal 2017, when the company began implementing a focused growth strategy to emerge from the doldrums;

- Photronics expects the overall semiconductor industry to contract by up to 12%, but the company's year-on-year sales growth confirms that the photomask market is less cyclical than the industry as a whole. According to management comments, signals from industry leaders and customers indicate that the current decline in the semiconductor cycle should transition to the next phase of growth around the middle of next year. Taking cyclical and manufacturing observations as a guide, the company forecasts that broader demand for photomasks should return to a more robust growth phase in the second or third fiscal quarter

China slowdown didn't hit Photronics

- In a commentary on the results, management pointed out that while the company, like other semiconductor companies, derives a significant portion of its revenues from China, its operations in that market remain unique in their resilience to revenue cyclicality. In a conference call with analysts, the company acknowledged that there are a significant number of new projects and factories in China that are driving demand for photomasks, despite the economic downturn. The bulk of photomasks production is supplied by private manufacturers.

- Revenues from integrated circuits rose 9.8% year-on-year and were an all-time high. By major category, IC revenue of $164.5 million in the fourth quarter rose 1% sequentially and 5% year-on-year. Revenues from the high-end segment, defined as chip masks using 28-nanometer or smaller technology, contributed 27% year-on-year growth in k/k terms, more than offsetting a decline in revenues from the main business segment. High-end revenues were strong in the US, as well as in Asia. The 9% decline in core segment revenue was largely due to lower delivery premiums due to somewhat moderate demand and normalized lead times for new products

Akche Photronics (PLAB.US)![]()

Looking at the scale of recent increases, a correction toward the 23.6 or 38.2 Fibonacci retracement of the upward wave from the fall of 2022, at $24 or $26 per share, is not out of the question. The company's shares are still about 50% short of their historical highs, dating back to 2000. Source: xStation5

Photronics valuation forecasts and indicators

The company has almost zero debt, with strong cash reserves and margins. What's very interesting, is the fact that P/E ratio is falling for year, but the net income and revenues are growing.

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.