Pfizer showed better-than-expected results for 2Q24, and raised its outlook for the full year 2024. After peaking at 4% in pre-market trading, the company is currently gaining just less than 0.5%.

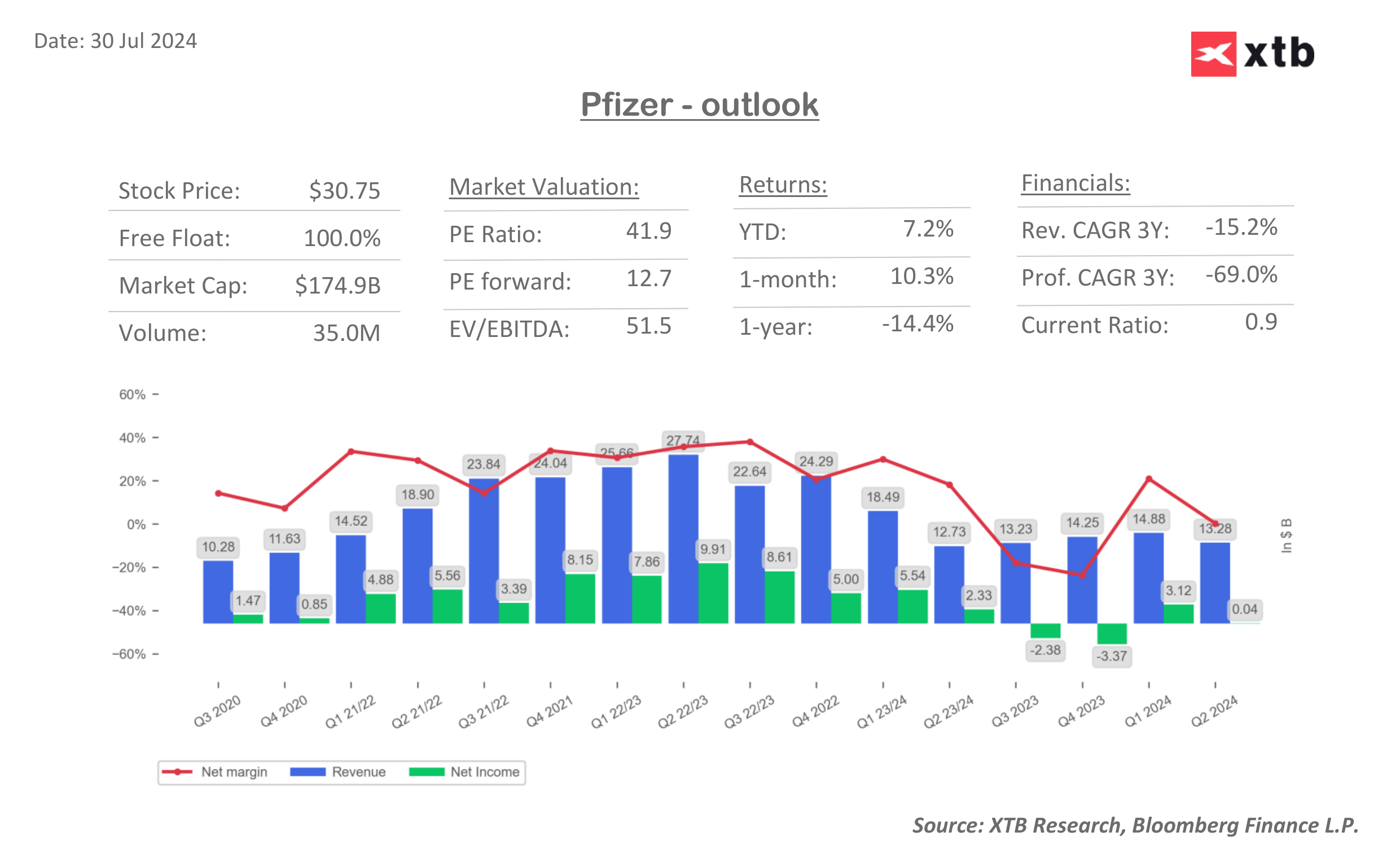

2Q24 was the first quarter since the record second quarter of 2022 (when revenues peaked thanks to sales driven by the COVID-19 pandemic) in which the company managed to achieve positive year-on-year revenue growth. Revenues rose to $13.28 billion (+3% y/y), despite a decline in revenues generated in the COVID-related segment (sales of the Comirnata vaccine fell 87% y/y). Excluding this segment, revenues grew 14% y/y.

Currently, Pfizer's results are most strongly influenced by the anticoagulant drug Eliquis, with sales of $1.88 billion. The company also achieved strong growth in its oncology segment and has plans to continue its strong growth.

Strong results for 2Q24 led the company to raise its forecast for the full year 2024, with revenue estimates rising to $59.5-62.5 billion (vs. $58.5 - $61.5 billion previously) and adjusted earnings per share projected by the company at $2.45 - $2.65 (vs. $2.15 - $2.35 previously). Excluding the COVID-19 segment, this implies a sales growth rate of 9-11%.

2Q24 RESULTS

- Revenue $13.28 billion, estimates $13 billion

- Adjusted earnings per share: $0.60, estimates $0.46

- Comirnata revenues $195 million, estimates $216.6 million

- Paxlovid revenues $251 million, estimates $244.7 million

- Ibrance revenues $1.13 billion, estimates $1.14 billion

- Eliquis revenues $1.88 billion, estimates $1.89 billion

- Vyndaqel family revenues $1.32 billion, estimates $1.11 billion

- Enbrel revenues $179 million, estimates $181 million

- Xeljanz revenues $303 million, estimates $406.9 million

- Inlyta revenues $252 million, estimates $256.2 million

- Adjusted R&D: costs $2.67 billion, estimates $2.83 billion

- Adjusted SI&A: $3.67 billion, estimates $3.48 billion

2024 OUTLOOK:

- Revenues: $59.5-62.5 billion (previous: $58.5-61.5 billion); estimates: $61 billion

- Adjusted R&D costs: $11-$12 billion

- Adjusted SI&A: $13.8-$14.8 billion

- Adjusted earnings per share: $2.45-$2.65 (previously $2.15-$2.35)

Pfizer continues gains today, approaching the resistance level near $31.41. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.