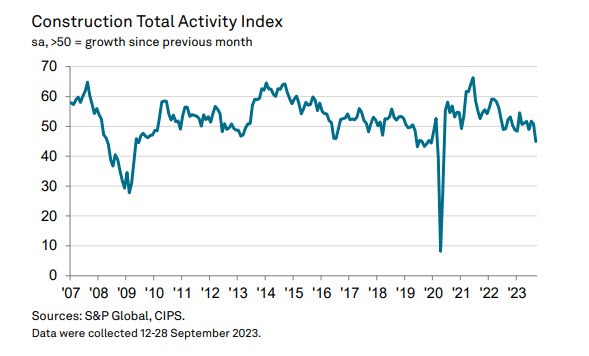

The UK's construction PMI reading came in well below forecasts at 45 versus 49.9 forecasts and 50.8. The downturn came from a slump in housing construction. Manufacturing also recorded the steepest decline since May 2020. New orders also recorded the fastest decline in more than three years. previously.

S&P Commentary

- September's downturn marked the worst overall performance since the early stages of the 2020 pandemic. Construction frms widely commented on cuts in new development projects due to weak demand and rising borrowing costs.

- Concerns about the outlook for the domestic economy curbed customer spending in September, contributing to the fastest decline in new commercial building completions since January 2021.

- Forward-looking indicators in the survey once again remained relatively pessimistic, with orders falling at an accelerated pace. Expectations for business activity fell to the lowest level ever this year.

- Fewer project starts meant that the availability of subcontractors increased at the highest rate since the summer of 2009. Lower demand across the supply chain contributed to a significant improvement in delivery times for construction products and materials, as well as a stabilization of purchasing costs in September.

Source: S&P Global, CIPS

Despite a devastatingly weaker-than-forecast reading (analysts had anticipated a very slight weakening), shares of one of the UK's largest property development and construction companies, specializing in house building Persimmon (PSN.UK), are gaining nearly 1.5% and attempting to stem the recent dynamic sell-off at the lower boundary of the symmetrical triangle formation. We can relate the increases more to 'selling the news'. At the same time, however, the macro environment in the UK, according to the 'Construction PMI' reading, is not positive for the momentum of the property development sector, and thus shares may still extend the downward trend. If the rebound proves unsustainable, a potential breakout from the bottom of the triangle formation could result in a dynamic sell-off. Key support is currently located around GBP 10 per share.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.