Pepsi (PEP.US) stock rose over 1.5% before the opening bell after the beverage and snack giant posted better than expected quarterly figures, mainly thanks to price increases. Company also decided to raise its annual dividend.

-

Pepsi reported EPS growth of up 9.1% YoY to $1.67 on revenue of $28 billion (11.0% YoY increase). Analysts were expecting EPS of $1.65 on sales of $26.8 billion.

-

Organic sales volumes fell 2% following average price increases of around 16% in Q4

-

Pepsi’s net income dropped 60% to $535 million, largely due to a $1.5 billion impairment charge for its SodaStream brand and other assets.

-

Company lifted its annualized dividend by 10% to $5.06 per share.

Highlights of Pepsi Q4 financial results. Company's anticipates that economic slowdown may have a negative impact on its results in the current quarter. Source: Alpha Street

Highlights of Pepsi Q4 financial results. Company's anticipates that economic slowdown may have a negative impact on its results in the current quarter. Source: Alpha Street

-

In Q1 company forecasts core earnings of around $7.20 per share, below market consensus of $7.12 signaling multiple price hikes were likely to dampen demand for its products amid a cost-of-living crisis.

-

Organic sales are expected to increase by 6% .

-

"We are pleased with our results for the fourth quarter and the full year as our business remained resilient and delivered another strong year of growth," said CEO Ramon Laguarta. " Moving forward, we will continue to focus on driving growth and winning in the marketplace while developing advantaged capabilities to fortify our businesses for the long-term."

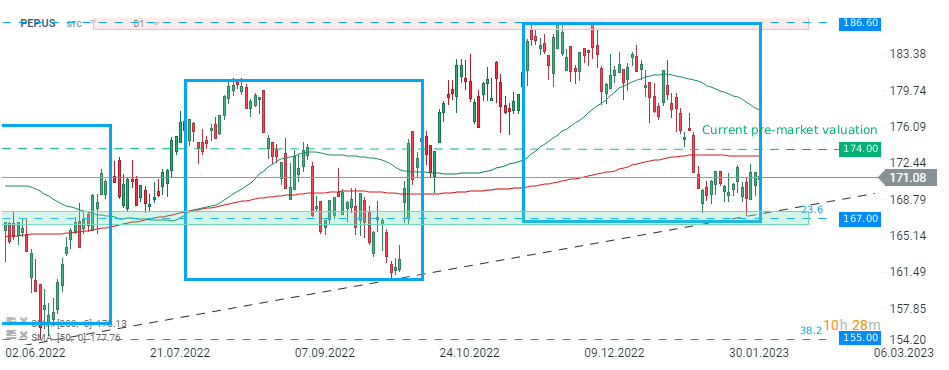

Pepsi (PEP.US) stock recently bounced off key support at $167.00, which is marked with lower limit of the 1:1 structure, 23.6% Fibonacci retracement of the bullish move started in March 2020 and long-term upward trendline. As long as price sits above this level, bullish move may accelerate towards all-time high at $186.60. Source: Station5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.