Peloton (PTON.US) stock plunged over 25.0% before the opening bell after the exercise equipment and media company reported a wider-than-expected quarterly loss and slowing sales volume followed by weak sales guidance for Q4 due to softening demand;

- Company recorded a Q3 loss of $2.27 per share, down from a loss of 3 cents per share over the same period last year and well above analysts’ estimates of 83 cents per share loss.

- Revenues plunged 23.5% from last year to $964.3 million, below Wall Street estimates of $973 million;

- Similar to other pandemic winners, the company is grappling with weakening demand. Peloton market value fell to $4.69 billion from nearly $50 billion during the pandemic;

- For the current quarter, the equipment maker expects revenues in the region of $675 million to $700 million and approximately 3 million Connected Fitness subscribers.

- Peloton will increase price of its connected fitness programs for the first time since 2014, while reducing costs of bikes and treadmills as company want more people to be able to afford their training equipment;

- The company plans to cut 2,800 workers, more than a fifth of its workforce, and has confirmed the decommissioning of the $ 400 million facility it planned to build in Ohio;

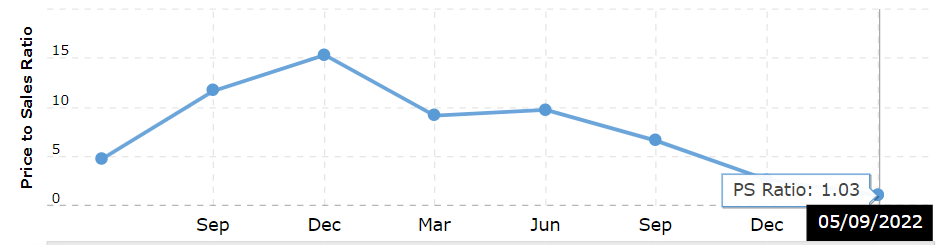

The price-to-sales ratio (P/S) fell sharply from pandemic highs. Source: Macrotrends

The price-to-sales ratio (P/S) fell sharply from pandemic highs. Source: Macrotrends

Peloton (PTON.US) stock fell sharply in premarket to new all-time low around $11.50. Source xStation5

Peloton (PTON.US) stock fell sharply in premarket to new all-time low around $11.50. Source xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.