PayPal (PYPL.US) shares have been on a dismal streak since 2021 and yesterday dived below the psychological $60 level.

- Despite fairly good Q2 results, a share buyback program and management's belief in the company's long-term success, the market has been steadfastly selling shares amid concerns about margins, market share, growing competition and the recession as a sizable threat to the company's business growth. Yesterday, the stock was losing ground after news of a share sale by Elliot Capital Management.

- The activist fund took $2 billion worth of PayPal shares in the summer of 2022 - the company announced this when it raised full-year forecasts and approved a $15 billion share repurchase program - and the market received the news euphorically at the time;

- Such a swift departure of Elliott from the shareholding was taken by investors as a sign of lack of faith in a broader rebound of declines from current price levels by which PayPal shares discounted by 6% yesterday. Do financials justify such a scale of correction?

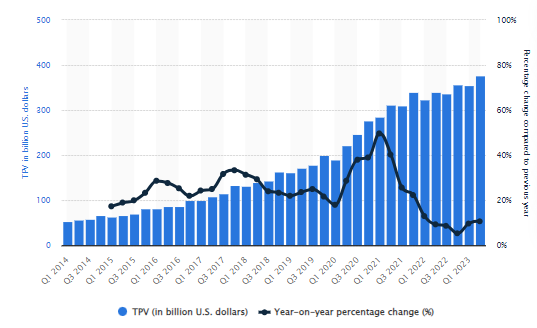

The value of payments processed by PayPal (TPV) recorded record levels in Q2 2023, approaching $400 billion, but the market considers the dynamics of this growth more important. This one was declining y/y from 2021 until Q4 2022 - we are now seeing a rebound again. The 'lows' now may support a possible 'favorable' base effect in subsequent quarters, but it's worth noting that PayPal is starting to get a bit weighed down by scale - it's hard to expect the dynamics at $400 billion in processed payments to be anywhere near that when it was two or three times less. The market downgraded the valuation - it saw the risk of PayPal becoming a 'stagnant' company - not a 'growth' business. Source: Statista

Growing competition from ApplePay, GooglePay and the huge market shares of Visa or Mastercard make the market see PayPal's revenue growth environment as increasingly challenging. In China, users are using other payment intermediaries more frequently. Source: Reuters

Revenue and margins - is it really that bad?

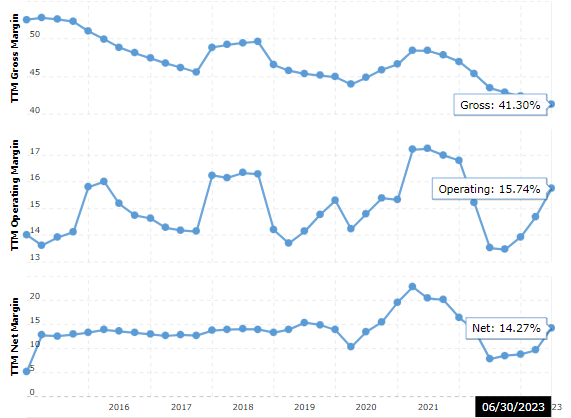

The market sees a problem on PayPal's margin side. Although the gross margin (41.3%) has fallen to its lowest levels in nearly eight years, it is still relatively high, and the net margin result is still close to the historical average before the pandemic with a more than satisfactory result on the operating margin side. Source: Macrotrends

The company's revenues, although registering a slowdown in y/y growth (no significant catalysts), recorded a record high in Q2, rising from $12 billion to $28.5 billion or nearly 150% from 2017. However, some stagnation is visible on a quarterly basis. At the same time, negative y/y growth is not visible, which could justify the reluctance with which the market treats the company. Source: Macrotrends

- It seems that the company needs to look for new ways to scale its business, which should be helped by excellent free cash flow and relatively low debt. At the same time, the magnitude of the sell-off in recent quarters may create a 'contrarian' environment for aggressive bulls to emotionlessly consider whether PayPal has deserved to fall from nearly $310 to $59 in 2 years.

- A potential macro risk, of course, is a recession, which could exacerbate the slowdown. The company has appointed a new CEO, Alex Chriss, who will take office on September 27. Investors hope he will break the 'stagnant' tenure of incumbent Dan Schulman. The company has begun to get more involved in the crypto market and has teamed up with Paxos to create the stablecoin PYUSD, which is the equivalent of a digital dollar in the blockchain world.

PayPal shares (PYPL.US). The SMA200 average on the D1 interval is consistently a key resistance level for bulls and currently runs at $73 per share. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.