Shares of dental and veterinary company Patterson (PDCO.US) are trading on a rally today as the company beat analysts' forecasts and reported a net growth rate on revenue growth, indicating that it has improved business margins despite a challenging environment in the US. The market expected a y/y decline in earnings per share, this one surprised with a 20% increase.

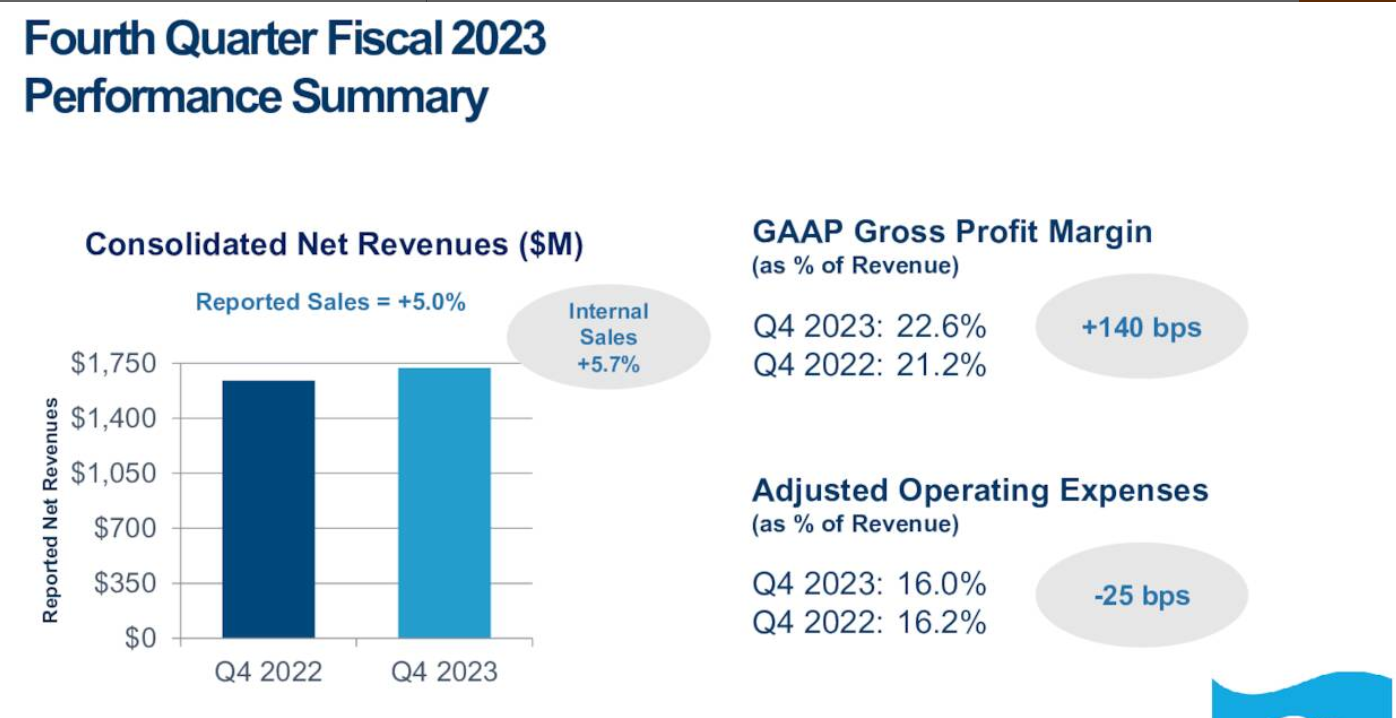

Revenue: $1.72 billion vs. $1.71 billion forecast, $61 million above consensus ($1.64 billion a year ago)

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appEarnings per share: $0.84 vs. SD 0.70 forecasts ($0.71 a year ago)

The company said it repurchased 1.5 million shares during the fourth quarter of fiscal 2023 and decided to pay $0.26 in quarterly dividends to shareholders (over $25 million). At the same time, the company's free cash flow fell from $194 million to $180 million.

The company's operating expenses fell, margins and consolidated net income increased. Source: Patterson Earnings Report

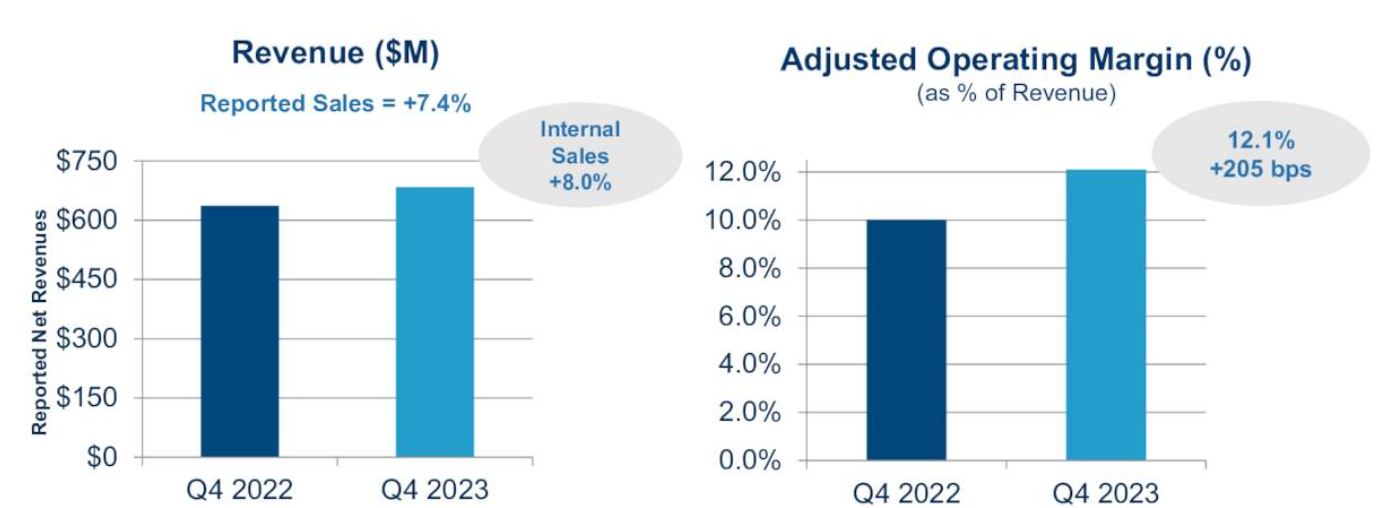

International sales rose 8% y/y with 12.1% operating margins (up more than 2% y/y). Source: Patterson Earnings Report

Patterson (PDCO.US) shares rose today above long-term resistances near the SMA100 and SMA200 (red and black lines). A retest of $38 per share, the local highs of 2021, may become possible.Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.