Oracle's (ORCL.US) 1Q24/25 results beat consensus expectations, with the company's sales driven by continued strong demand for AI-related cloud services. It is noteworthy that the company delivered strong results despite overall weakness in the technology sector.

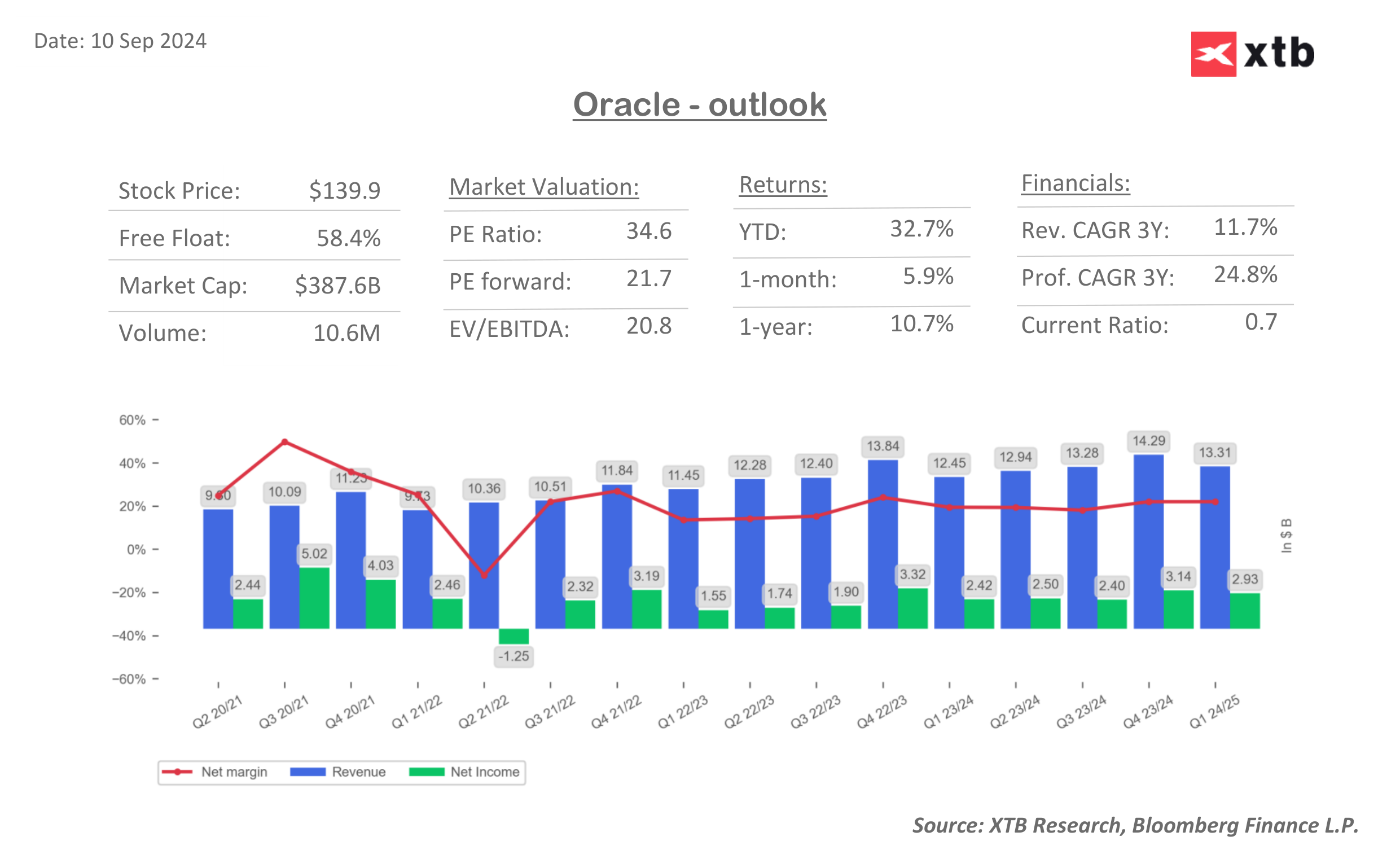

Oracle generated revenue of $13.31 billion in 1Q24/25 (+6.9% y/y), maintaining its uninterrupted positive y/y revenue growth for more than 12 quarters. Seasonally, Q1 of the company's fiscal year performed the weakest, hence in q/q terms the company recorded a decline of 7%. However, it is worth noting that the revenues achieved for the last 3 months turned out to be the highest quarterly excluding 4Q22/23 and 4Q23/24. The strongest dynamics can be seen in the cloud revenue segment, where sales increased by 22% y/y (both in reported and constant currency terms). These results remain in line with expectations.

The company performed significantly better on cost discipline, pushing adjusted operating profit to $5.71 billion (vs. $5.59 billion forecast) and resulting in an adjusted operating margin of 43% (vs. 41% a year earlier and 42.2% forecast).

The company continues to increase its partnerships with leading technology giants, with agreements with Microsoft and Google ensuring continued strong growth in the database segment.

On top of that, Oracle announced a partnership with Amazon, which is further expected to help bolster revenue growth throughout the 2024/25 fiscal year.

In pre-open market trading, the company is up more than 8%, thus setting a new historical peak at $152. Source: xStation

FINANCIAL RESULTS 1Q24/25

- Adjusted revenue $13.31 billion, +6.9% y/y, estimates $13.26 billion

- Revenue in constant currency +8%, estimates +7.43%

- Adjusted EPS $1.39 vs. $1.19 y/y, estimate $1.33

- Cloud revenue (IaaS plus SaaS) $5.6 billion, +22% y/y, estimate $5.61 billion

- Cloud revenue (IaaS plus SaaS) in constant currency +22%, estimate +22.4%

- Cloud Infrastructure revenue (IaaS) $2.2 billion, +47% y/y, estimate $2.2 billion

- Cloud Infrastructure revenue (IaaS) in constant currency +46%, estimate +45.7%

- Cloud Application revenue (SaaS) $3.5 billion, +13% y/y, estimate $3.41 billion

- Cloud Application revenue (SaaS) in constant currency +10%, estimate +11.6%

- Cloud services and license support revenue $10.52 billion, +10% y/y, estimate $10.51 billion

- Cloud services and license support revenue in constant currency +11%, estimate +10.9%

- Applications cloud services and license support revenue $4.77 billion, +6.7% y/y, estimate $4.75 billion

- Infrastructure cloud services and license support revenue $5.75 billion, +13% y/y, estimate $5.96 billion

- Cloud license and on-premise license revenue $870 million, +7.5% y/y, estimate $731 million

- Cloud license and on-premise license revenue in constant currency +8%, estimate -9.2%

- Hardware revenue $655 million, -8.3% y/y, estimate $690.3 million

- Service revenue $1.26 billion, -8.7% y/y, estimate $1.35 billion

- Adjusted operating income $5.71 billion, +13% y/y, estimate $5.59 billion

- Adjusted operating margin 43% vs. 41% y/y, estimate 42.2%

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.