Oracle is trading +8.40% higher at US$130.40 per share in trading ahead of the opening of the US cash session following the release of Q4 and full year 2024 results. Despite mixed Q4 2024 report, missing consensus attention is driven by record-breaking sales contracts related to the AI language model demand in its cloud services segment.

Summary of Oracle's Q4 and FY 2024 Earnings Release

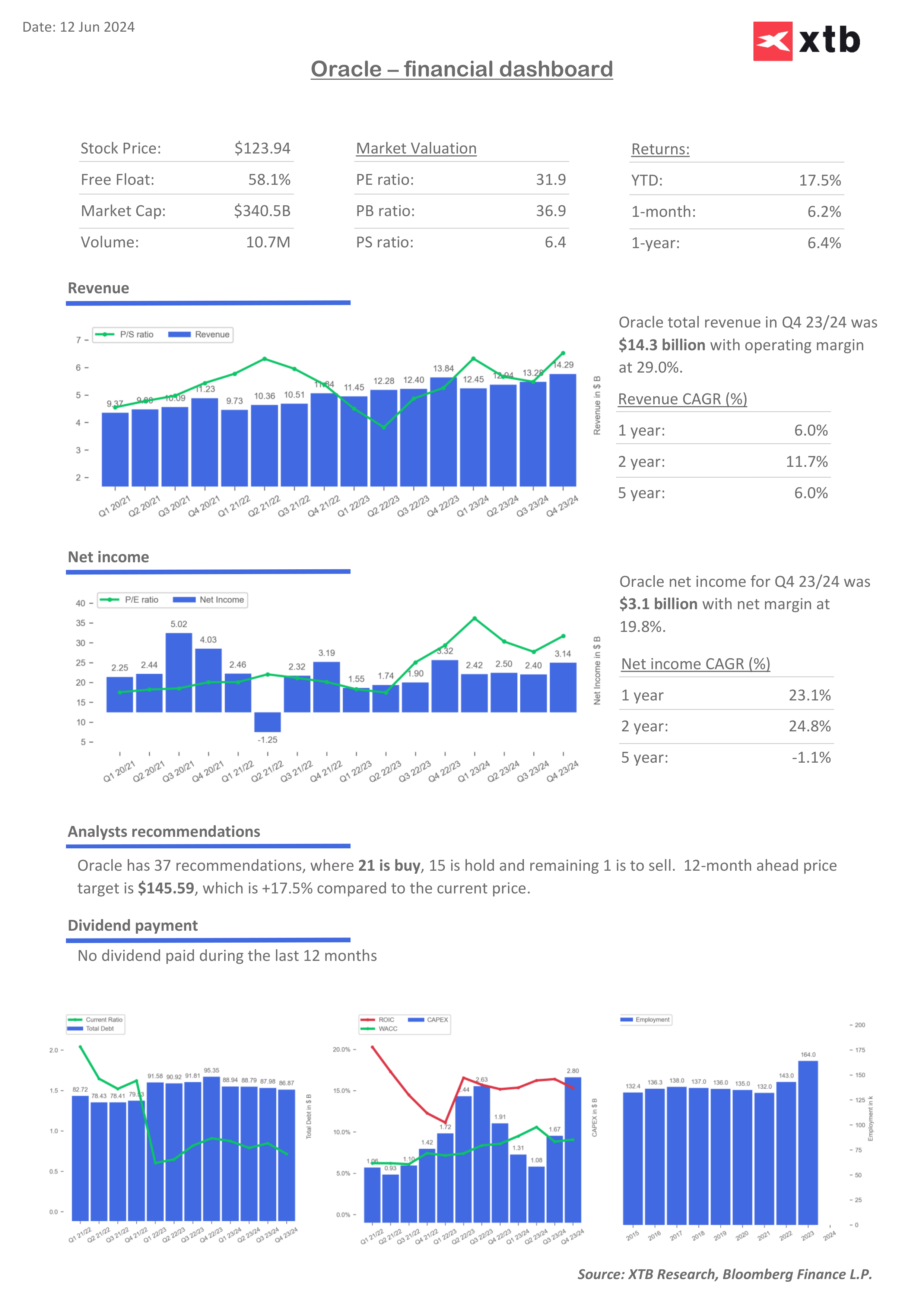

Q4 revenues rose 3% year-over-year to $14.3 billion, with cloud revenues up 20% to $5.3 billion. CEO Safra Catz emphasized strong AI demand, forecasting continued sales and RPO growth in 2025. Oracle's strategic partnerships, including those with OpenAI and Google, are set to bolster its cloud capabilities and drive further growth.

For the full fiscal year 2024, Oracle reported total revenues of $53.0 billion, a 6% increase. Cloud services and license support revenues grew by 12% to $39.4 billion, while cloud infrastructure revenues surged 42% in Q4 alone. Despite a decline in cloud license and on-premise license revenues, Oracle's operating income and margins remained robust, with non-GAAP operating income rising 8% to $6.7 billion in Q4, and operating cash flow reaching $18.7 billion for the year, up 9%.

Looking ahead, Oracle anticipates sustained AI-driven growth and a positive trajectory for fiscal year 2025, expecting each quarter to outpace the previous one. The company's multicloud partnerships with Microsoft and Google, alongside expanding datacenter infrastructure, are poised to enhance cloud database growth and service capabilities. The board declared a quarterly cash dividend of $0.40 per share, reflecting continued shareholder returns.

Earnings Summary of Key Metrics:

Q4 Quarter

- Q4 Total Revenue: $14.3 billion, up 3% in USD, up 4% in constant currency

- Q4 Cloud Revenue: $5.3 billion, up 20%

- Cloud Infrastructure (IaaS) Revenue: $2.0 billion, up 42%

- Cloud Application (SaaS) Revenue: $3.3 billion, up 10%

- Q4 Fusion Cloud ERP Revenue: $0.8 billion, up 14%

- Q4 NetSuite Cloud ERP Revenue: $0.8 billion, up 19%

- Q4 Cloud Revenue: $5.3 billion, up 20%

- Q4 GAAP Operating Income: $4.7 billion, Non-GAAP Operating Income: $6.7 billion

- Q4 GAAP Earnings per Share: $1.11, Non-GAAP Earnings per Share: $1.63

FY 2024

- FY 2024 Total Revenue: $53.0 billion, up 6%

- FY 2024 Operating Cash Flow: $18.7 billion, up 9%

- FY 2024 GAAP Net Income: $10.5 billion, Non-GAAP Net Income: $15.7 billion

Source: xStation 5

Source: xStation 5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.